UK DIY News

Like-For-Like Sales Decline At Kingfisher; Guidance Maintained

Kingfisher plc is today providing its Q1 23/24 sales.

Key points

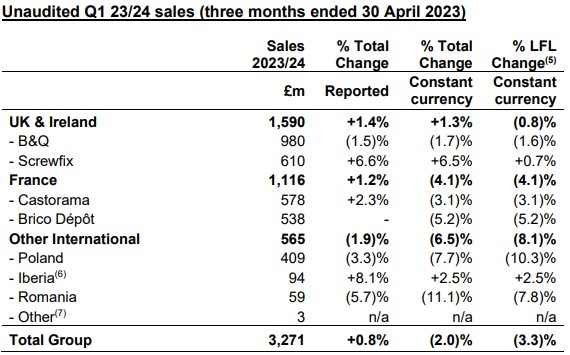

- First quarter sales of £3.3bn; total sales +0.8% (reported) and -2.0% (constant currency)

- LFL -3.3% including a -0.5% calendar impact(1)

- Resilient performance in core and ‘big-ticket’ categories(2) (82% of sales), with LFL -1.3%

- Sales of seasonal categories(3) (18% of sales) affected by weather conditions, with LFL - 11.3%

- Improved trading since early April; continued resilience in core and ‘big-ticket' trading and better seasonal sales

- Q1 by region:

o UK & Ireland: good performance at B&Q given impact of weather on seasonal sales; strong market share gains and positive LFL at Screwfix with trade customers continuing to see strong pipelines

o France: resilient performance in core and ‘big-ticket’; both banners impacted by weather and 10 days of national pension reform strikes

o Poland: year-on-year performance impacted by strong comparative; performance vs pre-pandemic levels consistent with Q4 22/23

- Opened two Screwfix stores in France (both in May); targeting up to 85 new stores across the UK, Ireland and France in FY 23/24

- Total e-commerce sales growth of +4.7%, representing 16.9% of Group sales (Q1 22/23: 15.9%; Q1 19/20: 7.2%). Continued strong growth of B&Q marketplace, reaching 27% of B&Q’s e-commerce sales in April 2023

- Full year guidance reiterated; remain comfortable with consensus of sell-side analyst expectations for FY 23/24 adjusted PBT of £634m(4)

For Kingfisher International results, click here

UK & IRELAND

Total sales +1.3% (LFL -0.8%), with seasonal categories impacted by unusually poor spring weather, especially in March.

- B&Q sales -1.7%. LFL -1.6%, reflecting a good performance given the impact of weather on seasonal sales. LFL sales of core and ‘big-ticket’ categories were +2.1% with bathroom & storage sales performing well in the quarter. B&Q’s surfaces & décor, electricals, plumbing, heating & cooling (EPHC) and tools & hardware categories also saw good year-on-year (YoY) growth. LFL sales of seasonal categories were -13.7%, impacted by the weather in March. B&Q’s total e-commerce sales increased +14.3% YoY in Q1, with an overall e-commerce sales penetration of 11.4% (Q1 22/23: 10.0%). B&Q’s e-commerce marketplace, which has scaled rapidly since its launch in March 2022, continues to see strong growth and reached a participation of 27% in April (i.e., B&Q’s marketplace gross sales divided by B&Q’s total e-commerce sales). B&Q opened one new store in Q1 (a small retail park compact format in Newark) and closed all eight of its ‘grocery concession’ format stores. TradePoint, B&Q’s trade-focused banner, saw a robust performance in the quarter with LFL sales -1.6% and a penetration of B&Q’s total sales of 21% (Q1 22/23: 21%). The banner continues to focus on building customer engagement and loyalty, trade-only deals and events, and improving trade-specific product ranges and services.

- Screwfix sales +6.5%. LFL +0.7%, with demand from trade customers driving strong market share gains in Q1. The business saw good YoY growth across most categories, apart from outdoor, with particularly good momentum in its building & joinery, kitchen and bathroom categories. Screwfix opened three new stores in the UK & Ireland and remains on track to open up to 60 new stores in these countries this financial year. Note that total sales for Screwfix UK & Ireland include sales (not material) arising from the acquisition on 20 March 2023 of the assets of Connect Distribution Services. The results of Screwfix France are recorded within the ‘Other International’ division.

Thierry Garnier, Chief Executive Officer, said: “As we move through our key trading season, we are pleased to see that sales in our core and ‘big-ticket’ categories, which make up over 80% of our total sales, are showing continued resilience. The unusually poor spring weather in the UK and France affected our seasonal sales in the quarter, impacting demand for items such as garden and outdoor products. We have however seen an improvement in trading since early April, and anticipate a release of some pent-up demand as the weather continues to improve. Our inventory remains healthy and, in aggregate, is reducing in line with our expectations.

“We continue to execute our strategy at pace, making good progress across all our key priorities. Screwfix is trading well and seeing particularly strong demand from trade customers, with total sales up 6.5%. The business continues to drive its store expansion plans in the UK, Ireland and France. E-commerce sales were another highlight in the quarter, up 4.7%. One of the drivers of this is the continued success of B&Q’s marketplace, which reached 27% of B&Q’s online sales in April, a year after its launch.

“Across the Group, we are maintaining a sharp focus on competitive pricing, while balancing inflationary pressures. With the continued easing of raw material prices and freight costs, we expect to see lower product cost inflation in H2. “We are comfortable with market expectations for the business this year, and confident in delivering growth ahead of our markets, strong cash generation, and higher returns to shareholders over the medium-term.”

Current trading and outlook

Trading trends since early April have seen an improvement in seasonal sales as well as continued resilience in our core and ‘big-ticket’ categories. For the three weeks to 20 May 2023 (8) LFL sales were -1.0%, including a -0.4% impact from the additional UK coronation public holiday. We see resilience across our customer segments (DIY and DIFM/trade) with ongoing strength from the trade segment.

We remain well positioned to navigate FY 23/24 against the current backdrop of heightened macroeconomic uncertainty. We are delivering value to our customers at all price points, whilst also managing inflationary pressures effectively. We are confident in our diverse and resilient business model, and our priority remains consistent execution against our strategy to drive top line and market share growth. Furthermore, we remain committed to active and responsive management of our operating costs, and are on track with our plans to reduce inventory levels this year.

We are comfortable with the consensus of sell-side analyst expectations for FY 23/24 adjusted PBT of £634m(4) , and for H1 we expect to report an adjusted PBT of c.£350m.

We remain highly cash generative and expect >£500m free cash flow for the year, supported by the unwind of working capital outflows in the prior year. And as stated in our FY 22/23 results in March, we intend to announce a new share buyback programme following completion of the existing programme this year, subject to our capital allocation framework and market conditions. As of 22 May 2023, c.£205m of the current £300m share buyback programme had been completed.

Source : Kingfisher PLC

Image : Chris Warham / shutterstock.com (242222707)

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.