UK DIY News

Kingfisher: LFL Sales Drop; UK & Ireland Market Share Gains

- Final results for the year ended 31 January 2025

- Strong delivery against strategic objectives & market share gains in all key regions

Click here for B&Q and Screwfix UK & Ireland performance

Click here for Kingfisher France performance

Watch Kingfisher CEO Thierry Garnier discussing the results in a short video

Download the presentation that accompanied today's results announcement here

Thierry Garnier, Chief Executive Officer, said:

“For the first time in over six years, we grew our market share in all key regions. We delivered profit and free cash flow in line with or ahead of our initial guidance, with strong delivery against our strategic objectives. Our e-commerce marketplaces are now live in the UK & Ireland, France, Poland and Iberia, and growing strongly with total GMV up 62%. Our trade sales penetration, excluding Screwfix, reached 17.9% in January, up 4.9%pts, with rapid progress being made in France and Poland. Our restructuring of Castorama France is progressing and we have accelerated our plans. As expected, the wider market backdrop was a headwind, though we maintained our laser focus on managing costs and cash, removing £120m of structural costs and lowering same-store inventory by over £100m.

“Looking to the year ahead, the recent government budgets in the UK and France have raised costs for retailers and impacted consumer sentiment in the near term. With this in mind, we remain focused on what is in our control – progressing our strategic objectives at pace to deliver further market share gains, and continuing to manage gross margin, costs and cash effectively. Kingfisher is in its best operational shape for years, and we remain confident about the growth opportunities in our business.”

Key messages

- Market share gains in the UK & Ireland, France and Poland, driven by e-commerce & trade

- Total sales -0.8% and LFL -1.7%. Core categories (67% of sales) driving resilience; encouraging ‘bigticket’ sales trends in Q4

- Adjusted PBT (£528m) and free cash flow (£511m) delivered in line with or ahead of initial guidance; statutory PBT down 35.4% to £307m

- Focused execution against strategic objectives. Strong growth in e-commerce (sales penetration up 1.6%pts to 19.0%), and trade customer sales excluding Screwfix +53.0% YoY

- Accelerating Castorama France restructuring, with works in motion or completed on a total of 24 low-performing stores by end of FY 25/26. Operating costs in France down 1.6% YoY

- Against a challenging market backdrop, maintained a disciplined financial performance, with strong management of gross margin (+50bps), costs (c.£120m of structural cost reductions, as guided) and same-store net inventory (down £107m)

FY 25/26 outlook and guidance

- Guiding to FY 25/26 adjusted PBT of £480m to £540m(2) , and free cash flow of £420m to £480m • New £300m share buyback programme announced

- Remain confident about the medium to longer-term outlook for the sector; targeting free cash flow of >£500m per annum from FY 26/27

FY 24/25 results summary

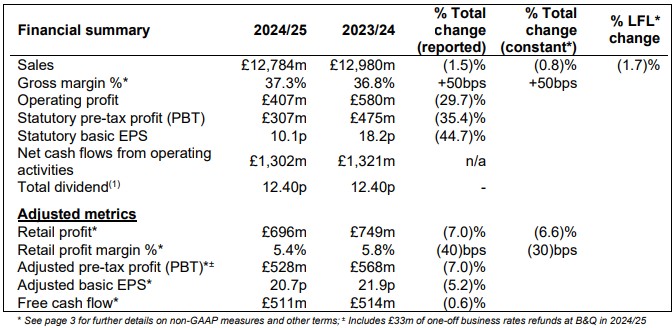

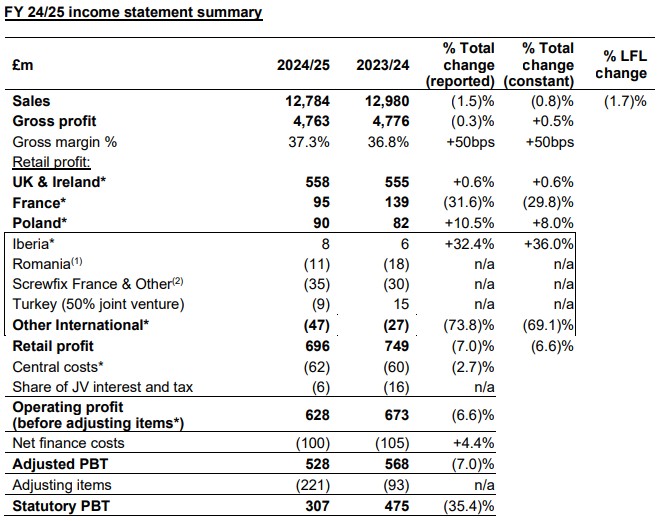

FY 24/25 results summary

- Total sales -0.8% (constant currency) and -1.5% (reported)

- LFL sales -1.7% including a +0.2% leap year impact(3)

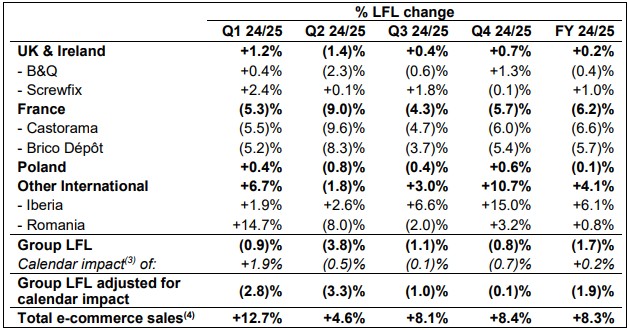

− Underlying Q4 LFL sales -0.1% (adjusted for a -0.7% calendar impact(3) ), ahead of underlying Q3 LFL -1.0% - Sales by region:

− UK & Ireland LFL +0.2%: market share gains at B&Q supported by strong e-commerce and TradePoint sales; market share gains and positive LFL at Screwfix

− France LFL -6.2%: reflecting the soft consumer backdrop. Castorama and Brico Dépôt sales ahead of the market

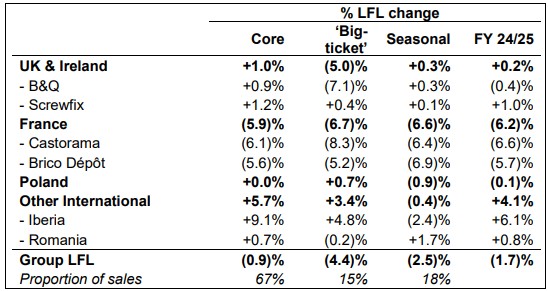

− Poland LFL -0.1%: supported by stable consumer environment and strong trade customer initiatives; sales ahead of the market - Sales by category:

− Core* (67% of sales): LFL -0.9%, driven by repair, maintenance and renovation activity on existing homes

− ‘Big-ticket’* (15% of sales): LFL -4.4%, reflecting weaker trends across the broader market. Encouraging ‘big-ticket’ sales trends in Q4 (LFL +0.6%)

− Seasonal* (18% of sales): LFL -2.5%, given unfavourable weather in Q2 - Retail price inflation flat year-on-year (YoY); negative mix impact on average selling price from lower ‘big-ticket’ sales. Overall volume lower YoY, with improving underlying volume trends in core categories throughout the year

- Gross margin % +50 basis points to 37.3% (FY 23/24: 36.8%) reflecting effective management of product costs, supplier negotiations and retail prices, and lower clearance costs and stock provisions

- Retail profit -6.6% in constant currency to £696m (FY 23/24: £749m), reflecting lower profits in France and higher losses from our joint venture in Turkey; partially offset by higher profits in Poland and reduced losses in Romania

- Adjusted PBT -7.0% to £528m (FY 23/24: £568m), including £33m of one-off business rates refunds at B&Q. Movement reflects lower retail profit, partially offset by lower net finance costs and share of JV interest and tax

- Statutory PBT -35.4% to £307m (FY 23/24: £475m), reflecting lower operating profit, including £178m of net store asset and goodwill impairments resulting from higher discount rates in France and revised financial projections

LFL Sales By Quarter

LFL Sales By Category

Trading in Q4 24/25

Group LFL sales were lower by 0.8% in Q4, or lower by 0.1% adjusted for calendar impacts, an improvement from underlying trading in Q3 (i.e., LFL -1.0% adjusted for calendar impacts). Q4 LFL performance was supported by resilient sales from trade customer channels, particularly in the UK & Ireland and Poland. We saw LFL sales growth in our outdoor and kitchen categories, together with resilience in our tools & hardware, building & joinery and bathroom & storage sales. We were encouraged by our kitchen sales in Q4, with YoY growth in all markets. Seasonal category sales delivered growth in the UK & Ireland and Poland, while unfavourable weather conditions impacted seasonal performance in France. E-commerce sales grew by 8.4% in Q4, driven by the continued strong growth of our marketplace at B&Q, together with online sales growth at Screwfix supported by a strong performance in app sales.

In the UK & Ireland, core category sales remained positive in Q4, supported by repair, maintenance and existing home renovation activity. TradePoint was the standout performer (LFL +6.7%) in the quarter. ‘Bigticket’ categories delivered sales growth YoY in Q4, supported by successful kitchen and bathroom range launches and campaigns at B&Q. Seasonal LFL sales improved slightly from Q3 despite mixed weather in Q4. Screwfix sales growth was lower in Q4 compared to Q3, driven by the impact of milder weather in November on electrical, plumbing, heating & cooling (EPHC) sales. B&Q, TradePoint and Screwfix all grew faster than their respective markets in Q4, as measured by the British Retail Consortium (BRC), Barclays and GfK.

In France, Castorama and Brico Dépôt both gained market share in Q4 (based on GfK) through strong execution against our strategic priorities, despite the backdrop of continued softness in consumer sentiment. Castorama, whose e-commerce marketplace launched in Q1 24/25, achieved marketplace sales penetration of c.12% in Q4, while Brico Dépôt’s trade penetration grew to 12.8% in January (compared to 8.6% at the start of FY 24/25). Underlying sales trends in core categories were slightly lower from Q3 to Q4, driven by the weaker market backdrop. Seasonal sales were also lower, impacted by unfavourable weather conditions. ‘Big-ticket’ sales saw an improvement in Q4, driven by a successful kitchen range review at Brico Dépôt France.

In Poland, Castorama’s underlying sales trend improved strongly from Q3. The business delivered growth across all categories in the quarter (i.e., core, ‘big-ticket’ and seasonal), with continued strong momentum from trade customers. The business grew ahead of the market in Q4 (as measured by GfK).

Iberia saw a strong improvement in its Q4 sales trend (LFL +15.0%), with growth in all categories.

Romania delivered LFL sales growth of 3.2%, driven by growth in its core and ‘big-ticket’ categories.

Market outlook for FY 25/26

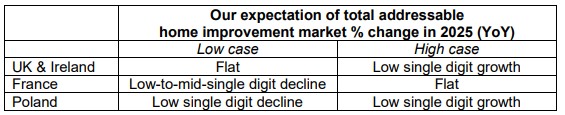

To support our planning for FY 25/26, we have assessed various scenarios for the annual growth of our total addressable home improvement markets in the UK & Ireland, France and Poland in 2025, compared to 2024. The scenarios consider a range of indicators including macroeconomic, consumer health, mortgage approvals and housing transactions, as well as our own research on retail and trade customer sentiment. Our “high case” and “low case” scenarios are noted below, in constant currency and including expected market space growth:

Our expectation of total addressable home improvement market % change in 2025 (YoY)

The spread between the high and low cases in each of the markets above is c.3 to 4%pts.

In the UK & Ireland, we have observed a relatively resilient consumer over the last two to three years, with repairs, maintenance and existing home renovation being supportive. We believe that resilience will continue, supported by real wage growth and a customer base weighted towards the median income demographic. However, we continue to be mindful of the near-term uncertainties facing households (especially from employment and mortgage rates), and also a nine to 12-month lag, on average, between housing demand and the realisation of home improvement spend. As a result, our outlook for the UK & Ireland home improvement market in 2025 is flat to low single digit % growth YoY.

In France, the unstable political environment weighed on the economy and consumer confidence in 2024, which remained subdued throughout the year. The household savings ratio in France remains significantly higher than the long-term average, which provides opportunity for a positive inflection in home improvement market growth over the medium-term. For 2025, while repairs and maintenance activity remains supportive, we remain cautious on consumer sentiment and the housing market in the near term, supporting our home improvement market outlook of low-to-mid single digit % decline to flat YoY.

In Poland, we saw inflation and interest rates in 2024 come down from their peaks in 2023, and an improvement in consumer confidence YoY. While consumers expect to see real wage growth in 2025, we are mindful of the uncertainties continuing to face Polish households (including from geopolitical factors and higher mortgage rates). Our outlook for the home improvement market in Poland is therefore low single digit % decline to low single digit % growth YoY.

Against the backdrop described above, our focus remains on delivering against the factors within our control, namely: (1) continuing to grow our market share, (2) executing against our strategic objectives, including further growing our e-commerce and trade customer sales, and delivering on our operational objectives in France, and (3) effectively managing our gross margin, operating costs* and inventory.

Guidance for FY 25/26

Regarding our FY 25/26 adjusted PBT guidance, we are mindful of the one-off benefit in the prior year of £33m related to business rates refunds at B&Q. We expect a c.£10m YoY benefit from the sale of our Romanian business.

We expect to fully offset, through gross margin and operating cost mitigations, c.£145m of additional operating costs in FY 25/26. These additional costs relate to: (i) operating cost inflation of c.£90m (including higher pay rates across the Group), (ii) higher UK employer national insurance contributions and similar taxes in France of c.£45m, and (iii) the impact of the new packaging fees regulations in the UK of c.£10m.

As a result of the above, and taking into consideration our market growth scenarios, we expect FY 25/26 adjusted PBT of c.£480m to £540m (FY 24/25: £528m).

We expect FY 25/26 free cash flow of c.£420m to £480m (FY 24/25: £511m), supported by further inventory reductions but also reflecting the unwind of timing benefits in FY 24/25 related to capital expenditure and creditor payments.

Source : Kingfisher

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.