UK DIY News

Kingfisher: B&Q And Screwfix Performance

Kingfisher plc has published a trading update for the 2024/2025 financial year.

Click here for the full results summary

Watch Kingfisher CEO Thierry Garnier discussing the results in a short video

Download the presentation that accompanied today's results announcement here

Note: All commentary below is in constant currency unless otherwise stated. In the current year, Poland meets the quantitative thresholds in IFRS 8 to be reported as a separate reportable segment and has therefore been separated from the ‘Other International’ segment (where it had previously been included). The ‘Other International’ segment consists of businesses and operating segments that do not meet the quantitative thresholds to be separate reportable segments under IFRS 8.

UK & IRELAND

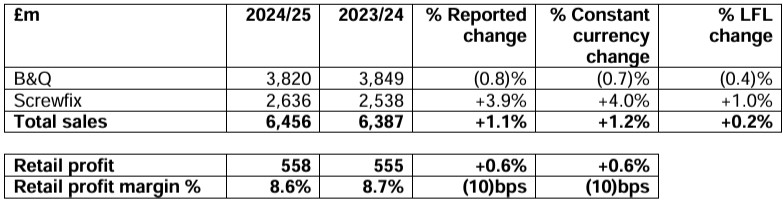

UK & Ireland sales increased by 1.2% (LFL +0.2%) to £6,456m, with market share gains at both banners (as measured by BRC, Barclays and GfK) supported by strong e-commerce sales and our progress in addressing trade customer needs. Gross margin % increased by 20 basis points, reflecting the effective management of product costs, supplier negotiations and retail prices, and a favourable channel mix reflecting the growth of B&Q’s marketplace; partially offset by category mix.

Retail profit increased by 0.6% to £558m (FY 23/24: £555m, at reported rates), reflecting higher gross profit, largely offset by higher operating costs (up 2.1%). Operating cost increases were driven by YoY increases in staff costs, higher costs associated with 29 net new store openings, and higher marketing and technology investment. Cost increases were partially offset by savings achieved by our structural cost reduction programme, lower energy costs and £33m of one-off business rates refunds at B&Q related to prior years. Retail profit margin % decreased by 10 basis points to 8.6% (FY 23/24: 8.7%).

B&Q total sales decreased by 0.7% (LFL -0.4%) to £3,820m, with LFL sales growth in core categories and seasonal sales offset by weakness in ‘big-ticket’. Sales trends improved in Q4 within our seasonal and ‘big-ticket’ categories compared to Q3, while core categories remained slightly positive YoY. B&Q’s total e-commerce sales increased by 17.2% YoY, driven by the continued strong performance of B&Q’s marketplace which reached an e-commerce sales penetration of 43% in January 2025. B&Q’s ecommerce sales penetration moved up to 15% for the year (FY 23/24: 13%; FY 19/20: 5%). The business closed one big-box and two medium-box stores in the year. B&Q opened one retail park store and one compact format store under the ‘B&Q Local’ banner. In Q4, B&Q announced the acquisition of eight former Homebase leasehold stores (five in the UK and three in Ireland). The acquisition of all the stores has completed, with conversion into B&Q stores taking place in the next few months. As of 31 January 2025, B&Q had a total of 310 stores in the UK & Ireland.

B&Q’s trade-focused banner, TradePoint, delivered a strong performance with sales up 6.4%, now representing 23.4% of B&Q sales (FY 23/24: 21.8%). This was supported by strong performances across all categories except kitchens, although this category was much improved in Q4 following the successful launch of new ranges. TradePoint sales outperformed the rest of B&Q across all categories. TradePoint is present in 217 stores within the B&Q network (70% of stores), opening eight new counters in the year.

Screwfix total sales increased by 4.0% (LFL +1.0%) to £2,636m, reflecting robust demand from trade customers. In particular, Screwfix achieved LFL sales growth in its tools & hardware, building & joinery, outdoor and kitchen categories, together with sales growth in its Spares business. Screwfix sales growth was lower in Q4 compared to Q3, driven by the impact of milder weather in November on EPHC sales. Screwfix’s e-commerce sales increased by 4.7% YoY, with e-commerce sales penetration of 58% (FY 23/24: 57%; FY 19/20: 33%). This was supported by several app-exclusive campaigns which drove a c.7%pts uplift in app sales participation in FY 24/25 to 22% (i.e., Screwfix app sales divided by Screwfix’s 15 total sales), and the extension of its Screwfix Sprint proposition to an additional 151 stores (i.e., one-hour home delivery now available in 485 stores, covering around 60% of the UK population).

Space growth and acquisitions contributed c.3.0% to total Screwfix sales. Screwfix opened 32 new stores – 31 in the UK (including seven Screwfix ‘City’ ultra-compact format stores) and one in Ireland. Screwfix also closed two stores in the year, bringing its total to 952 as of 31 January 2025.

The results for Screwfix France are captured in ‘Other International’.

Source : Kingfisher

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.