UK DIY News

Kingfisher: Q3 Sales In Line Or Ahead of The Market

- Sales in line or ahead of the market across all our banners; full year profit guidance range tightened

Kingfisher plc ('Company', 'Group' or 'Kingfisher') is today providing its Q3 24/25 sales.

Click here for Kingfisher France and International performance data

Key points

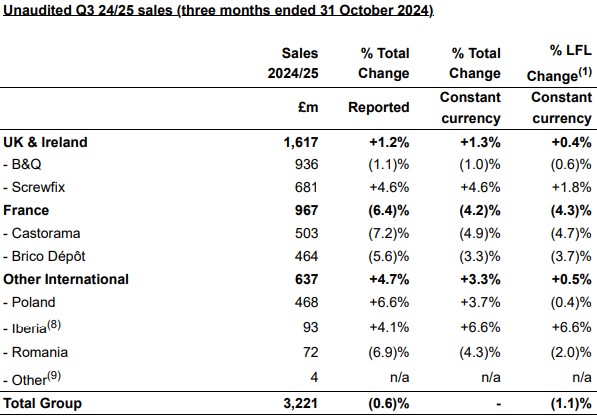

- Q3 sales of £3.2bn; total sales flat (constant currency) and -0.6% (reported)

- LFL -1.1%(1), with sales in line or ahead of the market for all our key banners

- Solid underlying trading in August and September; weak market and consumer in the UK and France in October, impacted by uncertainty related to government budgets in both countries

- Average selling prices flat year-on-year with improved volume trends versus Q2

- Q3 by region:

o UK & Ireland: sales growth driven by Screwfix (LFL +1.8%) and TradePoint (LFL +4.9%), with strong market share gains. Strong growth of B&Q's e-commerce marketplace (GMV +45%(2))

o France: sales in line with the market; lower sales trend at both banners in October due to weak consumer sentiment and adverse weather

o Poland: market share gains with improving 'big-ticket' sales trends - Q3 by category:

o Core (69% of sales): improved sales trends (LFL -0.4%)(3) driven by repair, maintenance and renovation activity on existing homes

o Big-ticket (16% of sales): LFL -4.0%(4) with improved trends at B&Q, Brico Dépôt France and Castorama Poland, supported by new ranges o Seasonal (15% of sales): sales impacted in October from wetter and milder than normal weather in our key markets (LFL -0.9%)(5) - Q4 trading to date(6) improved versus exit rate from Q3, with LFL -0.5%

- Full year profit guidance range tightened: expect adjusted PBT of c.£510m to £540m(7) (previously c.£510m to £550m). Free cash flow guidance unchanged

- Expect near-term market outlook to remain uncertain; confident in our business model, ability to drive market share and effectively manage retail prices, costs and cash

Thierry Garnier, Chief Executive Officer, said: "Overall trading in the third quarter was resilient. Improved performance in August and September was offset by the impact of increased consumer uncertainty in the UK and France in October, related to government budgets in both countries. All our banners in the UK, France and Poland performed in line or ahead of their respective markets, with particularly strong market share gains at Screwfix. We continued to see improved volume trends in our core categories, supported by repairs, maintenance and existing home renovation. As expected, sales of our 'big-ticket' categories remained soft, although we are seeing early signs of improvement.

"We continue to deliver rapid progress against our strategic and operational objectives. Ecommerce sales penetration increased by 1.3%pts to 18.8% in Q3, supported by the continued strong growth of our marketplaces. In Q3 our trade sales penetration reached 16.5% across the Group excluding Screwfix, up nearly 3%pts from the start of the year, as we continued to develop our trade proposition, including the launch of TradePoint's first mobile app last month. We are also making strong progress with our plan to restructure and modernise Castorama France's lowest performing stores, having selected partners for our first two franchised stores.

"Looking towards next year, recent political and macroeconomic developments have layered incremental uncertainty onto the near-term outlook in our markets. And so we continue to focus our energy on what we can control - delivering further market share gains through our key strategic priorities, and managing our retail prices, costs and cash effectively. As a Group, we are strongly positioned to benefit from the inflection to come within home improvement."

Current trading and FY 24/25 outlook

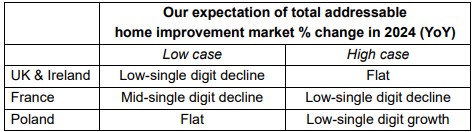

Trading in Q4 has started with an improvement versus the exit rate from Q3, with Group LFL sales -0.5% for the three weeks to 23 November 2024(6). Our scenarios for the growth of our total addressable home improvement markets in the UK & Ireland, France and Poland in 2024, compared to 2023, are unchanged as below:

Consistent with what we set out in September, we believe the UK & Ireland and Polish markets are currently tracking within the higher end of our scenarios. We believe the French market is continuing to track at the low end.

Given this, together with our performance in the year to date, we have tightened our FY 24/25 adjusted PBT guidance range to c.£510m to £540m (previously c.£510m to £550m). We are maintaining a tight control of our costs, and expect full delivery of c.£120m of structural cost reductions for the full year as guided.

We are also maintaining a significant year-on-year reduction in net inventory, and our free cash flow guidance range of c.£410m to £460m is unchanged. We are on track to complete our current £300m share buyback programme in March 2025 and remain committed to returning surplus capital to shareholders.

Impact of recent government announcements in the UK and France

Wages

Reflecting on the recent Autumn Budget in the UK, as we have effectively demonstrated in

recent years, we expect to offset the impact of wage increases through structural cost

reductions and productivity gains.

National Insurance Contributions and Other Taxes

Regarding higher employers' National Insurance Contributions (NICs) in the UK, we expect the

pro-rated impact in FY 25/26 to be c.£31m, before any mitigations.

In France, the government's draft Finance Bill for 2025 proposes certain changes to social

taxes (equivalent to NICs in the UK) as well as the postponement of the abolishment of CVAE

taxes (a sales-based tax). Assuming these measures are enacted through the French

parliament, we expect the impact in FY 25/26 to be c.£14m, before any mitigations.

The combination of these measures in the UK and France is therefore c.£45m on Group retail

profit. We are developing a range of additional mitigations, but at this stage expect to offset

only part of this impact.

Corporation Tax

In addition, we note the French government's proposal to temporarily increase Corporate

Income Tax (CIT) for a two-year period. If enacted, our expectation is that the Group Effective

Tax Rate (ETR) for FY 24/25 would be c.29% (current ETR guidance is c.27%), with the impact

halving in FY 25/26.

Technical guidance on net finance costs

Our current expectation for net finance costs next year (FY 25/26) is c.£115m. This is higher

than the current year, due to: (1) an expectation of lower interest receivable in FY 25/26, based

on our current view of cash balances and deposit rates in 2025, and (2) slightly higher lease

interest linked to lease re-gears.

For the current year (FY 24/25), we expect net finance costs of c.£100m (previously c.£105m).

As a reminder, net finance costs exclude our share of JV (Koçtaş) interest and tax.

Q3 trading highlights

All commentary below is in constant currency.

UK & IRELAND Total sales +1.3% (LFL +0.4%), reflecting a resilient overall performance. This was despite economic uncertainty ahead of the Autumn Budget, which impacted consumer sentiment, and wetter and milder than normal weather in October. Performance at B&Q was in line with the market while strong market share gains were achieved at Screwfix (as measured by the British Retail Consortium, Barclays and GfK).

- B&Q sales -1.0%. LFL -0.6%, supported by e-commerce and trade sales, and a sequential improvement in sales to retail customers. Despite the weaker market in October, overall sales in Q3 improved across all categories compared to Q2, with positive LFL sales in core and seasonal categories including tools & hardware, building & joinery and outdoor. As expected, performance in 'big-ticket' categories remained soft. B&Q's total e-commerce sales increased by 14.3% YoY, with overall e-commerce sales penetration increasing to 14.6% (Q3 23/24: 12.9%). This was driven by the continued growth of B&Q's marketplace (GMV +45%(2)), reaching a participation(10) of 41% in October. The business is making good progress onboarding international sellers to its marketplace, and scaling its retail media proposition.

- TradePoint, B&Q's trade-focused banner, delivered a strong performance with LFL sales growth of 4.9%, reaching its highest penetration of B&Q's total sales of 24% (Q3 23/24: 23%). TradePoint remains focused on strengthening its product range, digital and customer service proposition, and successfully launched its first mobile app in October.

- Screwfix sales +4.6%. LFL +1.8%, with robust demand from trade customers supporting positive LFL sales and volume growth in core categories. Notable performances were seen in its tools & hardware, building & joinery and outdoor categories. Screwfix opened six new stores (net) in the UK & Ireland, including two 'Screwfix City' ultra-compact format stores. The business continued to extend its market-leading Screwfix Sprint proposition, with Sprint orders growing by c.50% YoY. The results of Screwfix France are recorded within the 'Other International' division - see below for further information.

Source : Kingfisher plc

Image : Alan Morris / iStock / 1281594226

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.