UK DIY News

Kingfisher: Group Like-For-Like Sales Decline By 3.1%

Kingfisher has published full-year results for the year ended 31st January 2024.

For France performance click here

For Other International performance click here

For Screwfix UK performance click here

FY 23/24 highlights

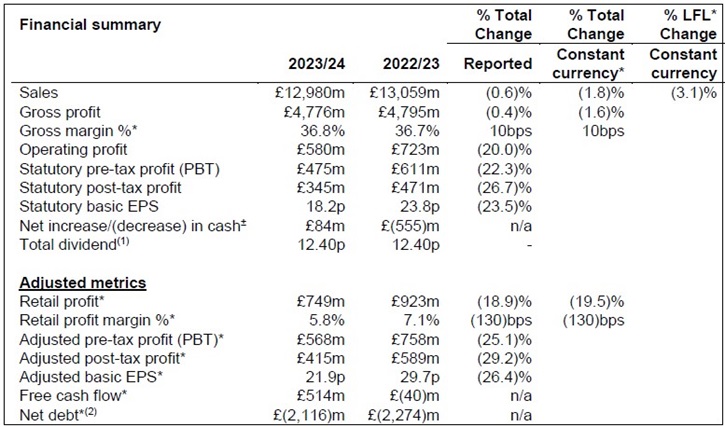

- Total sales -1.8% and LFL -3.1%. Q4 LFL -4.3%

- Positive UK & Ireland sales, alongside consistent market share gains. France and Poland sales impacted by more challenging consumer backdrop

- Sequential quarterly improvement in volume trend in 'core' categories as retail price inflation tapers

- E-commerce sales penetration up to 17.4% (FY 22/23: 16.3%), supported by strong marketplace sales growth at B&Q

- Adjusted PBT and free cash flow delivered in line with guidance. Statutory PBT down 22.3% to £475m

- Commenced new £300m share buyback programme (c.£50m completed to date). Proposed total dividend for FY 23/24 maintained at 12.40p per share, in line with FY 22/23

Key strategic priorities will drive market share and our medium-term financial priorities

- Grow by building on our different banners:

- Screwfix UK & Ireland: up to 40 new stores planned in FY 24/25; medium-term target of >1,000

- Screwfix France: up to 15 new stores planned in FY 24/25; potential for >600 stores over time

- Castorama Poland: targeting up to 75 medium-box and compact store openings over next 5 years

- Net space growth to drive an uplift in sales of c.+1.5% to +2.5% per annum over medium term - Accelerate e-commerce through speed and choice: launching new e-commerce marketplaces in France and Poland, following strong results at B&Q. Ambition for e-commerce to reach 30% sales penetration, one third of which represents high margin marketplace gross sales

- Build a data-led customer experience: embedding data and AI-powered solutions and retail media across the Group to drive incremental revenue, profit and cash. Ambition for retail media revenues to reach up to 3% of the Group's total e-commerce sales

- Develop our trade business: continued success in the UK & Ireland; strong results from trade proposition tests in France and Poland - accelerating roll-out in FY 24/25. Aiming for >£1bn sales at TradePoint UK & Ireland, and to double trade penetration in France and Poland over medium term

A clear plan to take France to the next level

- Initiating a new plan to simplify French organisation and significantly improve performance and profitability of Castorama

- Medium-term retail profit margin target for France of c.5% to 7%

FY 24/25 outlook and guidance

- Current trading: Q1 24/25 LFL sales (to date)(3) -2.3%

- Improved sales trend in the UK & Ireland, France and Poland, compared to Q4 23/24

- Improved volume trend in all three categories: core, 'big-ticket' and seasonal - Outlook for FY 24/25:

- Expect repairs, maintenance and renovation on existing homes to provide resilience, but cautious on overall market outlook given lag between housing demand & home improvement demand

- Continued effective management of product costs and retail prices

- Expect c.£120m of additional cost reductions and productivity gains to partially offset higher pay rates and technology investments

- Expect FY 24/25 adjusted PBT of c.£490m to £550m(4) and free cash flow of c.£350m to £410m - Strongly positioned for growth in 2025 and beyond - more agile, significant cost taken out across the Group, and confidence in multiple profitable growth drivers over the medium term. Targeting free cash flow of c.£450m in FY 25/26, followed by >£500m per annum from FY 26/27

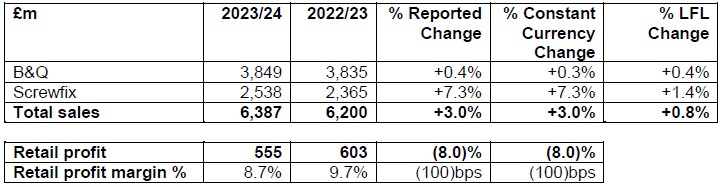

UK & Ireland

UK & Ireland sales increased by 3.0% (LFL +0.8%) to £6,387m, supported by resilient e-commerce and trade customer sales. Core categories performed well, supported by an improving underlying volume trend through the year, while retail sales in ‘big-ticket’ categories (i.e., kitchen and bathroom & storage) weakened in H2. Seasonal categories were impacted by adverse weather patterns during the year, particularly in Q1 and Q4, but notably improved in H2 relative to the first half of the year. B&Q, TradePoint and Screwfix all gained market share (as measured by BRC, Barclays and GfK), strengthening their competitive positions in the UK home improvement market. Gross margin % increased by 40 basis points, reflecting effective management of inflation and favourable channel mix impacts due to the strong growth of B&Q’s e-commerce marketplace.

Retail profit decreased by 8.0% to £555m (FY 22/23: £603m, at reported rates), due to higher operating costs. Operating costs increased by 8.0%, driven by cost inflation, including YoY increases in staff and energy costs, higher costs associated with 45 net new store openings (YoY), and higher technology spend. Cost increases were partially offset through structural savings achieved by our cost reduction programme. Retail profit margin % decreased by 100 basis points to 8.7% (FY 22/23: 9.7%).

B&Q total sales increased by 0.3% (LFL +0.4%) to £3,849m, with LFL sales growth in surfaces & décor and tools & hardware categories and resilient sales in building & joinery and outdoor. Sales trends slowed in H2 (LFL -0.2%), particularly in Q4, with a weaker performance seen in ‘big-ticket’ categories and warmer weather impacting the sales of EPHC (electricals, plumbing, heating & cooling). B&Q’s total ecommerce sales increased by 21.5% YoY, driven by the strong growth of B&Q’s marketplace. B&Q’s ecommerce sales penetration was 13% (FY 22/23: 11%; FY 19/20: 5%). The business opened one medium-box (small retail park) and two compact ‘B&Q Local’ stores in the year, and closed all eight of its grocery concession stores. As of 31 January 2024, B&Q had a total of 311 stores in the UK & Ireland.

B&Q’s trade-focused banner, TradePoint, delivered a good performance supported by resilient demand from trade customers. LFL sales for TradePoint were up 0.7%, despite tough comparatives, with penetration of B&Q sales at 22% (FY 22/23: 22%). A strong performance was seen in the surfaces & décor and tools & hardware categories. In H2, TradePoint’s LFL sales improved to +3.6%. Sales to trade customers of ‘big-ticket’ categories also improved in the second half of the year, with resilient sales of bathroom & storage. TradePoint opened 21 new counters in the UK & Ireland, extending its presence within the B&Q store network to 209 stores (67% of stores).

Screwfix total sales increased by 7.3% (LFL +1.4%) to £2,538m, driven by resilient demand from trade customers. Good performance was seen across most categories, with tools & hardware, building & joinery and outdoor performing particularly well. Sales trends slowed in H2 (LFL -0.2%) largely due to a weak market in December and unseasonably warmer weather throughout the period. The business gained significant market share in the year. Screwfix’s e-commerce sales increased by 1.6% YoY, with ecommerce sales penetration of 57% (FY 22/23: 60%; FY 19/20: 33%), reducing slightly YoY due to the increasing adoption of in-store digital browsing tablets.

Space growth and acquisitions contributed c.6% to total Screwfix sales. Screwfix opened 51 new stores, including 46 in the UK and five in Ireland, and closed one store in the UK, bringing its total to 922 as of 31 January 2024. Screwfix plans to open up to 40 new stores in the UK & Ireland in FY 24/25, remaining on track to reach its medium-term goal of over 1,000 stores.

In March 2023, the business acquired the stock, intellectual property, contracts and fixed assets of Connect Distribution Services Limited (renamed Screwfix Spares), a leading retailer of appliance spares, accessories and consumables to tradespeople and consumers. Since acquisition, Screwfix Spares has performed in line with expectations, contributing c.1.8% to total Screwfix sales growth. Monthly sales accelerated in H2, with the business reaching a profit-making position by the end of the year.

Further progressing its international expansion plans, Screwfix opened 15 stores in France in the year (with 20 stores in total as of 31 January 2024), and plans to open up to 15 stores in FY 24/25. The results for Screwfix International are captured in ‘Other International’ – see later story for further information.

Thierry Garnier, Chief Executive Officer, said:

"Despite all the macroeconomic and consumer challenges in our markets over the past year, we have stayed focused on our customers and our long-term strategy. I am immensely proud of all our teams for their efforts. In the UK & Ireland, B&Q, TradePoint and Screwfix each delivered resilient sales and market share growth - in particular very strong gains at Screwfix. In France, where the market has been impacted by low consumer confidence, we have made significant adjustments to the cost base and started to embed e-commerce marketplace and trade customer initiatives similar to those successfully implemented in the UK. And in Poland, where we faced strong comparatives and a tough economic backdrop, sales trends are gradually improving in line with the consumer environment.

"We continue to execute against our strategic priorities at pace, with high conviction in our multiple growth opportunities. The success of our marketplaces in the UK and Iberia is well ahead of our expectations, with launches also planned in France and Poland this year. We have continued the international expansion of Screwfix, with 22 stores now open in France and encouraging results so far. Our trade proposition trials in France and Poland, as well as our data, AI and retail media initiatives, are also delivering positive results - encouraging us to accelerate their roll-out. We are also today outlining a new plan to simplify the French organisation and significantly improve the performance and profitability of Castorama France, which includes restructuring and modernising the store network.

"Looking forward, we remain confident in the attractive growth prospects of the home improvement industry and our ability to grow ahead of our markets. In the short term, while repairs, maintenance and renovation activity on existing homes continue to support resilient demand, we are cautious on the overall market outlook for 2024 due to the lag between housing demand and home improvement demand. Against this backdrop we will remain agile and focused on what is within our control - leveraging our strategy to deliver market share growth, driving productivity gains, and managing our costs and cash effectively.

"In line with this view, we reaffirm our medium-term financial priorities, focused on growth, cash generation and attractive returns to shareholders."

Source : Kingfisher

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.