International DIY News

Kingfisher France Posts Negative Sales Growth

Kingfisher has published full-year results for the year ended 31st January 2024.

Click here for Group performance

Click here for Screwfix UK performance

Click here for Other International performance

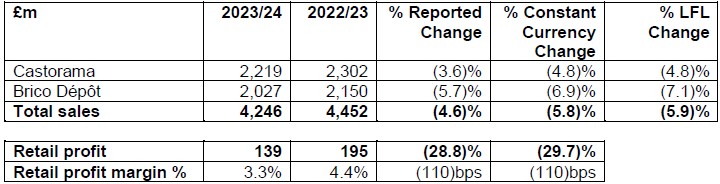

France sales decreased by 5.8% (LFL -5.9%) to £4,246m, with the trading environment impacted by low consumer confidence, particularly in the second half of the year. In H2, LFL sales were -8.3%, with market weakness reflected broadly across all categories. Unseasonal weather conditions also impacted the performance of seasonal categories during the year (LFL -9.2%). Gross margin % decreased by 10 basis points, reflecting the higher weighting of sales towards special promotions (‘arrivages’) at Brico Dépôt, largely offset by effective supplier negotiations and lower distribution costs and shrinkage rates. Gross margin % increased by 20 basis points in H2.

Retail profit decreased by 29.7% to £139m (FY 22/23: £195m, at reported rates), with lower gross profit somewhat offset by lower operating costs. Operating costs decreased by 2.9% due to the active flexing of variable costs, and structural savings achieved by our cost reduction programme. This was partially offset by cost inflation, including YoY increases in pay rates and energy costs, together with higher technology spend. In H2, in response to the weaker trading environment, the business accelerated several structural cost reduction initiatives and strengthened its actions around staff costs and discretionary spend, resulting in an operating cost reduction of 4.4% YoY. Retail profit margin % decreased by 110 basis points to 3.3% (FY 22/23: 4.4%, at reported rates).

Castorama total sales decreased by 4.8% (LFL -4.8%) to £2,219m, broadly in line with the market against a challenging consumer backdrop. Sales trends slowed in H2 (LFL -7.3%), reflecting the weaker trading environment in that time period. Market weakness was reflected broadly across the categories, with EPHC also lapping strong sales of heating and energy efficiency products in the prior year. Volume trends YoY in core and ‘big-ticket’ categories improved in Q4, compared to Q3. Castorama’s e-commerce sales increased by 4.9% YoY, with e-commerce sales penetration of 6% (FY 22/23: 5%; FY 19/20: 2%). As of 31 January 2024, Castorama had a total of 95 stores in France.

Brico Dépôt total sales decreased by 6.9% (LFL -7.1%) to £2,027m, a weaker performance relative to Castorama. Performance in H1 was impacted by a reallocation of a portion of its marketing budget to digital, which proved unsuccessful and was corrected in mid-July. Sales trends slowed in Q3 (LFL 10.6%) as the trading environment weakened, with Brico Dépôt more exposed than Castorama due to a relatively higher category weighting towards building materials and EPHC, with plumbing, heating and insulation products also impacted by milder weather and strong comparatives. Sales trends improved in Q4, notably in EPHC and bathroom & storage, with Brico Dépôt’s sales broadly in line with the market (LFL -7.9%). For the year, e-commerce sales increased by 14.7%, the fastest first-party (1P) e-commerce sales* growth rate of all banners in the Group. E-commerce penetration reached 5% (FY 22/23: 4%; FY 19/20: 2%). Brico Dépôt opened two stores during the year, with a total of 125 stores in France as of 31 January 2024.

Thierry Garnier, Chief Executive Officer, said:

"Despite all the macroeconomic and consumer challenges in our markets over the past year, we have stayed focused on our customers and our long-term strategy. I am immensely proud of all our teams for their efforts. In the UK & Ireland, B&Q, TradePoint and Screwfix each delivered resilient sales and market share growth - in particular very strong gains at Screwfix. In France, where the market has been impacted by low consumer confidence, we have made significant adjustments to the cost base and started to embed e-commerce marketplace and trade customer initiatives similar to those successfully implemented in the UK. And in Poland, where we faced strong comparatives and a tough economic backdrop, sales trends are gradually improving in line with the consumer environment.

"We continue to execute against our strategic priorities at pace, with high conviction in our multiple growth opportunities. The success of our marketplaces in the UK and Iberia is well ahead of our expectations, with launches also planned in France and Poland this year. We have continued the international expansion of Screwfix, with 22 stores now open in France and encouraging results so far. Our trade proposition trials in France and Poland, as well as our data, AI and retail media initiatives, are also delivering positive results - encouraging us to accelerate their roll-out. We are also today outlining a new plan to simplify the French organisation and significantly improve the performance and profitability of Castorama France, which includes restructuring and modernising the store network.

"Looking forward, we remain confident in the attractive growth prospects of the home improvement industry and our ability to grow ahead of our markets. In the short term, while repairs, maintenance and renovation activity on existing homes continue to support resilient demand, we are cautious on the overall market outlook for 2024 due to the lag between housing demand and home improvement demand. Against this backdrop we will remain agile and focused on what is within our control - leveraging our strategy to deliver market share growth, driving productivity gains, and managing our costs and cash effectively.

"In line with this view, we reaffirm our medium-term financial priorities, focused on growth, cash generation and attractive returns to shareholders."

Source : Kingfisher

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.