UK DIY News

Kingfisher: Annual LFL Sales Decline Of 2.1%

Kingfisher has published final results for the year ended 31st January.

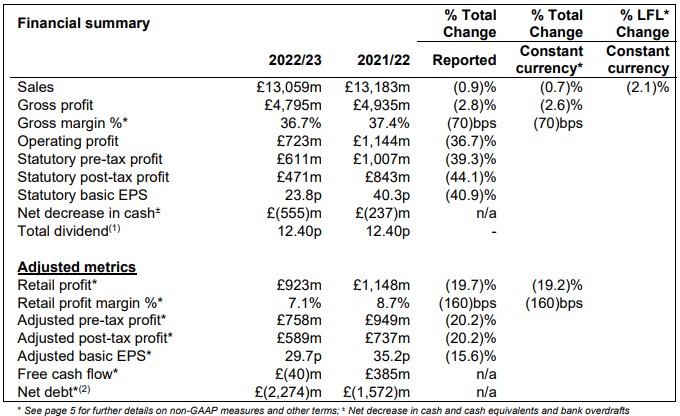

FY 22/23 Group results

- Sales down 0.7% in constant currency, reflecting strong prior year comparatives linked to high demand for home improvement products. Resilient sales across both retail and trade channels

- LFL sales down 2.1% and corresponding 3-year LFL up 15.6% − Double-digit 3-year LFL sales growth across all banners − Positive 1-year growth in Poland, Iberia and Romania; resilient performance in France; strong prior year comparatives for the UK & Ireland

- Q4 22/23 LFL sales flat, and up 13.7% on a 3-year basis, broadly consistent with the trend from Q3 22/23 (LFL +0.2%; 3-year LFL +15.3%)

- Gross margin % down 70 basis points to 36.7% (FY 21/22: 37.4%; FY 19/20: 37.0%), reflecting banner & category mix, and the impact in H1 of ‘normalised’ promotional activity and one-off logistics spend to secure/manage seasonal and ‘buffer’ stock

- Retail profit down 19.2% in constant currency to £923m (FY 21/22: £1,148m; FY 19/20: £786m), largely reflecting very strong prior year comparatives in the UK & Ireland and France

- Statutory pre-tax profit down 39.3% to £611m (FY 21/22: £1,007m; FY 19/20: £103m), reflecting lower operating profit, including the impact of impairments following significant increases in discount rates and revised future projections

- Adjusted pre-tax profit down 20.2% to £758m (FY 21/22: £949m; FY 19/20: £544m), reflecting lower retail profit, partially offset by lower finance costs

- Free cash flow of £(40)m, down £425m (FY 21/22: £385m; FY 19/20: £191m), reflecting lower EBITDA* and one-off working capital outflow from completion of inventory rebuild programme • Net decrease in cash of £555m (FY 21/22: £237m), largely reflecting lower free cash flow, and £583m of outflows in relation to ordinary dividends and share buybacks

- Net debt up to £2,274m (31 January 2022: £1,572m), including £2,444m of lease liabilities under IFRS 16, reflecting the net decrease in cash. Net debt to EBITDA of 1.6x (31 January 2022: 1.0x)

- Total dividend per share proposed of 12.40p (FY 21/22: 12.40p)

Highlights

A year of solid execution

− FY performance in line with our expectations & guidance, against strong prior year comparatives

− Total sales -0.7% in constant currency and LFL -2.1% (3-year LFL* +15.6%)

− Sales outperforming home improvement industry growth, with 3-year total sales CAGR(3) of +5.9% vs market CAGR(4) of +4.9%

− Total e-commerce sales* -9.1% (3-year growth +146%), with growth of +3.7% in H2. E-commerce sales penetration* of 16.3% (FY 19/20: 7.9%)

− Adjusted pre-tax profit (PBT) -20% to £758m (+39% vs FY 19/20). Statutory PBT -39.3% to £611m

− Exceeded target for 1.5°C science-based scope 1 and 2 carbon reduction (-52.7% vs FY 16/17)

− Proposed total dividend maintained at 12.40p per share, in line with FY 21/22

- Multiple profitable growth opportunities being pursued at pace

− Ambition of 25% e-commerce sales penetration. Successful e-commerce marketplace launches in the UK and Iberia*; preparing roll-out in Poland and France*

− Opened first 5 Screwfix stores in France; up to 25 new stores planned in FY 23/24

− Record 82 Screwfix store openings in the UK & Ireland*; up to 60 new stores planned in FY 23/24

− Targeting up to 80 medium-box and compact store openings in Castorama Poland over 5 years

− Continued focus on increasing trade penetration across all banners. TradePoint (in B&Q) 3-year LFL sales growth of +31.5%, outperforming core B&Q and reaching 22% sales penetration

- Well positioned to navigate FY 23/24

− Resilient underlying sales trends in the new year (February 23/24 LFL sales(5) : +0.5%)

− Maintaining strong price indices in our key markets, and continuing to deliver value to customers

− Own exclusive brands (45% of sales) providing customer benefits and support to gross margin %

− Effectively managing inflation, costs and inventory levels

− Comfortable with current consensus of sell-side analyst estimates for FY 23/24 adjusted pre- tax profit(4), with expectation of >£500m free cash flow for the year

• Announcing new medium-term financial priorities; confident in growth and cash generation opportunity

Kingfisher UK & Ireland Results

Kingfisher UK & Ireland sales decreased by 4.7% (LFL -6.9%) to £6,200m, against very strong prior year comparatives in H1. In H2, total sales increased by 1.5% (LFL -1.2%). 3-year LFL sales for the year were up 15.3%. The 3-year sales trend improved to +16.2% in Q4 (versus +12.9% in Q3) supported by resilient sales from DIFM/trade categories.

Over the last three years, B&Q (including TradePoint) and Screwfix have increased their market shares in the UK, supported by strong engagement with new and existing customers and higher store and online NPS scores.

Gross margin % decreased by 80 basis points, reflecting ‘normalised’ promotional activity in H1 versus the prior year and one-off logistics spend in H1 to secure and manage seasonal and ‘buffer’ stock, in addition to mix impacts. Mix impacts were the result of a lower YoY share (versus Screwfix) of B&Q’s higher gross margin % revenues given very strong prior year sales; and unfavourable B&Q category mix between lower margin building & joinery and EPHC (electricals, plumbing, heating & cooling) and higher margin surfaces & décor categories.

Retail profit decreased by 24.0% to £603m (FY 21/22: £794m; FY 19/20: £499m; at reported rates), due to the exceptionally higher sales and gross margin % in H1 last year. In H2, retail profit increased 22.4% to £264m (H2 21/22: £215m at reported rates). Operating costs increased by 1.3%, driven by higher costs associated with 86 net new store openings in the year, higher technology spend, and operating cost inflation including increases in pay rates and significantly higher energy costs. Advertising, marketing and travel costs also normalised compared to one-off COVID-related savings in the prior year. Increases were substantially offset through flexing our staff costs and cost reductions achieved by our strategic cost reduction programme. Retail profit margin % decreased by 250 basis points to 9.7% (FY 21/22: 12.2%; FY 19/20: 9.8%).

B&Q total sales decreased by 8.2% (LFL -8.8%) to £3,835m against very strong prior year comparatives, especially in H1. Sales trends improved in H2 (LFL -3.2%) with positive LFL growth in the EPHC, building & joinery and bathroom & storage categories. 3-year LFL sales for the year were up 15.8%. The business achieved good growth across all categories on a 3-year basis, in particular building & joinery and outdoor. LFL sales of weather-related categories decreased by 16% (increase of 21% on a 3-year LFL basis), while LFL sales of non-weather-related categories, including showroom, decreased by 6% (increase of 14% on a 3-year LFL basis).

B&Q’s total e-commerce sales (including marketplace gross sales) decreased by 7% YoY, which was a resilient performance against strong online trading in the first half of the prior year. In H2, total e-commerce sales increased by 9%, driven by the growth of B&Q’s marketplace which has scaled rapidly since its launch in March 2022. Marketplace reached a penetration of 22% in January 2023 (i.e., B&Q’s marketplace gross sales divided by B&Q’s total e-commerce sales). B&Q’s total e-commerce sales were up 130% on a 3-year basis, with overall e-commerce sales penetration of 11% (FY 21/22: 11%; FY 19/20: 5%).

B&Q opened five small format stores in FY 22/23, including its first two B&Q Local compact format stores, and closed one store. As of 31 January 2023, B&Q had a total of 316 stores in the UK and Ireland. In February 2023, B&Q announced that it is terminating its ‘grocery concession’ partnership with ASDA in eight stores.

B&Q’s trade-focused banner, TradePoint, continued to perform ahead of expectations in FY 22/23, supported by resilient sales from trade customers. LFL sales for TradePoint outperformed the rest of B&Q, down just 1.2% YoY, with 3-year LFL sales up 31.5%. TradePoint’s penetration of B&Q sales increased to 22% (FY 21/22: 20%). Throughout the year, TradePoint continued to focus on customer engagement and loyalty through targeted campaigns, trade-only deals and events, and improvements to trade-specific product ranges and services. E-commerce sales increased by 14% in the year as TradePoint grew awareness of its digital offer. During the year, TradePoint opened 18 new counters in the UK within B&Q stores, and expanded into Ireland with its first eight counters. Further roll-out of the proposition will continue in FY 23/24.

For Kingfisher France performance, click here

Thierry Garnier, Chief Executive Officer, said:

“Across all our markets, sales have remained resilient in both DIY and DIFM/trade channels, with like-for-like sales 15.6% ahead of pre-pandemic levels. We have maintained a sharp focus on pricing to deliver value to our customers during this challenging period for household finances, while at the same time managing our cost inflation pressures effectively. Strong supply chain management has ensured good product availability and a firm grip on our inventories.

“We continue to execute our strategy at pace and invest in our multiple growth opportunities. We are proud of the progress our teams have made during the year, and since the start of our ‘Powered by Kingfisher’ strategy. Our e-commerce sales have increased by 146% over the last three years and we have enhanced our online proposition with the launch of marketplace offerings in the UK, Spain and Portugal, which are all performing strongly. Across the Group, we are strengthening our proposition for trade customers, building on the success of B&Q’s TradePoint and the accelerated expansion of Screwfix. Whilst it’s still early days for Screwfix’s ambitions in France, we are happy with the results of the first few months of operations and planning for up to 25 more store openings this year. We are also building on our leadership position in Poland and the attractive potential of this market by opening seven more Castorama stores in 2023.

“We remain confident in both the growth of our industry, and in our strategic priorities supporting growth ahead of our markets. And we are announcing today our new medium-term financial priorities, focused on growth, cash generation and higher returns to shareholders.”

Source : Kingfisher PLC

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.