International DIY News

Wesfarmers: Retail Divisions Performed Strongly In First Half

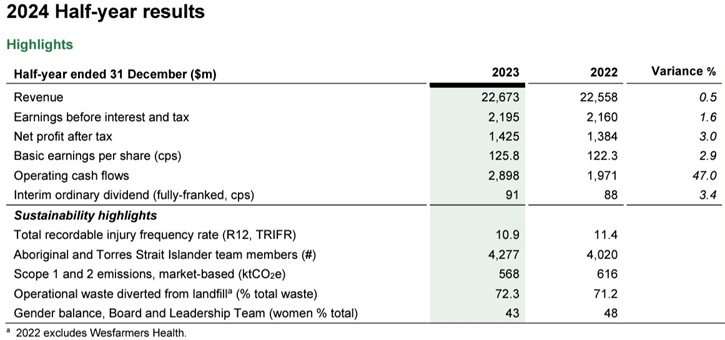

Wesfarmers Limited has reported a statutory net profit after tax of $1,425 million for the half-year ended 31 December 2023, an increase of 3.0 per cent.

Wesfarmers Managing Director Rob Scott said the pleasing profit growth and strong cash flows for the half demonstrate the strength of Wesfarmers’ operating model and quality of the Group’s portfolio of businesses.

“Wesfarmers’ retail divisions executed strongly during the half, responding effectively to changing customer needs as households increasingly sought out value,” Mr Scott said. “In this environment, the retail divisions’ core offer of everyday products with market-leading value credentials supported growth in sales and customer transaction numbers.

“The retail divisions have benefitted from a proactive focus on productivity and efficiency initiatives in recent years, which together with their unique sourcing capabilities and strong supplier partnerships enabled them to mitigate ongoing cost pressures and provide compelling value for customers during the half.

“In Bunnings, solid sales and earnings growth continued during the half, with growth in both consumer and commercial sales. Kmart Group delivered record earnings for the half, reflecting the market-leading value credentials of its Anko products as well as actions to drive cost efficiencies, and a moderation in some key input costs. Officeworks’ results were supported by continued growth in stationery, art, education, Print & Create and technology categories.

“OnePass launched significant enhancements to its offer during the period, with new retail partnerships and unique online and in-store benefits providing additional value for customers. These enhancements supported new customer acquisition, improved customer retention and incremental sales for Wesfarmers’ businesses during the half.

“Strong operating performance continued in WesCEF, with good plant availability and production rates during the period. As previously indicated, earnings for the half were impacted by lower global commodity prices relative to the elevated pricing environment over recent years. The Mt Holland concentrator was successfully commissioned during the half, and operations recently entered the ramp-up phase. Good progress continued on the construction of the Kwinana lithium hydroxide refinery.

“Wesfarmers Industrial and Safety recorded solid revenue and earnings growth for the half, despite the impact of ongoing domestic cost pressures, foreign exchange movements and continued investments to support long-term growth.

“Wesfarmers Health’s results for the half reflected ongoing investments to position the division for long-term growth and value creation, including through progress on the ‘Accelerate’ transformation plan and the acquisitions of SILK Laser Australia and InstantScripts.

“Catch recorded a reduction in operating losses during the half, simplifying its in-stock offer to enable improved unit economics and further reducing its cost base.”

The Group delivered strong growth in operating cash flows of 47.0 per cent, supported by 27.1 per cent growth in divisional operating cash flows as a result of favourable working capital movements and strong earnings growth in Kmart Group.

As a result of profit growth and strong cash flows for the half, the Wesfarmers Board has determined to pay a fully-franked interim dividend of $0.91 per share, an increase of 3.4 per cent on the prior corresponding period.

Wesfarmers maintains significant balance sheet flexibility, supporting investment activity across the Group and providing capacity to manage potential risks and opportunities under a range of economic scenarios.

The Group recognises the alignment between long-term shareholder value and sustainability performance.

Wesfarmers maintains its commitment to providing a safe and fulfilling work environment for team members, and improvements in safety results were recorded across most divisions, with Wesfarmers’ TRIFR improving to 10.9.

At the end of the period, the Wesfarmers Board and Leadership Team remained in gender balance. The Group also remained above Indigenous employment parity, with 4,277 Aboriginal and Torres Strait Islander team members, representing 3.7 per cent of the Group’s Australian workforce. During the half, 37 team members completed the Wesfarmers Indigenous Leadership Program to receive a Certificate II or IV in Indigenous Leadership.

At a Group level, Scope 1 and 2 market-based emissions reduced 7.8 per cent, with the divisions making continued progress towards their intermediate and long-term targets. WesCEF achieved a 3.8 per cent reduction in Scope 1 emissions for the half, while a continued focus on operational efficiency and renewable electricity use supported reductions in Scope 2 market-based emissions across the retail divisions.

Operational waste recovery, including for recycling, is supported by a diverse range of strategies across the Group. During the half, operational waste diverted from landfill increased to 72.3 per cent of total operational waste.

Outlook

Wesfarmers remains focused on long-term value creation and continues to invest to strengthen its existing businesses and develop platforms for growth.

Low unemployment and strong population growth provide support to overall economic conditions in Australia, driving demand and contributing to the need for additional housing stock. While Australian inflation has moderated over the last 12 months, current inflation and interest rates remain elevated, and consumers continue to focus on value and manage spending carefully.

The strong value credentials and expanding offer of everyday products across the Group’s retail businesses make them well positioned in the current environment and for any improvements in consumer sentiment.

For the first five weeks of the second half of the 2024 financial year, Kmart Group has continued to deliver strong sales growth. Sales growth in Bunnings remained broadly in line with results for the first half. Officeworks’ sales for the first five weeks were in line with the prior corresponding period.

Domestic cost pressures in Australia and New Zealand are expected to remain elevated, driven by inflation, labour market constraints and wage cost increases, and energy and supply chain costs. The Group is monitoring ongoing pressures in international supply chains and key shipping routes, and has implemented additional contingencies where possible to mitigate the risk of interruptions.

Wesfarmers’ larger businesses are benefitting from investments made to digitise their operations and develop their sourcing capabilities. Together with benefits from proactive investments in productivity and efficiency over recent years, the Group remains focused on disciplined cost management.

The high quality of the Mt Holland deposit is expected to enable the integrated Covalent lithium hydroxide project to operate with an attractive relative cost structure and support satisfactory long-term shareholder returns.

Following the successful commissioning of the concentrator at Mt Holland, operations are now in ramp up and WesCEF’s share of spodumene concentrate production in the 2024 financial year is expected to be approximately 50,000 tonnes. Spodumene concentrate sales volume for 2024 will be dependent on commercial factors including the prevailing spot price, but at current spodumene prices sales will not contribute positive earnings during the 2024 financial year due to the higher cost of production while volumes ramp up towards full capacity.

The performance of the Group’s industrial businesses remains subject to international commodity prices, foreign exchange rates, competitive factors and seasonal outcomes.

Wesfarmers will continue to invest in its existing operations and in the development of platforms for long-term growth and shareholder value creation. The Group expects net capital expenditure of between $1,000 million and $1,200 million for the 2024 financial year, subject to net property investment and the timing of project expenditures.

Source : Wesfarmers

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.