International DIY News

Bunnings Notes H1 Revenue Growth

Wesfarmers Limited has reported a statutory net profit after tax (NPAT) of $1,467 million for the half-year ended 31 December 2024, an increase of 2.9 per cent. Wesfarmers Managing Director Rob Scott said the increase in profit in a challenging environment highlights the strong execution across the Group, with the divisions improving their customer propositions and delivering productivity initiatives that drove growth and efficiency.

“During the half, cost of living and cost of doing business pressures continued to significantly impact many households and businesses,” Mr Scott said. “In this environment, the divisions remained focused on long-term shareholder value creation, investing in even greater value, service and convenience for customers. Proactive efficiency and digitisation initiatives helped mitigate higher costs, while enabling divisions to enhance the customer experience.

“The Group’s largest divisions performed well, with Bunnings and Kmart Group’s everyday low prices, market-leading offers and strong execution driving growth in transactions, sales and earnings. The retail divisions benefited from households prioritising value, and from new and expanded ranges and offerings that helped grow their addressable markets.

“Bunnings demonstrated the resilience of its offer, with strong consumer sales growth and continued sales growth in the commercial segment. Kmart Group’s earnings growth was supported by the market-leading value and appeal of its Anko product ranges, and productivity initiatives undertaken in recent years, including the integration of Kmart and Target’s systems and processes. Officeworks benefited from above-market growth in technology, as it continued to evolve its offer."

Bunnings Group Performance Summary

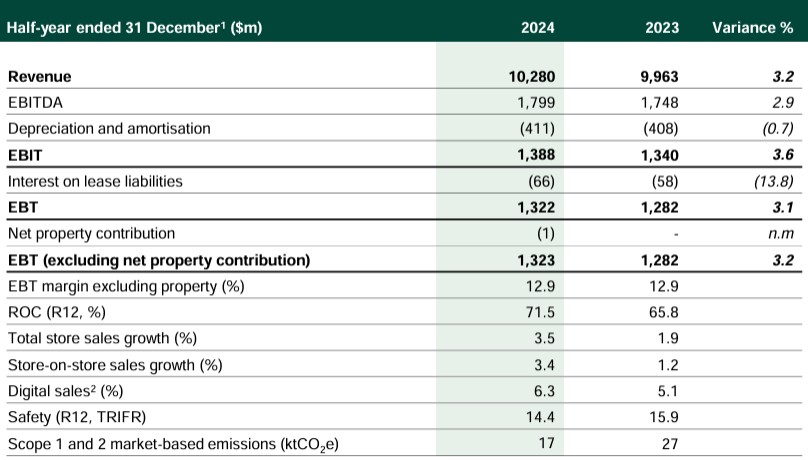

Revenue growth of 3.2% to $10,280m

- Total store sales increased 3.5% and store-on-store sales growth of 3.4%

- Growth across both consumer and commercial segments

- Delivering the best customer offer – increase in transaction volumes and units sold‒ Sustained demand for repairs and maintenance, growth in digital sales and the appeal of new and expanded ranges

Earnings growth of 3.2% to $1,323m excluding net property contribution

- Price reinvestment and range innovation and expansion driving higher volumes

- Sustained cost discipline and productivity focus offsetting cost inflation

- Executing material technology, rostering and supply chain initiatives to enable structural productivity improvements

- Continuing to improve the customer experience through investments in store network, merchandise offer, digital / tech, retail media and supply chain

BUNNINGS GROUP PROGRESS ON STRATEGY

Care

- Material improvement in safety performance

- New rostering system driving productivity, flexibility and better customer experience

- On track to deliver 100% renewable electricity commitment by end of CY25

- Substantial growth in community contributions

Grow

- Lowest Prices, Widest Range and Best Experience pillars resonating strongly

- Range innovation and expansion supported strong sales growth in the power garden, tools, smart home and consumables categories

- Disciplined execution driving commercial sales growth in a subdued environment

- Sustained online growth (including Marketplace) and strong initial retail media uptake

Simplify

- Improved productivity through structural cost reductions and tech enablement, supporting reinvestment in price and service

- Delivering better customer experience, lower costs and better working capital efficiency

Renovate

- Scaling the space optimisation program to drive sales growth across multiple categories Waipapa (NZ) store team Eastern Creek Distribution Centre 2024 expansion

- New same-day delivery offer resonating with customers

BUNNINGS GROUP OUTLOOK

- Bunnings continues to maintain its long-term focus on sustainable earnings growth, underpinned by its:

‒ Resilient operating model

– Lowest Prices, Widest Range, Best Experience

‒ Relentless attention to customer value

‒ Diverse customer base

‒ Focus on simplicity and productivity - Despite challenging economic conditions, Bunnings remains well positioned to continue providing value to cost-conscious customers

- Continuing to improve the customer offer and profitability through a focus on productivity, including investments in technology and supply chain

- Strong pipeline of range innovation, network optimisation and digital growth is driving the expansion of Bunnings’ addressable market and deeper participation in existing markets

- Pursuing initiatives that support long-term growth, including expanding and optimising space and ranges, and accelerating retail media

- While cost pressures are expected to persist in 2H25, Bunnings will continue to execute productivity initiatives to mitigate their impact

- Building activity is expected to remain subdued in 2H25, but population growth and the undersupply of housing are anticipated to support a recovery over the medium term

Source : Wesfarmers

Image : Wesfarmers

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.