International DIY News

Annual Revenue Rises By 5% At Bunnings

Wesfarmers Limited has reported a statutory net profit after tax (NPAT) of $2,352 million for the full-year ended 30 June 2022. Excluding significant items in the prior period, NPAT declined 2.9 per cent for the year, but increased 13.1 per cent in the second half.

Wesfarmers Managing Director Rob Scott said that it was pleasing to have delivered solid financial results for the 2022 financial year while continuing to invest in our businesses and renew the portfolio, despite the significant disruptions caused by COVID-19.

“The Group’s financial results for the year reflect the material impact of COVID-19 on trading conditions during the first half, which included weeks where almost half of the Group’s retail stores were either subject to trading restrictions or closed,” Mr Scott said. “In the second half of the year, Wesfarmers delivered strong NPAT growth of 13.1 per cent excluding significant items in the prior period, with trading conditions improving as restrictions were eased.

“As a result of the strong second-half result, Wesfarmers directors have determined to pay a final fully-franked dividend of $1.00 per share, bringing total fully-franked ordinary dividends for the year to $1.80 per share, an increase of 1.1 per cent on the prior year.

“During the year, Wesfarmers established new businesses and continued to invest in its existing operations, developing platforms to support long-term shareholder returns. Consistent with our objective, we have maintained a long-term focus, advancing our sustainability agenda and supporting team members, customers and the community, while managing what continued to be a significantly disrupted operating environment.

“The impact of the pandemic over the last two years has highlighted the importance of prioritising health and wellbeing, and the Group has maintained its focus on providing a safe environment for customers and team members. Throughout the year the Group provided a range of support measures, including additional paid leave and financial assistance, to team members impacted by COVID-19.

“Bunnings and Wesfarmers Chemicals, Energy & Fertilisers (WesCEF) delivered pleasing results for the year. Bunnings continued to demonstrate the resilience of its operating model and ability to deliver growth through a range of market conditions. Record earnings in WesCEF reflected elevated global commodity prices and continued strong operating performance. It was also pleasing to report continued improvement in the performance of Wesfarmers Industrial and Safety.

“Relative to the Group’s other divisions, Kmart Group was the most materially impacted by trading restrictions in the first half. Results for Kmart Group improved significantly in the second half, with Kmart and Target delivering strong second-half earnings growth of 19.4 per cent, benefiting from actions taken in recent years to optimise the store network. Lower earnings in Officeworks for the year reflected the impact of trading restrictions and the margin impact of sales mix changes, as well as increased investment in the supply chain, data and digital capabilities and to support the launch of new products.”

Divisional performance overview: Bunnings

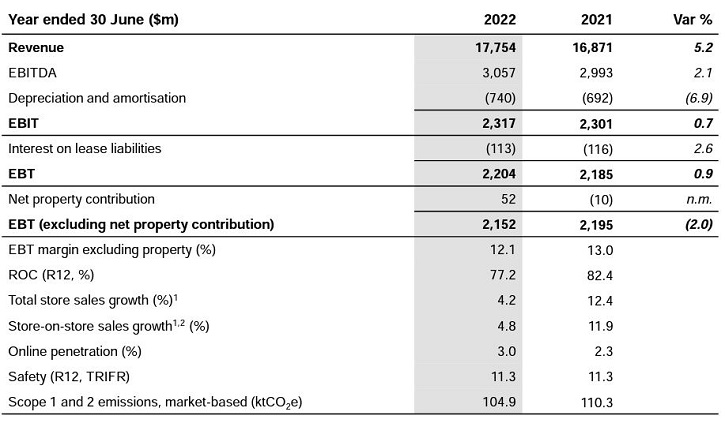

Bunnings’ revenue increased 5.2 per cent to $17,754 million for the year. Earnings increased 0.9 per cent to $2,204 million, including a favourable contribution from property disposals.

Revenue of $17.8 billion

- Total store sales growth of 4.2% (7.8% in the second half)

- Driven by strong commercial growth and solid DIY activity, while cycling elevated levels of demand in prior year

- Deeper digital engagement contributing to sales growth online, instore and through the PowerPass App

Earnings of $2.2 billion

- Record earnings in FY22 follow extraordinary growth through FY20 and FY21, with EBT increasing over 10% per annum over the last three years

- Earnings impacted by continued investment in data, digital and technology as well as additional costs due to COVID 19 and continued supply chain disruptions

- Favourable property divestment outcomes during period

“The pleasing sales and earnings results delivered by Bunnings continue to demonstrate the resilience of its operating model and the execution of its strategic agenda,” Mr Scott said. “Sales growth was supported by continued strong demand from commercial customers and consumer sales remained robust, despite cycling elevated demand in prior periods.

“Bunnings continued to accelerate investment in long-term growth initiatives while managing the ongoing operational disruptions associated with COVID-19. During the year, Bunnings delivered enhancements to the shopping experience for customers both instore and online, and continued to expand its range, store network and fulfilment capabilities.

“Good progress was also made on the ‘Whole of Build’ commercial strategy with the launch of new product ranges, enhanced capability of frame and truss and improvements to sales support. Progress continued on the development of Tool Kit Depot, which expanded into Western Australia with six new stores, and the acquisition of Beaumont Tiles completed in November 2021.”

View the results presentation here.

Source : Wesfarmers

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.