International DIY News

Unseasonable Spring Weather Hits Castorama and Brico Dépôt Trading

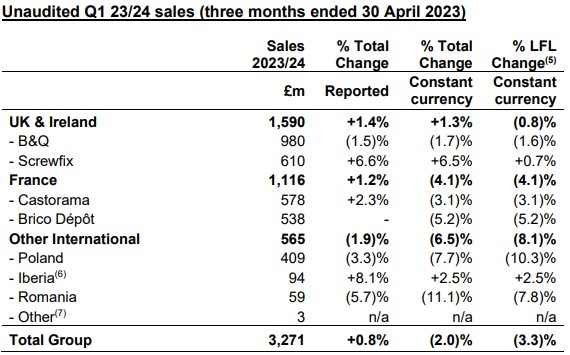

Kingfisher plc is today providing its Q1 23/24 sales.

Key points

- First quarter sales of £3.3bn; total sales +0.8% (reported) and -2.0% (constant currency)

- LFL -3.3% including a -0.5% calendar impact(1)

- Resilient performance in core and ‘big-ticket’ categories(2) (82% of sales), with LFL -1.3%

- Sales of seasonal categories(3) (18% of sales) affected by weather conditions, with LFL - 11.3%

- Improved trading since early April; continued resilience in core and ‘big-ticket' trading and better seasonal sales

For UK & Ireland results, click here

FRANCE

Total sales -4.1% (LFL -4.1%). As in the UK & Ireland, trading in France was impacted by the weather, especially in March. Furthermore, 10 days of national pension reform strikes across the quarter impacted customer footfall to both banners.

- Castorama sales -3.1%. LFL -3.1%, with resilient underlying sales from both DIY and DIFM/trade customers. Sales from the building & joinery and EPHC categories were robust, with the latter seeing good growth in energy and water-saving products. LFL sales of seasonal categories were -9.3%, while LFL sales of core and ‘big-ticket’ categories were -1.2%.

- Brico Dépôt sales -5.2%. LFL -5.2%, with several store locations directly impacted by strike action in the quarter (e.g., due to nearby road closures). ‘Big-ticket’ sales were resilient, with growth in the bathroom & storage category. Overall core and ‘big-ticket’ LFL sales were -2.2%. Seasonal categories were -17.5% LFL, with the weather affecting the important garden structure and outdoor paint ranges. Brico Dépôt continues to strengthen its discounter credentials through further differentiating its ranges and maintaining a strong price index relative to its home improvement peers.

OTHER INTERNATIONAL

Poland sales -7.7%. LFL -10.3% against strong comparatives from the prior year (Q1 22/23 LFL +54.5%). Market growth in Poland has been impacted since Q4 22/23 by ongoing macroeconomic challenges in the country, including the impact on the consumer of high inflation and interest rates. Looking at Castorama’s performance on a 4-year LFL sales basis, growth was +10.1% – a slight improvement on its Q4 22/23 3-year LFL of +9.4%. LFL sales of core and ‘big-ticket’ categories were -10.5% and LFL sales of seasonal categories were -9.6%. We opened one new medium-box store in Q1 and remain on track to open six more Castorama stores this financial year.

Iberia sales +2.5%. LFL +2.5%, supported by strong growth in seasonal categories, especially in outdoor and EPHC given more favourable weather conditions. The business also saw good performances in its building & joinery and kitchen categories.

Romania sales -11.1%. LFL -7.8% against a strong comparative from the prior year (Q1 22/23 LFL +13.9%). The business saw a strong performance in its kitchen category.

Other consists of the consolidated results of Screwfix International, NeedHelp and franchise agreements. While these businesses are in their early investment phase, we are pleased with their performance to date. There are now seven Screwfix stores in operation in France, with two new openings this financial year to date. We remain on track to open up to 25 stores this financial year. The business continues to invest in its operations and brand awareness, and is seeing an encouraging progression in sales and customer trends.

In Turkey, Kingfisher’s 50% joint venture, Koçtaş traded well against a challenging macroeconomic backdrop. The business launched a new e-commerce marketplace in the quarter and opened 24 new stores. As a joint venture, Koçtaş is not included in our reported sales or Group LFL.

Source : Kingfisher PLC

For all the very latest news and intelligence on the UK's largest home improvement and garden retailers, sign up for the Insight DIY weekly newsletter.

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.