UK DIY News

Next Profits Reach Record High

Next plc has published full-year trading results for the year ended 31st January 2024.

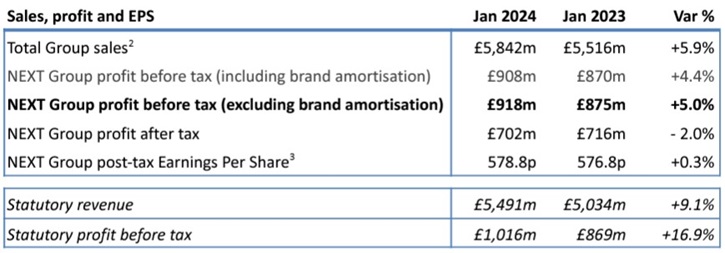

In our January Trading Statement we explained that going forward we would report our headline profit excluding the amortisation of acquired brands. This more accurately reflects the underlying profitability of the Group. Hereinafter, we will report NEXT Group profit and Earnings Per Share (EPS) excluding brand amortisation as shown above. Prior year figures are stated on the same basis.

Headlines

- NEXT Trading full price sales4 up +4.0% and total Group sales (including subsidiaries) up +5.9%.

- NEXT Group profit before tax £918m, up +5.0%. This is £3m ahead of the guidance of £915m5 given in January, largely due to better than expected clearance rates of Sale stock in January.

- Over and above this, we made an exceptional gain (non-cash) on the Reiss acquisition of £109m. We have excluded this gain from our headline profit number.

Guidance for the Year Ahead

- Underlying full price sales growth of +2.5% and total Group sales (including subsidiaries) +6.0%.

- NEXT Group profit guidance £960m, up +4.6%.

- Post-tax Earnings Per Share (EPS) is forecast to be 606.3p, up +4.8%.

Chairman's Statement

In the context of the wider economic environment, the year to January 2024 was a very good year for NEXT and the business materially outperformed our initial expectations. NEXT Group profit before tax1 rose to a record high of £918m, up +5.0%. Cash flow remained strong and we returned £425 million to shareholders through a combination of dividends (£248 million) and share buybacks (£177 million). In the last year we have focused on improving our product ranges, improving our online service levels, managing costs and profitability, whilst also laying the foundations for future growth businesses. We launched three new Total Platform clients (JoJo Maman Bébé, Joules and MADE), taking our total number of clients to seven. We also made a number of new investments, increasing our equity stake in Reiss by 21% to 72% and taking a 97% equity stake in FatFace. We also acquired 100% of the intellectual property in Cath Kidston.

The year ahead will see a number of changes to our Board. Amanda James, who has been with NEXT for 28 years and our Finance Director for nine years, retires from the Board in July. Amanda has seen many changes over that time and has made a huge contribution to the Group. She has been an exceptional guardian of our finances and an integral part of the leadership of the Company. Our financial position today is testament to her diligence and hard work and, on behalf of all of us at NEXT, I thank Amanda for her amazing work.

I am delighted that Jonathan Blanchard will succeed Amanda on the Board. Jonathan was most recently the Chief Financial Officer and Chief Operating Officer of the Reiss Group, having joined Reiss as a Board Director in 2017. We have worked closely with Jonathan for over three years since we acquired an equity stake in Reiss. Jonathan brings to the Board a wealth of retail experience, a strong eye for financial detail and a good understanding of our operations, gained through managing Reiss’s transition onto Total Platform. I am very confident that he will make an excellent addition to our Board.

Dame Dianne Thompson, one of our non-executive directors, is leaving the Board in May. Dianne has made a valuable contribution to the Board over the last nine years. In particular, I would like to thank Dianne for the time and insight she has given to the Board’s relationship with colleagues through her participation in our people and communication forums.

Finally, I am pleased that Amy Stirling and Venetia Butterfield will be joining our Board in April as independent non-executive directors. Between them they bring a breadth and depth of expertise that will enhance and broaden the Board’s collective knowledge. The continued success of NEXT is built on the hard work, dedication and decision making of all the people who work for NEXT. I would like to thank them all for their contribution during the year; I have little doubt and much expectation that they will rise to the new challenges and opportunities that are presented in 2024.

Source : Next plc

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.