UK DIY News

Next Posts Q1 Sales Increase; Maintains Guidance

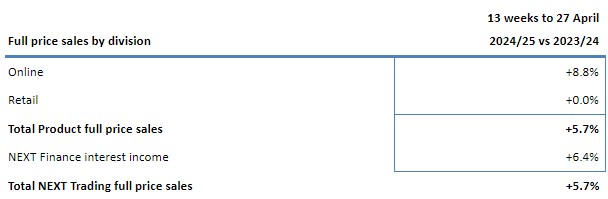

In the thirteen weeks to 27 April NEXT Trading full price sales1 were up +5.7% versus last year, slightly ahead of our guidance for this period, which was to be up +5%.

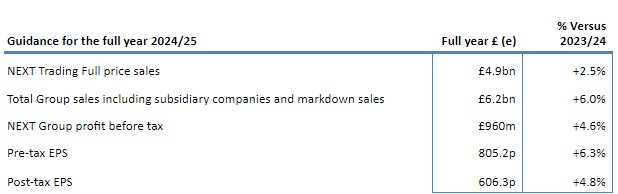

We are maintaining our sales and profit guidance for the full year, with NEXT Group profit2 before tax forecast to be £960m (+4.6%).

1. NEXT Trading full price sales include items sold in Retail and Online plus NEXT Finance interest income, but excludes Sale events, Clearance, Total Platform commission and the sales from subsidiaries.

2. NEXT Group profit before tax excludes: (1) the cost of brand amortisation, (2) the profit attributable to shares that we do not own in subsidiary companies, and (3) an exceptional, non-cash, loss relating to the closure of our defined benefit pension scheme.

FULL PRICE SALES PERFORMANCE BY BUSINESS DIVISION

Full price sales by division

GUIDANCE FOR SALES, PROFIT AND EARNINGS PER SHARE

Our guidance for the full year remains unchanged from that given in our Year End Results in March. For completeness, this guidance is repeated below.

As stated in our Year End Report, and explained further in the notes below, Group sales in the year are expected to increase by more than NEXT full price sales. The difference is the result of the acquisition of equity stakes in FatFace and Reiss.

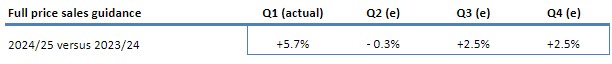

A note on expected sales phasing for the rest of the year

We are maintaining our guidance for full price sales in the first half to be up +2.5%. This implies that our sales in Q2 will be down -0.3%. We expect the sales performance in the second quarter to be weaker than the first quarter because last year benefited from particularly warm weather from late May through to the end of June.

For completeness, our guidance for the rest of the year is summarised below.

Our next sales update will cover the first 26 weeks of the year to 27 July 2024 and is scheduled for Thursday 1 August 2024.

Our next sales update will cover the first 26 weeks of the year to 27 July 2024 and is scheduled for Thursday 1 August 2024.

Notes on Total Group Sales

Total Group sales are the sum of total sales (full price and markdown) from all of the Group's divisions plus revenue from subsidiary companies. Subsidiaries' turnover is calculated using our share of our subsidiaries' turnover. For example, we own 72% of Reiss so we include 72% of their sales in our top line.

Total Group sales for the full year are expected to be up +6% on last year, which is 3.5% higher than our expected underlying growth in NEXT Trading full price sales of +2.5%. This difference in sales growth is explained by the timing of acquisitions completed during last year; we acquired 97% of FatFace in October 2023 and increased our equity share in Reiss from 51% to 72% in September 2023.

Source : Next plc

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.