UK DIY News

Next Posts 6% Sales Growth In Christmas Trading

Next has published Christmas Trading and Full Year Guidance for the year ending January 2025.

HEADLINES

Christmas Trading and Full Year Guidance - Year Ending January 2025

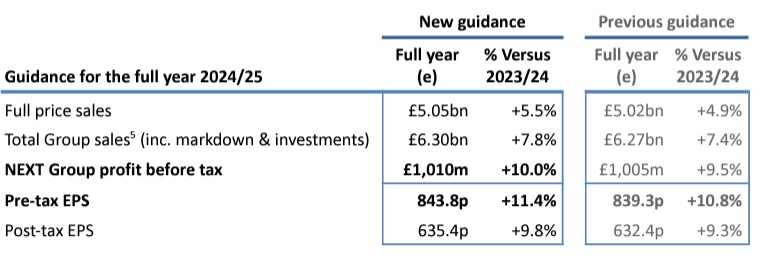

- In the nine weeks to 28 December, full price sales were up +6.0% versus last year. This number is slightly flattered by the timing of the end-of-season Sale. Adjusting for this effect, underlying full price sales were up +5.7%, which compares to our previous guidance for the period of +3.5%.

- The over-achievement adds £27m to full price sales, and increases our full year guidance for Group profit before tax by +£5m to £1,010m.

- Group profit before tax is now forecast to be up +10.0% versus last year, and pre-tax Earnings Per Share (EPS) up +11.4%.

- In the nine weeks to 28 December, full price sales were up +6.0% versus last year. This number 2 1 is slightly flattered by the timing of the end-of-season Sale. Adjusting for this effect, underlying full price sales were up +5.7%, which compares to our previous guidance for the period of +3.5%. 3

- The over-achievement adds £27m to full price sales, and increases our full year guidance for Group profit before tax by +£5m to £1,010m.

- Group profit before tax is now forecast to be up +10.0% versus last year, and pre-tax Earnings Per Share (EPS) up +11.4%.

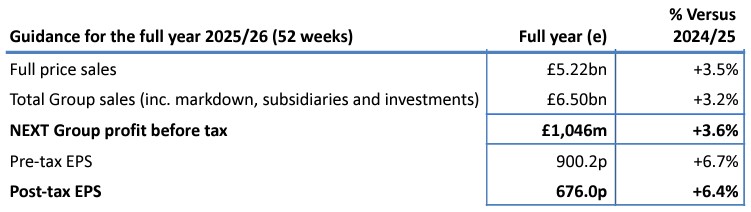

Initial Guidance for the Year Ahead (Year Ending January 2026)

- Full price sales growth forecast to be up +3.5%.

- Group profit before tax forecast to be £1,046m, up +3.6%.

- Share buybacks forecast to enhance EPS by +3.1%, resulting in pre-tax EPS growth of +6.7%.

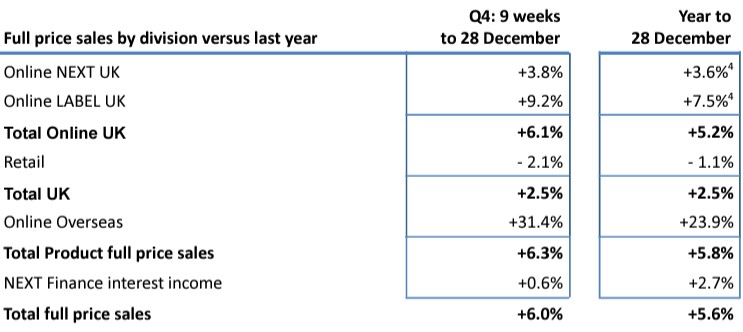

Full Price Sales Performance to 28 December 2024

The table below sets out the full price sales performance for the nine weeks to 28 December and for the year to 28 December. There are two elements of our performance worth highlighting. Firstly, growth in the UK was in line with the performance for the rest of the year, but Online sales growth increased at the expense of growth in our Retail stores. Secondly, and unexpectedly, our sales growth overseas accelerated in the run up to the holiday period.

End-of-Season Sale

Stock for the end-of-season Sale was up +13% versus last year, which was higher than our growth in full price sales. Last year, our surplus stock was particularly low and it has returned to more normal levels this year. Clearance rates are in line with our expectations.

Sales and Profit Guidance for the Current Year

Our sales, profit and EPS guidance for the current year is set out below along with our previous guidance. This forecast assumes that full price sales in January will be up +3.5%.

GUIDANCE FORSALES, PROFIT AND EPS 2025/26

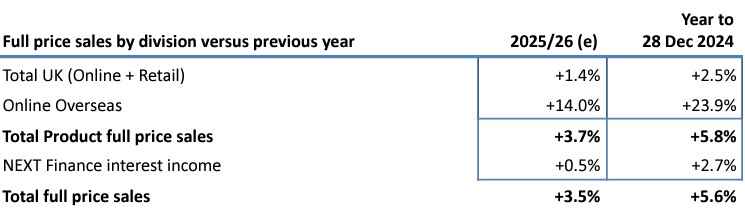

We have assumed that full price sales, including NEXT Finance interest income, will be up +3.5%. For clarity, these sales exclude sales in subsidiaries and investments. Full price sales growth forecast in the UK and Overseas is summarised below. The right hand column shows the equivalent numbers in the year to 28 December 2024.

We have been cautious in our outlook for both the UK and overseas:

- We believe that UK growth is likely to slow, as employer tax increases, and their potential impact on prices and employment, begin to filter through into the economy.

- We anticipate that growth overseas will moderate from the +24% we have achieved this year to +14% in the year ahead. In the current year, overseas sales benefited from an +85% step change in marketing expenditure, funded by some price increases. We do not believe we can profitably increase our overseas marketing expenditure by the same percentage next year, and expect the growth to be closer to +20%.

Total Group Sales

Total Group sales growth of +3.2% is lower than full price sales growth of +3.5%, mainly due to an expected reduction in markdown sales in our subsidiary companies.

FULL YEAR RESULTS ANNOUNCEMENT

We are scheduled to announce our results for the full year ending 25 January 2025 on Thursday 27 March 2025.

Source : Next plc

Image : Next

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.