International DIY News

Kingfisher Notes Growth In Poland And Iberia

Kingfisher has published unaudited half year results for the six months ended 31 July 2024.

For UK & Ireland performance, click here

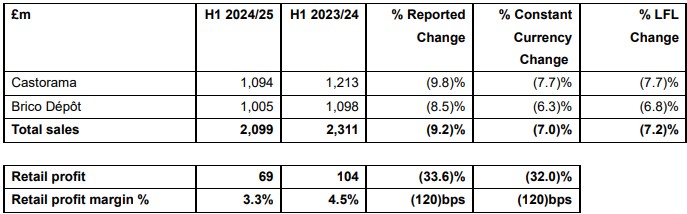

France

France sales decreased by 7.0% (LFL -7.2%) to £2,099m, as the home improvement market continued to be impacted by a soft consumer environment. Underlying sales trends in core and 'big-ticket' categories were broadly consistent from Q1 to Q2, with YoY volume trends improving compared to H2 23/24. Adverse weather conditions impacted the performance of seasonal categories from April to June and, although improving in July (slightly positive YoY), lost seasonal sales were not fully recovered. Based on external panel data and Kingfisher analysis, Castorama and Brico Dépôt both performed broadly in line with the market. Gross margin % increased by 20 basis points, reflecting effective supplier negotiations and lower stock provisions, partially offset by customer participation in promotional and clearance activity and selective price investments at Brico Dépôt.

Retail profit decreased by 32.0% to £69m (H1 23/24: £104m, at reported rates), with lower gross profit somewhat offset by lower operating costs. Operating costs decreased by 3.0%, building on the strengthened actions initiated in H2 23/24 around staff costs and discretionary spend in response to the weaker trading environment. Both banners also continued to deliver structural savings from their longer term cost reduction programme. The savings were partially offset by cost inflation, including YoY increases in staff costs. Retail profit margin % decreased by 120 basis points to 3.3% (H1 23/24: 4.5%, at reported rates), in line with the margin % achieved in FY 23/24.

Castorama total sales decreased by 7.7% (LFL -7.7%) to £1,094m. While the home improvement market weakness in France was reflected across all categories, LFL sales performance in the tools & hardware, building & joinery and outdoor categories was better than the overall Castorama average. Sales trends slowed in Q2 largely due to the impact of weather on seasonal category sales (Q2 -11.4% vs Q1 -2.1%), with stable underlying sales trends in core and 'big-ticket' categories. Castorama's total e-commerce sales increased by 9.8% YoY, with ecommerce sales penetration increasing to 7% (H1 23/24: 6%; H1 19/20: 2%), benefiting from expanded data and AI capabilities, and positive early results from Castorama's marketplace. As of 31 July, Castorama had a total of 95 stores in France.

Brico Dépôt total sales decreased by 6.3% (LFL -6.8%) to £1,005m, with sales trends slightly better than Castorama. Performance in its tools & hardware, building & joinery, EPHC and bathroom & storage categories was better than the overall Brico Dépôt average. LFL sales trends slowed in Q2, again due to the impact of weather on seasonal category sales (Q2 -12.3% vs Q1 -0.3%), while the underlying sales trends in core and 'big-ticket' categories was slightly improved. E-commerce sales decreased by 9.0%, against strong prior year comparatives (H1 23/24 e-commerce sales +20.2%). E-commerce sales penetration was maintained at 5% (H1 23/24: 5%; H1 19/20: 2%). The business continued to develop its trade customer proposition, with service desks, dedicated colleagues and a new loyalty programme rolled out to all stores in February, following successful trials. Brico Dépôt opened one compact store format in H1, with a total of 126 stores in France as of 31 July.

Other International

± 'Other' consists of the consolidated results of Screwfix International, NeedHelp, and results from franchise and wholesale agreements. On 18 July 2024, we completed a divestment of our c.80% equity interest in NeedHelp

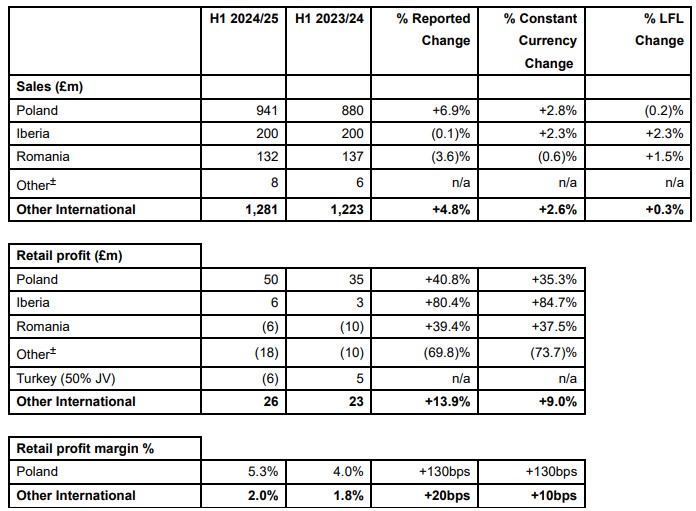

Other International total sales increased by 2.6% (LFL +0.3%) to £1,281m, driven by growth in Poland and Iberia. Retail profit increased by 9.0% to £26m (H1 23/24: £23m, at reported rates). This reflected higher retail profits in Poland and Iberia, together with reduced losses in Romania, offset by losses in Turkey and higher 'Other' retail losses. Retail profit margin % increased by 10 basis points to 2.0% (H1 23/24: 1.8%, at reported rates).

Poland total sales increased by 2.8% (LFL -0.2%) to £941m, supported by an improved consumer environment and good progress in the development of its initiatives to support trade customers. Positive LFL sales growth in core categories was driven by a good performance from its building & joinery and tools & hardware categories. Sales trends in core and 'big-ticket' categories improved sequentially and were positive in Q2, but seasonal category sales were adversely impacted by weather (Q2 -5.4% vs Q1 +5.5%). On a YoY basis, Castorama outperformed the broader market (as measured by GfK). Castorama's e-commerce sales increased by 2.5% YoY, as performance recovered following the implementation of its new digital technology stack in the prior year. Ecommerce sales penetration was 4% (H1 23/24: 4%; H1 19/20: 2%). The business continues to focus on expanding its trade customer proposition through further rollout of 'CastoPro' zones within its stores, specialised sales partners and the development of a dedicated mobile app for tradespeople.

Space growth contributed c.3% to total Poland sales. Castorama opened four stores in H1 (three big-boxes and one compact 'Castorama Smart' store), bringing its total to 106 stores in Poland as of 31 July.

Gross margin % increased by 140 basis points, reflecting effective management of product costs, retail prices and supplier negotiations, and a lower stock provision movement. Retail profit increased by 35.3% to £50m (H1 23/24: £35m, at reported rates), with a higher gross profit partially offset by an increase in operating costs. Operating costs increased by 3.3%, reflecting YoY increases in pay rates, higher bonus accruals, and higher costs associated with eight new store openings (YoY). Cost increases were largely offset by a continuation of the actions taken in H2 23/24 to reduce costs (including further flexing of staff levels and discretionary spend), together with structural savings achieved by our cost reduction programme. The operating costs movement also reflects a favourable YoY impact from charges related to ineffective foreign exchange hedges in the prior year. Retail profit margin % increased by 130 basis points to 5.3% (H1 23/24: 4.0%, at reported rates).

Iberia total sales increased by 2.3% (LFL +2.3%) to £200m, with positive LFL sales in core and 'big-ticket' categories. While sales trends in seasonal categories lapped strong prior year comparatives in Q1, a sequential improvement was seen in Q2. The business saw encouraging results from the continued development of its trade proposition, as reflected by strong YoY growth in its building & joinery category. Brico Dépôt also continued to scale its e-commerce marketplace, now with c.200k SKUs* and c.200 third-party (3P) merchants, reaching 22% of its online sales in H1. Retail profit increased to £6m (H1 23/24: £3m, at reported rates), reflecting higher gross profit partially offset by higher operating costs (up 2.6% YoY).

Romania total sales decreased by 0.6% to £132m (LFL +1.5%), reflecting a resilient overall performance. Sales trends slowed across all categories in Q2 (LFL -8.0% vs Q1 +14.7%), driven by abnormally hot weather across the quarter and a weaker consumer environment. For H1 overall, the business achieved positive LFL sales growth in its outdoor, building & joinery, tools & hardware and EPHC categories. Romania's retail loss decreased to £6m (H1 23/24: £10m reported retail loss), reflecting slightly higher gross profit and lower operating costs. Operating costs decreased by 7.3%.

In Turkey, Kingfisher's 50% joint venture, Koçtaş, contributed a retail loss of £6m (H1 23/24: £5m retail profit, at reported rates) in a very challenging macroeconomic and trading environment. The YoY movement largely reflects sales challenges in addition to higher operating costs related to staff pay rates and costs of credit collection, and the negative impact of accounting under high inflation.

Including our share of Koçtaş' interest and tax (H1 24/25: £7m loss vs H1 23/24: £11m loss), the overall contribution of Koçtaş to Group adjusted PBT was a net loss of £13m (H1 23/24: £6m net loss). As a result of the significant ongoing challenges associated with trading in Turkey, Koçtaş has initiated a comprehensive restructuring programme, including a large reduction in headcount, store closures and rightsizings. For the full year, we expect Koçtaş to contribute an overall net loss of c.£25m to Group adjusted PBT (FY 23/24: £1m net loss). As of 30 June 2024, the business had a total store count of 369.

'Other' consists of the consolidated results of Screwfix International, NeedHelp, and franchise and wholesale agreements. In line with our expectations, a combined retail loss of £18m (H1 23/24: £10m reported retail loss) was recorded, largely driven by Screwfix France as the business invested in the opening of new stores. Screwfix had a total of 25 stores in operation in France as of 31 July, having opened five new stores in H1. The business continues to see encouraging sales trends against the backdrop of market weakness in France, and remains focused on strengthening its brand awareness in the north of France (up 8 percentage points YoY in H1) and extending its customer proposition to attract and retain trade customers. Screwfix plans to open 10 stores in total in FY 24/25 (previously: up to 15 stores). On 18 July, we completed a divestment of our c.80% equity interest in NeedHelp. Finally, we are focused on growing our franchise and wholesale business in new markets. We currently have six wholesale partners across 10 countries in Europe, Africa and the Middle East, whereby certain own exclusive brands* (OEB) products are supplied to retailers.

Source : Kingfisher

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.