International DIY News

Kingfisher: LFL Sales Down 7.7% In 'Other International' Division

Kingfisher has published full-year results for the year ended 31st January 2024.

Click here for Group performance

Click here for Screwfix UK performance

Click here for France performance

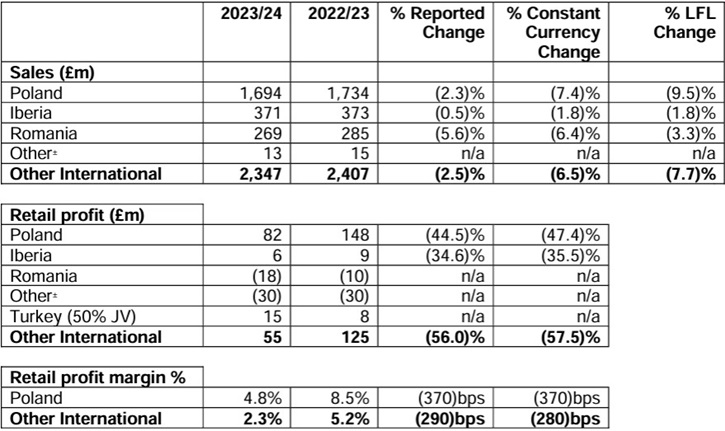

± ‘Other’ consists of the consolidated results of Screwfix International, NeedHelp, and results from franchise and wholesale agreements.

Other International total sales decreased by 6.5% (LFL -7.7%) to £2,347m, reflecting tough prior year comparatives across all geographies (FY 22/23 LFL +11.2%). Retail profit decreased by 57.5% to £55m (FY 22/23: £125m, at reported rates), largely reflecting the retail profit decline in Poland in H1 (£59m). Retail profit margin % decreased by 280 basis points to 2.3% (FY 22/23: 5.2%, at reported rates).

Poland total sales decreased by 7.4% (LFL -9.5%) to £1,694m, against strong prior year comparatives (FY 22/23 LFL +13.8%) and a challenging trading environment. Market weakness was reflected broadly across the categories, with EPHC lapping very strong prior year comparatives. Sales trends improved in H2 (LFL -7.9%, versus H1 LFL -10.9%), supported by core category sales, and in line with a gradual improvement in the consumer environment. The business exited the year with Q4 LFL of -6.6%, compared to the ‘trough’ second quarter of -11.5%, and sales trends have continued to improve into the new financial year. Castorama’s market share remained above FY 21/22 levels for the full year and, on a YoY basis, gained share in Q4 (as measured by GfK). Castorama’s e-commerce sales decreased by 32.6% YoY, following some temporary disruption arising from the implementation of its new digital technology stack in H1. E-commerce sales penetration was 3% (FY 22/23: 5%; FY 19/20: 2%).

Space growth contributed c.2% to total Poland sales. Castorama opened five stores in FY 23/24 (three big-box, one medium-box and one compact ‘Castorama Smart’ store), bringing its total to 102 stores in Poland as of 31 January 2024.

Gross margin % decreased by 20 basis points, reflecting higher customer participation in promotional activity and sales mix. This was largely offset by effective management of inflation and supplier negotiations, and a lower stock provision movement compared to the prior year. Gross margin % increased by 150 basis points YoY in H2. Retail profit decreased by 47.4% to £82m (FY 22/23: £148m, at reported rates) due to a lower gross profit and an increase in operating costs. Despite adjusting variable costs to the challenging environment and realising further savings from our structural cost reduction programme, operating costs increased by 5.6%. This was driven by high cost inflation (including YoY increases in pay rates and energy costs), higher technology spend, higher costs associated with five new store openings (YoY), and charges related to ineffective foreign exchange hedges. In H2, the business strengthened its cost initiatives by further flexing staffing levels, lowering discretionary spend, and rephasing certain investments (including fewer store openings), resulting in operating costs being limited to an increase of 1.7% YoY. Retail profit margin % decreased by 370 basis points to 4.8% (FY 22/23: 8.5%, at reported rates), with the H2 retail profit margin % improving sequentially to 5.8%, 80 basis points lower YoY (H2 22/23: 6.6%, at reported rates).

Iberia total sales decreased by 1.8% (LFL -1.8%) to £371m. Core and ‘big-ticket’ category sales were resilient (LFL -0.4%), while seasonal categories (LFL -8.0%) were impacted by unseasonal weather from Q1 onwards. The development of Iberia’s trade proposition supported good YoY growth in its building & joinery and kitchen categories. Retail profit decreased to £6m (FY 22/23: £9m, at reported rates), reflecting lower sales and gross margin %, partially offset by lower operating costs, down 0.8% YoY.

Romania total sales decreased by 6.4% to £269m (LFL -3.3%), against strong prior year comparatives (FY 22/23 LFL +7.8%) and a challenging trading environment. Sales trends improved in H2 (LFL -1.6% vs H1 -4.9%), driven by an improvement in core and seasonal category sales, with LFL sales in Q4 slightly positive (+0.4%). Sales in the EPHC category were particularly strong, with a resilient performance in outdoor and bathroom & storage. Romania’s retail loss increased to £18m (FY 22/23: £10m reported retail loss), reflecting lower sales and gross margin %. Operating costs decreased by 3.1%, with cost inflation more than offset by our structural cost reduction initiatives including reduced energy usage in stores.

In Turkey, Kingfisher’s 50% joint venture, Koçtaş, contributed £15m of retail profit (FY 22/23: £8m, at reported rates). The increase in retail profit largely reflects accounting under high inflation, and was more than offset by related higher interest rates recorded in our share of Koçtaş’ interest and tax. The overall contribution of Koçtaş was therefore a net loss of £1m (FY 22/23: £4m net profit contribution). Net of store closures, the business added 13 new stores (one big-box and 12 compact) in their financial year to 31 December 2023, bringing its total store count to 368.

‘Other’ consists of the consolidated results of Screwfix International, NeedHelp, and franchise and wholesale agreements. Due to these businesses being in their early investment phase, a combined retail loss of £30m (FY 22/23: £30m reported retail loss) was recorded, largely driven by Screwfix France as the business invested in the opening of new stores. Screwfix has a total of 20 stores in operation in France as of 31 January 2024, having opened 15 in FY 23/24. Sales from these stores continue to show an encouraging trend, supported by an expanded product range of c.14k SKUs*, and the launch of thirdparty trade credit and Sprint one-hour home delivery. The business also launched as a pure-play online retailer in six additional European countries in Q3. As reported in our half-year results in September, our two B&Q franchise stores in Saudi Arabia have now closed, and we are re-focusing efforts on wholesale and franchise agreements in other markets. We currently have wholesale agreements in place in three countries in Europe and the Middle East, whereby certain OEB products are supplied to its retailers.

Source : Kingfisher plc

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.