International DIY News

Kingfisher: France Sales Down; Poland Makes Market Share Gains

Kingfisher plc ('Company', 'Group' or 'Kingfisher') is today providing its Q3 24/25 sales.

Click here for UK and Ireland results

Key points

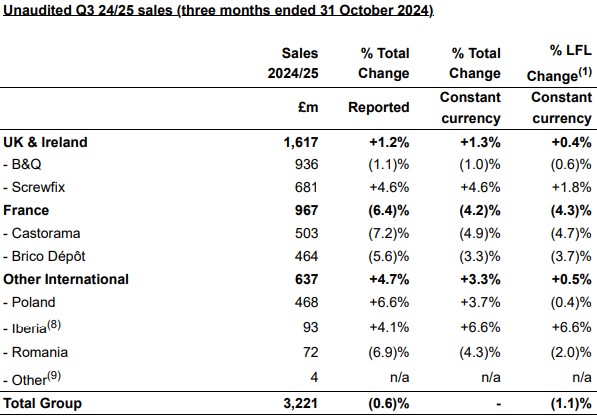

- Q3 sales of £3.2bn; total sales flat (constant currency) and -0.6% (reported)

- LFL -1.1%(1), with sales in line or ahead of the market for all our key banners

- Solid underlying trading in August and September; weak market and consumer in the UK and France in October, impacted by uncertainty related to government budgets in both countries

- Average selling prices flat year-on-year with improved volume trends versus Q2

- Q3 by region:

o UK & Ireland: sales growth driven by Screwfix (LFL +1.8%) and TradePoint (LFL +4.9%), with strong market share gains. Strong growth of B&Q's e-commerce marketplace (GMV +45%(2))

o France: sales in line with the market; lower sales trend at both banners in October due to weak consumer sentiment and adverse weather

o Poland: market share gains with improving 'big-ticket' sales trends - Q3 by category:

o Core (69% of sales): improved sales trends (LFL -0.4%)(3) driven by repair, maintenance and renovation activity on existing homes

o Big-ticket (16% of sales): LFL -4.0%(4) with improved trends at B&Q, Brico Dépôt France and Castorama Poland, supported by new ranges o Seasonal (15% of sales): sales impacted in October from wetter and milder than normal weather in our key markets (LFL -0.9%)(5) - Q4 trading to date(6) improved versus exit rate from Q3, with LFL -0.5%

- Full year profit guidance range tightened: expect adjusted PBT of c.£510m to £540m(7) (previously c.£510m to £550m). Free cash flow guidance unchanged

- Expect near-term market outlook to remain uncertain; confident in our business model, ability to drive market share and effectively manage retail prices, costs and cash

FRANCE

Total sales -4.2% (LFL -4.3%), reflecting continued weakness in the broader market. This was compounded in October by the release of the draft Finance Bill for 2025, which weighed on consumer sentiment, together with wetter and milder than normal weather. Based on external panel data and Kingfisher analysis, both banners performed in line with the market during the quarter.

- Castorama sales -4.9%. LFL -4.7%, with an improvement in LFL sales and volume trends across all categories compared to Q2 (LFL -9.6%) despite market weakness in October. Castorama's electrical, plumbing, heating & cooling (EPHC), outdoor, building & joinery and tools & hardware categories delivered resilient sales in Q3, while 'big-ticket' categories remained weak. The business is also seeing positive early results from its e-commerce marketplace, which launched in March. Castorama continues to test and adapt its new trade proposition in nine stores, with full roll-out planned in 2025.

- Brico Dépôt sales -3.3%. LFL -3.7%, with sales and volume trends improving across all categories compared to Q2 (LFL -8.3%). The improvement was supported by softer comparatives, but partially offset by the weak market and adverse weather in October. Sales performance in the EPHC, building & joinery and tools & hardware categories were better than the overall Brico Dépôt average, while a notable improvement in kitchen sales was supported by the successful launch of new ranges. Brico Dépôt's new trade proposition continues to resonate with trade customers, with an encouraging level of sign-ups to its loyalty programme in Q3 and a further increase in trade sales penetration.

OTHER INTERNATIONAL

- Poland sales +3.7%. LFL -0.4%, with sales supported by continued progress in addressing trade customer needs. The business delivered a resilient performance in its core categories, and improved LFL sales trends in 'big-ticket' and seasonal categories. Castorama delivered LFL sales growth in its kitchen, building & joinery, tools & hardware and EPHC categories. The business gained market share in the quarter (to 30 September, as measured by GfK) and opened one big-box store in Q3, reaching its target of five store openings this financial year. Castorama continues to focus on its engagement with trade customers, with extended roll-out of specialised colleagues and trade-dedicated product ranges driving a further increase in trade sales penetration.

- Iberia sales +6.6%. LFL +6.6%, with strong sales growth seen in its building & joinery, surfaces & décors and EPHC categories.

- Romania sales -4.3%. LFL -2.0%, with a good sequential improvement supported by positive LFL sales in its building & joinery, tools & hardware and bathroom & storage categories.

- In Turkey, Kingfisher's 50% joint venture, Koçtaş, remains focused on executing its comprehensive restructuring programme to manage performance in a very challenging macroeconomic and trading environment. We note significant actions taken to date, including store closures and headcount reductions, and continue to expect Koçtaş to contribute an overall net loss of c.£25m to Group adjusted PBT for the full year (FY 23/24: £1m net loss).

- Other consists of the consolidated sales of Screwfix International and franchise and wholesale agreements. Screwfix opened one store in France in Q3, with a total of 26 stores in operation as of 31 October 2024. The business continues to see encouraging sales trends and remains focused on growing its customer base, which has doubled YoY to date, as well as increasing brand awareness both locally and nationally.

Source : Kingfisher plc

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.