UK DIY News

Wickes Announces 'Robust' Trading Performance

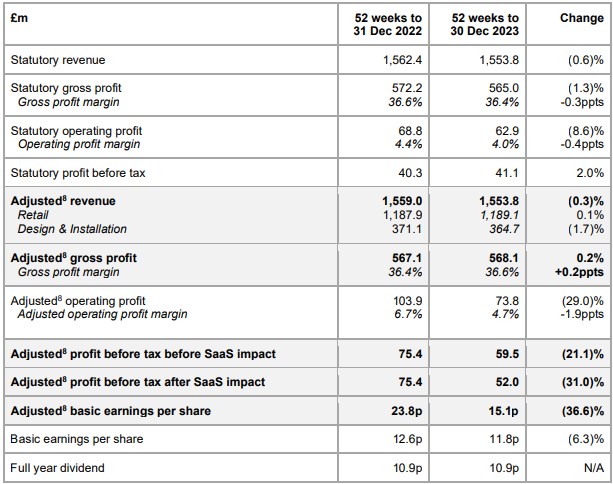

Wickes Group plc has published full year results for the 52 weeks to 30 December 2023, advising of robust sales performance with adjusted PBT ahead of market expectations.

Financial Highlights

- Total revenue of £1,553.8m in line with prior year (2022: £1,559.0m) reflecting LFL1 sales -0.3%

- Strong productivity gains of £22m offsetting cost inflation (excl. energy) in line with guidance

- Statutory profit before tax: £41.1m (2022 £40.3m)

- Adjusted profit before tax after SaaS impact2: £52.0m, ahead of consensus

- Net cash position of £97.5m (2022 £99.5m), after £10.1m of share buybacks; Average cash across the year of £154.9m (2022 £153.6m)

- Final dividend of 7.3p, giving a total of 10.9p for the full year, in line with guidance

- £10.1m of £25.0m share buyback programme completed by year end3

Strategic Highlights

- Strong TradePro sales growth +11%, driven by significant expansion in TradePro members to 881k (2022: 746k)

- Record highs for customer satisfaction scores across all channels (stores, Click & Collect and Home Delivery), underpinning market share position

- Accelerated H2 sales growth of +24% in Wickes Lifestyle Kitchens range since highly successful relaunch to gain share of the volume kitchen market

- Three new stores opened, in Chelmsford, Widnes and Torquay, creating c. 90 new jobs

- Store refit programme delivering strong sales uplifts and ROCE with 11 refits completed

- New Customer Experience Centre and field service tech platforms driving increased lead conversion, greater efficiencies and 92% Net Promoter Score in Design & Installation4

- Successfully broadening customer appeal for home improvers with more than 1 in 4 Wickes shoppers female5

- Entry into energy-saving solutions with Solar Fast acquisition (see separate RNS also released today)

NB. Retail6 refers to the revenue stream formerly described as Core. Design & Installation4 refers to the revenue stream formerly described as DIFM or Do-it-for-me.

Current Trading & Outlook

In the first 11 weeks of 2024 Retail sales are in line with last year. As previously noted, the consumer environment for larger purchases continues to be challenging with weaker leads in the market for Design & Installation, resulting in new orders down single digits year on year.

We maintain good cost control and have productivity plans in place for 2024, however these will not offset fully the cost headwinds from the scale of increases in National Minimum Wage and business rates. Wickes’ balanced business model and proven growth strategy affords the Group resilience in the current uncertain environment and leaves us well positioned for growth in the longer term. We are comfortable with consensus expectations for adjusted PBT after SaaS impact for FY247.

We will issue a Q1 trading update in May. We also plan to hold an investor insight event in May, focused on TradePro, with further details to follow in due course.

David Wood, Chief Executive of Wickes, commented:

“This has been another year of strong progress for Wickes. Our robust trading performance, targeted investment programme and disciplined cost control have delivered profits ahead of expectations.

“In the current economic environment, our unrivalled focus on providing great value and service has underpinned this performance. With this, I would like to thank each of my colleagues for their continued dedication and support, enabling us to achieve record customer satisfaction.

“I am also delighted to announce our acquisition of Solar Fast, which gives Wickes a majority stake in a leading operator in the emerging and exciting market for energy saving solutions. This acquisition enables us to rapidly accelerate our Design & Installation growth lever, capitalising on our expertise in installing major home improvement projects.”

Summary of full year financial results

Source : Wickes

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.