International DIY News

Walmart Reports Q2 Revenue Growth

- Strong revenue growth of 5.7%; operating income growing faster at 6.7%

- eCommerce up 24% globally

- GAAP EPS of $2.92; Adjusted EPS of $1.841

- Guides Q3 and raises FY24 outlook

Walmart Inc. announces second quarter results, including strong revenue and operating income growth of 5.7% and 6.7%, respectively. The Company sees strength in its omnichannel model across segments with strong comp sales globally, including 6.4%3 for Walmart U.S. The Company raises guidance for FY24 to reflect Q2 upside, confidence in continued business momentum and ongoing customer response to its value proposition.

Second Quarter Highlights

- Consolidated revenue of $161.6 billion, up 5.7%, or 5.4% in constant currency (“cc”)1

- Consolidated gross margin rate up 50bps on lapping elevated markdowns and supply chain costs, partially offset by ongoing mix pressure in grocery and health & wellness

- Consolidated operating expenses as a percentage of net sales grew 33bps

- Consolidated operating income up $0.5 billion, or 6.7%, adjusted operating income up 8.1%1

- ROA at 5.6%; ROI at 12.8%1, negatively affected by 140bps of discrete charges in Q3 & Q4 FY23

- Global advertising business2 grew approximately 35%

- Walmart U.S. comp sales up 6.4%3; eCommerce up 24%, led by pickup & delivery

- Celebrating the 65th anniversary of Bodega Aurrera stores in Mexico

Balance Sheet and Liquidity

- Cash and cash equivalents of $13.9 billion

- Total debt of $50.4 billion2

- Operating cash flow of $18.2 billion, an increase of $9.0 billion

- Free cash flow of $9.0 billion1, an increase of $7.2 billion

- Repurchased 8.0 million shares3 YTD, or $1.2 billion

Walmart U.S.

- Growth in eCommerce of 24%, with strength in pickup & delivery and advertising

- Walmart Connect advertising sales grew 36%

- Sales strength led by grocery and health & wellness, while general merchandise sales declined modestly

- Gained market share in grocery with strong unit growth

- Gross profit rate increased 40 bps, partially offset by operating expense deleverage of 28 bps

- Inventory declined 8% with higher in-stock levels

Walmart International

- Strong growth in net sales cc1, led by Walmex, China and Flipkart. Positive traffic across markets

- Growth in eCommerce sales of 26% with strength in store-fulfilled

- Gross margin rate declined 37 bps over last year on changes in format and channel mix

- Advertising up nearly 40%3

- Operating expense leverage of 129 bps on strong growth in net sales, driving fixed cost leverage

- Operating income cc1 up 2.2%, impacted 20 percentage points from lapping last year’s $0.2 billion one-time insurance benefit in Chile

Sam’s Club U.S.

- Strong comp sales, led by food and consumables, and healthcare as well as positive unit growth overall

- Gained market share in grocery and general merchandise, including apparel, home, and toys

- Growth in eCommerce of 18% led by curbside

- Strong growth in membership income, up 7.0%, with continued strength in Plus member growth and renewals

- Advertising up 33%2

- Membership count increased mid single-digits with Plus penetration up 130 bps vs. last year

“We had another strong quarter. Around the world, our customers and members are prioritizing value and convenience. They’re shopping with us across channels — in stores, Sam’s Clubs, and they’re driving eCommerce, which was up 24% globally. Food is a strength, but we’re also encouraged by our results in general merchandise versus our expectations when we started the quarter. Our associates helped deliver increases in transaction counts and units sold, and profit is growing faster than sales. We’re in good shape with inventory, and we like our position for the back half of the year.” Doug McMillon President and CEO, Walmart

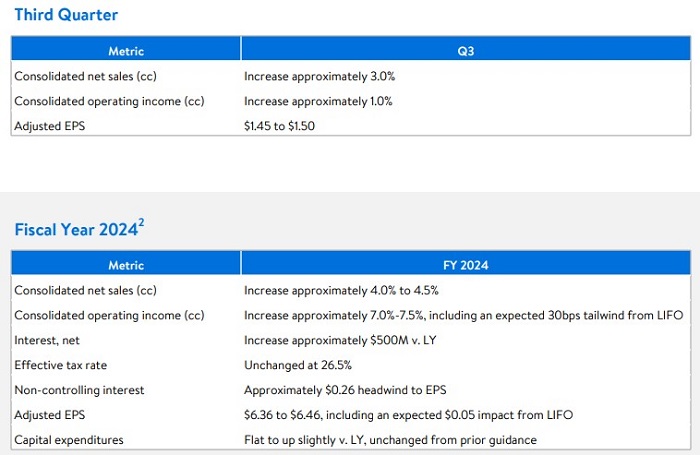

Guidance

The following guidance reflects the Company’s expectations for the third quarter and fiscal year 2024 and is provided on a non-GAAP basis as the Company cannot predict certain elements that are included in reported GAAP results, such as the changes in fair value of the Company’s equity and other investments. Growth rates reflect an adjusted basis for prior year results. Additionally, the Company’s guidance assumes a generally stable consumer and continued pressure from its mix of products and formats globally. The Company’s fiscal year guidance is based on the following previously disclosed FY23 figures: Net sales: $605.9 billion, adjusted operating income1 : $24.6 billion, and adjusted EPS1 : $6.29.

Source : Walmart

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.