International DIY News

Strong Full-Year Sales At Walmart

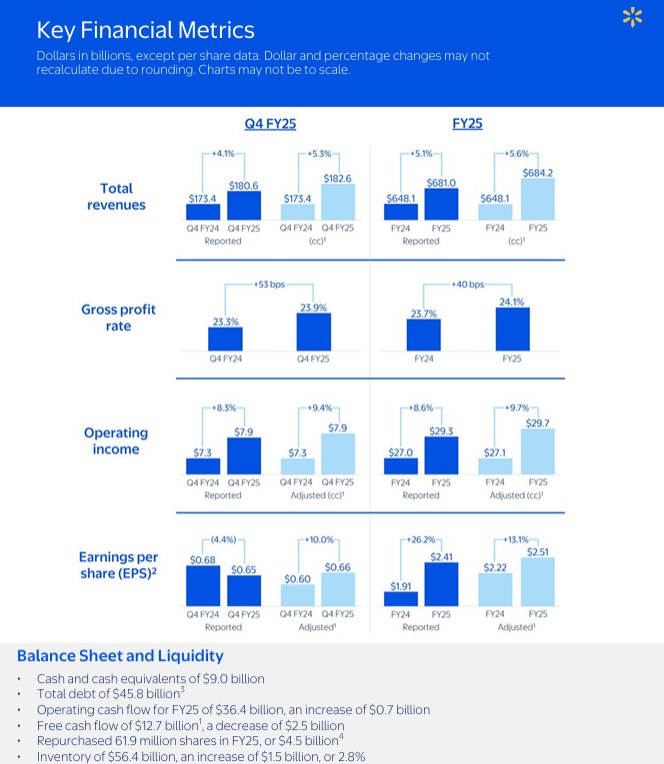

- Strong revenue growth of 4.1%, up 5.3% in constant currency (cc)1

- Operating income growing faster at 8.3%, or 9.4% adjusted (cc)1

- eCommerce up 16% globally

- GAAP EPS of $0.65; Adjusted EPS1 of $0.66

- Company provides outlook for Q1 and FY26

Walmart Inc. (NYSE: WMT) announces fourth-quarter results with strong growth in revenue and operating income. Globally, eCommerce grew 16% with penetration up across all segments. Walmart U.S. comp sales up 4.6%2 with positive growth in general merchandise. Looking ahead, the Company issues guidance for FY26 with net sales expected to grow 3% to 4% and adjusted operating income in constant currency (“cc”)1 to grow 3.5% to 5.5%, including a headwind of 150 basis points from the acquisition of VIZIO Holding Corp. (“VIZIO”) and lapping leap year.

Fourth Quarter Highlights

- Revenue of $180.6 billion, up 4.1%, or 5.3% (cc)1

- Gross margin rate up 53 bps, led by Walmart U.S.

- Operating income up $0.6 billion, or 8.3% , adjusted up 9.4% (cc)1 due to higher gross margins and growth in membership income; also benefited from improved economics in eCommerce

- Global eCommerce sales grew 16%, led by storefulfilled pickup & delivery and U.S. marketplace; growth negatively affected by timing of Flipkart’s Big Billion Days sales event (“BBD”)

- Global advertising business3 grew 29%, including 24% for Walmart Connect in the U.S.

- Adjusted EPS1 of $0.66 excludes the effect, net of tax, from a net loss of $0.02 on equity and other investments as well as $0.01 from the proceeds of an opioid-related legal settlement

- Completed acquisition of VIZIO

Full Year Highlights

- Revenue of $681.0 billion, up 5.1%, or 5.6% (cc)1

- Global advertising business3 grew 27% to reach $4.4 billion

- Operating income up $2.3 billion or 8.6%; adjusted up 9.7% (cc)1, growing faster than sales • ROA at 7.9%; ROI at 15.5%1, up 50 bps

- Global inventory up 2.8%, including an increase of 3.0% for Walmart U.S.; in-stock levels healthy

- Company raises dividend 13% to $0.94 per share; largest increase in over a decade

"Our team finished the year with another quarter of strong results. We have momentum driven by our low prices, a growing assortment, and an eCommerce business driven by faster delivery times. We’re gaining market share, our top line is healthy, and we’re in great shape with inventory. We’ll stay focused on growth, improving operating margins, and strengthening ROI as we invest to serve our customers and members even better.” Doug McMillon President and CEO, Walmart

Walmart U.S.

- Broad-based sales momentum across merchandise categories; strong seasonal sales despite compressed holiday shopping season; expedited delivery channels resonating with customers desiring speed of delivery

- Comp sales growth led by transaction counts and unit volumes; share gains primarily from upper-income households

- eCommerce sales up 20% reflects strength in store-fulfilled pickup & delivery, advertising and marketplace

- Walmart Connect advertising sales increased 24% aided by 50% growth in marketplace seller advertiser counts

- Gross profit rate increased 51 bps; membership income up double-digits; operating expense deleveraged 53 bps

- Operating income up 7.4% due in part to improved eCommerce economics, aided by improved business mix

- Inventory increased 3.0% on 5.0% sales growth while maintaining healthy in-stock levels

Walmart International

- Growth in net sales (cc)1 led by China, Walmex, and Canada; transaction counts & unit volumes up across markets

- Timing of Flipkart’s The Big Billion Days (“BBD”) event affected growth in Q4 with corresponding benefit in Q3

- eCommerce sales grew 4% and advertising business3 grew 10%; both affected by the timing of Flipkart’s BBD

◦ Other than Flipkart, strong growth in eCommerce sales and increased penetration in all markets

◦ eCommerce sales grew 20% and advertising business3 grew 26% in 2H; both similar to growth in 1H - Operating income (cc)1 growth driven by improved eCommerce economics and benefited from business mix changes

- Currency rate fluctuations negatively affected sales by $2.0 billion and operating income by $0.2 billion

Sam’s Club U.S.

- Strong sales growth across club and digital channels, led by food and health & wellness categories

- Comp sales growth primarily driven by transaction counts and unit volumes

- eCommerce sales up 24%, led by club-fulfilled pickup and delivery

- Share gains in grocery and general merchandise categories, including apparel and consumer electronics

- Strong growth in membership income, up 13%

- Operating income was impacted by previously announced associate wage investments and higher incentive pay; includes ~730 bps headwind due to lapping LIFO benefit last year

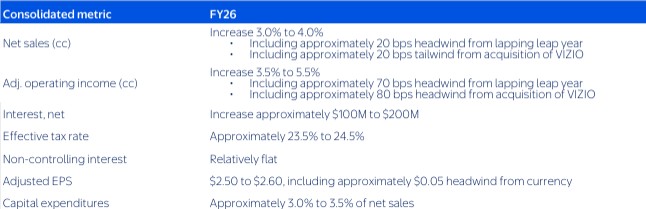

The following guidance reflects the Company’s expectations for the first quarter and fiscal year 2026 and is provided on a non-GAAP basis as the Company cannot predict certain elements that are included in reported GAAP results, such as the changes in fair value of the Company’s equity and other investments. Growth rates reflect an adjusted basis for prior year results. Additionally, the Company’s guidance assumes a generally stable consumer and continued pressure from its mix of products and formats globally.

Fiscal year 2026

The Company’s fiscal year guidance is based on the following FY25 figures: Net sales: $674.5 billion, adjusted operating income2: $29.5 billion, and adjusted EPS2: $2.51.

Source : Walmart

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.