UK DIY News

Retail Sales Slumped In December

The ONS has published retail sales data for December, revealing an unexpectedly steep decline which capped off a difficult year in retail.

Main points:

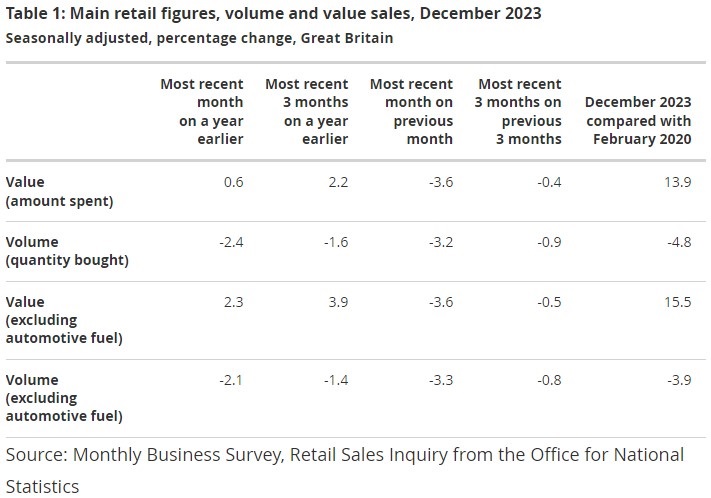

Retail sales volumes are estimated to have fallen by 3.2% in December 2023, from a rise of 1.4% in November 2023 (revised up from an increase of 1.3%); December's decrease was the largest monthly fall since January 2021, when coronavirus (COVID-19) restrictions affected sales.

Looking at the quarterly picture, sales volumes fell by 0.9% in the three months to December 2023 when compared with the previous three months.

On an annual basis, sales volumes fell by 2.8% in 2023 and were their lowest level since 2018.

Non-food store sales volumes fell by 3.9% in December 2023, following a 2.7% increase in November 2023 when earlier Black Friday sales, and wider discounting, increased sales.

Within the non-food sector, department stores sales volumes fell by 7.1% in December 2023. Retailers reported quiet trading in the post-Christmas period, and a reduction in the sales of household goods.

Clothing stores sales volumes fell by 1.5% over the month. Retailers commented on a tough trading month, alongside the effect of starting their sales period earlier than usual.

Household goods stores sales volumes fell by 3.0% in December 2023, mostly because of a strong monthly fall in hardware stores. Respondents again cited the difficult economic climate with customers spending less on average.

Other non-food stores sales volumes fell by 4.5% over the month, largely because of falls in sports equipment, games and toys stores, and watches and jewellery stores. Respondents reported a slow December because of cost-of-living pressures and reduced footfall.

Food store sales volumes fell by 3.1% in December 2023, from an increase of 1.1% in November 2023. Growth of 1.1% in November was attributed to early Christmas shopping by consumers, with this then partly contributing to the December fall.

Non-store retailing sales volumes fell by 2.1% over the month to December 2023, following a fall of 1.1% in November. Retailers reported economic factors behind the fall, in particular the effect of inflation.

Online spending values fell by 1.7% from November to December 2023, with falls across all sectors apart from non-store retailing which was unchanged.

The proportion of online sales in December 2023 is slightly above the average of the preceding 12 months (26.5%) and substantially above pre-coronavirus (COVID-19) pandemic levels (19.7% in February 2020).

As the monthly fall in the value of online retail was smaller than the fall in the value of total retail, the proportion of online sales rose from 26.6% in November 2023 to 27.1% in December 2023.

Automotive fuel sales volumes fell by 1.9% in December 2023, following a rise of 0.8% in November 2023.

Responding to the latest ONS Retail Sales Index figures, which showed sales up 2.3% by value, but down 2.1% by volume, Kris Hamer, Director of Insight at the British Retail Consortium, said:

“A drop in retail sales volumes in December capped a difficult year for retailers, with sales volumes across 2023 below those seen in 2019. Black Friday sales ate into Christmas spending, while the high cost of living meant some households had to cut back on festive gifting. Electricals and Furniture performed weaker than hoped, and even food saw smaller growth as many households traded down to cheaper brands . However, with inflation on a downward trend, and wages slowly rising, retailers hope that consumer confidence and sales volumes will bounce back in 2024.

“Retail is a vital part of the ‘everywhere economy’, serving the communities of every village, town and city in Britain. This is why it’s essential that political parties of all stripes have a clear and cohesive plan for retail as they make their pitch to the public ahead of the next election. Retail accounted for over £462bn in spending, employs around three million people, and contributes billions to the UK tax base.”

Lisa Hooker, PwC UK Leader of Industry for Consumer Markets, comments on the December 2023 ONS Retail Sales figures:

"In the midst of an on-going cost-of-living crisis, and after better-than-expected November results, helped by an earlier start to Black Friday sales, it’s perhaps no surprise that December’s retail sales disappointed. Total sales over the critical run-up to Christmas fell by 2.1% in volume terms compared with last year excluding petrol, while pounds in the till increased by only 2.3% which is far lower than the headline rate of inflation.

However, the scale of the decline will have surprised many, with retail sales volumes now falling well below pre-pandemic levels. In fact, volumes hit their lowest level since May 2020, right in the middle of the first nationwide lockdown of the pandemic.

There were volume declines in every category of non-grocery, with a combination of shoppers being more considered with their discretionary spending, buying earlier during Black Friday sales. There were also fewer large family gatherings reducing the number of gifts being bought overall. We reined back on areas such as toys, sports equipment, watches and jewellery, while fashion was one of the least affected categories.

Perhaps surprisingly, even grocery volumes declined, albeit masked in retailer trading results by the 8.0% inflation announced earlier in the week. And while the smallest decline appears to have been in online shopping, this was partly because last year’s online sales were hampered by postal strikes that caused knock-on delays to other parcel carriers.

The contrast between these figures and the better reported sales announced by several large retailers this month is stark, albeit those numbers will have represented pounds in the till including the impact of inflation, and over a longer time period - including November in most cases. However, this suggests that there may be bad news still to be reported by retailers that have yet to announce their Christmas trading.

Despite easing inflation, rising wages and the recent National Insurance cut, retailers have already talked about a slow start to 2024, as shoppers remain cautious about spending. So, while the prospects for the sector may improve later in the year, it may be a case of battening down the hatches for the early months of the new year."

Source : ONS, BRC and PwC

Image : IR_Stone / iStockphoto.com (1355828207)

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.