UK DIY News

Online Non-Food Market To Improve This Year

The UK non-food online market is set to grow by 2.9% to reach £106m in 2024, with online penetration forecast to climb to 39%, marking an improvement for the first time since the COVID-19 pandemic, according to GlobalData, a leading data and analytics company. GlobalData anticipates the non-food online market growth will outpace the total retail market, which is expected to increase by 2.1% in 2024.

Tash Van Boxel, Retail Analyst at GlobalData, comments: “Retailers must diversify online capabilities to take advantage of increased online demand. Enhancing online services will be essential, such as implementing AI powered tools to strengthen apps and websites and improving fulfilment services. Not doing so will expose retailers to fluctuations in footfall, impacting offline demand. A strong online proposition can help retailers convert online browsers to purchase through services such as Click & Collect.”

As online growth is set to continue, retailers must ensure that delivery services provide good value for money and high efficiency. 85% of frequent online shoppers* would switch away from their favourite online retailer if they could find faster delivery for the same item elsewhere, according to GlobalData’s September 2024 Consumer Views survey**. A further 60% of frequent online shoppers stated that the delivery experience impacts whether they shop at the retailer again.

Van Boxel continues: “Online shoppers value the delivery experience and will switch away to competitors if the experience goes sour. Prioritising cost-effective delivery methods is crucial for retailers to retain customers, ensuring shoppers have options, such as next-day delivery and nominated-day delivery at reasonable prices. Retailers must also be cautious about which couriers they partner with, as shoppers will look elsewhere if the only available courier has proved to be unreliable in the past.”

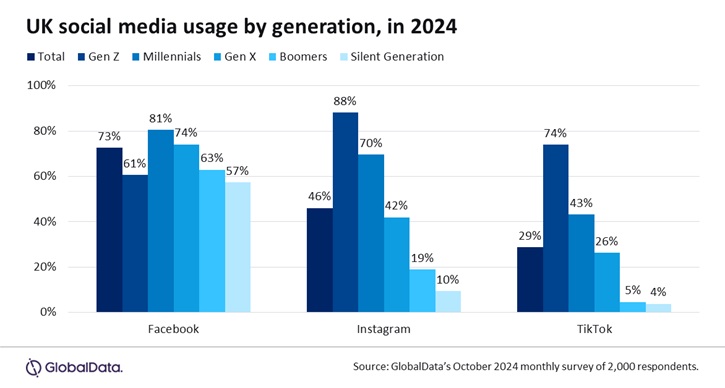

Social media will play a vital role in the growth of the non-food online market, as consumers increasingly shop directly through social media platforms. 49.0% of UK consumers use Instagram, and 30.9% use TikTok, according to GlobalData’s October 2024 survey. Usage is highest among Gen Z consumers, with 88% using Instagram and 74% using TikTok.

Van Boxel concludes: “Social media is growing as a retail channel, but given the variation in usage among the generations, retailers need to cater their content on each platform to reach their target audience. As younger consumers utilise Instagram and TikTok more than their older counterparts, retailers must tailor content to this demographic. For example, collaborations with content creators are more likely to resonate with younger consumers who are more trusting of social media reviews than sponsored posts announcing new product launches, which may capture all age groups. Personalising marketing campaigns and content will be key to growing retailers’ customer bases and bolstering online traffic.”

*A frequent shopper is defined as a consumer who shops online every few days or once a week

**GlobalData’s October 2024 and September 2024 monthly surveys were conducted with 2,000 respondents

Source : GlobalData

Image : shutterstock / William Potter / 1024344034

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.