UK DIY News

PHMI: Plumbing & Heating Sales Declined In August

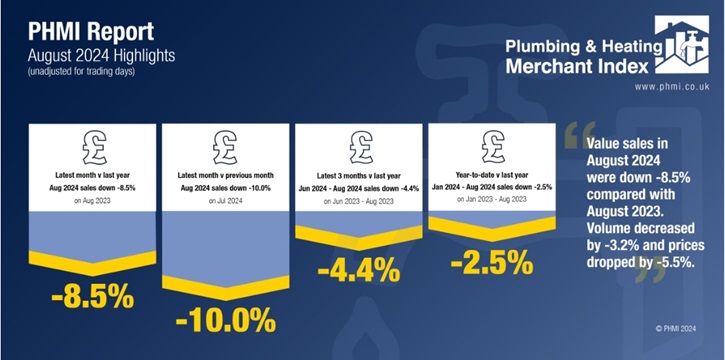

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for August 2024 through specialist plumbing and heating merchants were down -8.5% compared to the same month a year a year before. Volumes decreased -3.2% and prices also fell -5.5%.

With one less trading day in August 2024, like-for-like sales (taking trading day differences into account), were -4.1% lower than August 2023.

Month-on-month, August value sales were down -10.0% compared to July. Volume sales fell -11.7% and prices increased +1.9%. With two less trading days in August, like-for-like sales were -1.4% lower.

Total value sales in the three months from June to August 2024 were down -4.4% compared to the same period a year ago. There was a slight increase in volume sales (+0.4%) while prices fell -4.9%. With one less trading day in the most recent three-month period, like-for-like value sales were down -2.9%.

Compared to the previous three-month period (March to May 2024), value sales in the three months June to August 2024 were -4.9% lower. Volume sales were down -1.7%, as were prices (-3.3%). With two more trading days in the most recent period, like-for-like value sales were -7.9% lower.

Plumbing & Heating merchants’ value sales in the 12-month period from September 2023 to August 2024 were down -1.7% on the previous 12-month period (September 2022 to August 2023). Volume sales were -1.8% lower; prices were flat (+0.1%). With three more trading days this year, like-for-like value sales were down -2.9%.

August’s PHMI index was 90.0 with no difference in trading days.

Mike Rigby, CEO of MRA Research, which produces the report says: “Consumer confidence has taken a hit since the Chancellor’s grim warnings of the painful consequences of a £22bn black hole in UK finances. The first consequence was the withdrawal of winter fuel payments for some ten million pensioners, followed by a reported instruction to Ministers to cut their departmental budgets by 10%! After holding steady in August, GfK’s September Consumer Confidence Index plunged seven points to -20, along with major hits to the way people feel about their personal finances (down -9 points) and their view of the general economic situation over the next 12 months (down -12 points). Business confidence also took a hit.

“But despite the Government painting it black, there are many positive signs. Which will people heed? Will they keep their money for the Government’s many rainy days, or spend on much-needed big purchases, like a new heating system or a bathroom refurbishment? Signs of better times to come include mortgage approvals reaching their highest levels since August 2022; inflation falling to 1.7%, well below the Bank of England’s 2% target; expectations of two further cuts to interest rates before Christmas; and more bulk cement delivered to build new build foundations, which mean more new houses and buildings in the first half of 2025.

“Will the new Government put our money where its words are? A lot hangs on Labour’s first budget on 30 October!”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

Source : PHMI

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.