UK DIY News

Pepco Posts Record Sales; 'Disappointing' Profit

Pepco Group, the fast-growing pan-European variety discount retailer, has reported preliminary unaudited results for the 12 months ending 30 September 2023.1

KEY HIGHLIGHTS

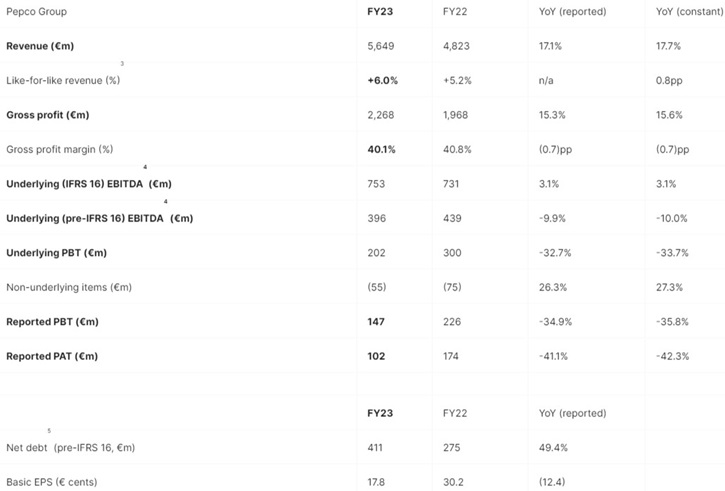

- Record full year Group revenue of €5,649m, up 17.7% on a constant currency basis, driven by Pepco growth of 24.8% and Poundland Group growth of 8.4%

- FY23 underlying EBITDA (IFRS 16) of €753m, up 3.1% on a constant currency basis

- Refocused strategy launched to drive core profitability through a more disciplined approach to growth and investment

- Total number of stores at the end of FY23 of 4,6292, with 668 net new stores equating to 16.9% year-on-year (“YoY”), driven by growth of Pepco

- Expected to open at least 400 net new stores across all formats in FY24 – with the Pepco brand accounting for the highest number

FINANCIAL PERFORMANCE

- FY23 Group revenue of €5,649m, growing +17.7% YoY at constant currency

- LFL revenue growth of +6.0% during the year

- Pepco +6.3% and Poundland Group +5.6%

- Gross margin of 40.1% in full year, with an expected improvement in FY24 as cost input inflation eases

- Underlying EBITDA (IFRS 16) of €753m up 3.1% YoY at constant currency; EBITDA (pre-IFRS 16) declined 10.0% year-on-year reflecting higher rent costs as new store openings accelerated

- Underlying PBT of €202m down 33.7% YoY at constant currency, reflecting investment in stores, expansion and related supply chain costs, alongside higher inflation and higher interest costs

- Net debt at end of FY23 was €411m (pre-IFRS 16), representing 1.0x EBITDA (pre-IFRS 16) leverage

Commenting on the results, Andy Bond, Executive Chair of Pepco Group, said:

“Despite a challenging market backdrop, we delivered another year of strategic progress and record sales of €5,649m, against a strong prior year comparative. We opened a record number of 668 net new stores, primarily with the Pepco brand in Central and Eastern Europe, but also in Western Europe, with new store openings in the region approaching half of the total introduced – amid encouraging progress into Western Europe in countries such as Spain and Italy.

“That said, our overall performance was mixed with a disappointing profit outturn. As we laid out at our Capital Markets Day in October, we are acting decisively to address this, reaffirming our strategy to deliver more measured growth – doing less, to achieve more – with a greater focus on improving profitability and cash generation. This includes a more targeted approach to new store openings in existing markets, and our renewed focus on transitioning into one single business through a unified customer offer and sourcing strategy, helping us drive enhanced cost and operational efficiency.

“We also committed to the UK as the Group’s largest market. Our ambition is to continue the strong progress made by the team, such as the ongoing enhancement of Poundland’s proposition, including introducing the Pepco clothing range in stores, alongside its extensive FMCG range that is appreciated by customers.

“The expertise and dedication of our colleagues are central to the Group’s progress, and I would like to take this opportunity to thank all of our colleagues for their hard work in working towards our strategic priorities.

“Looking ahead to 2024, while we expect industry-wide short-term sales challenges to continue, we are cautiously encouraged by recent third-party data pointing to an expected easing of certain pressures on household budgets, particularly in Central and Eastern Europe. We also continue to expect gross margin recovery throughout the year, and are already seeing encouraging signs here. The Group has a market-leading customer proposition, a strong balance sheet, and resilient operating cash flow to continue success across Europe. The opportunities in our core markets remain significant, and we will leverage them in a more targeted way, with an enhanced emphasis on capital, returns, and free cash flow, helping to grow the business in line with our renewed strategy.”

Source : Pepco Group

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.