UK DIY News

Pepco Group Reports Strong Trading Performance

- Strong trading and strategic progress achieved despite a challenging Covid impacted trading environment

The fast-growing pan-European variety discount retailer, Pepco Group, owner of the PEPCO and Dealz brands in Europe and Poundland in the UK, today reports an update for the financial year ending 30th September 2021 with the Full Year Preliminary Results to be published on 14th December.

Summary Financial Performance

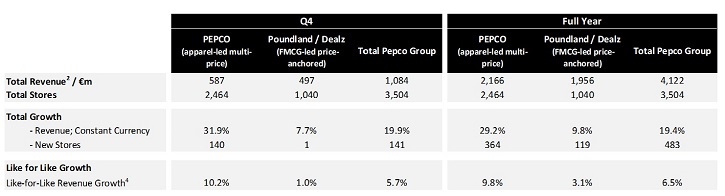

- Full year Group revenue2 of €4,122m, +19.4%3 year on year (“YoY”) led by PEPCO with 29.2% growth.

- Strong total like-for-like (“LFL”)4 full year growth of 6.5%:

- PEPCO: +10.2% LFL in Q4, +9.8% LFL growth in the full year.

- Poundland / Dealz: +1.0% LFL in Q4, +3.1% LFL growth in the full year. - Closing net debt 1,5 of €102m, (€226m reduction YoY) reflecting management action to reduce stock and optimise working capital across the year.

- On an IFRS16 basis Net Debt was €1,200m (LY € 1,239m).

- Full year underlying EBITDA6 is anticipated to be within a range of €640m to €655m. This range is at the upper end of analyst expectations and represents c.45% growth at the mid-point on the Covid impacted prior year.

Strategic Progress Towards Growth

- Significant new store expansion continues across all trading brands. Openings are in line with guidance with 424 net new stores opened in the year (483 including Fultons stores acquired trading at the year-end):

- PEPCO: 364 net new store openings, which represents a 17.3% increase versus last year, including 33 in the Western European markets of Italy and Spain and the opening of our first three stores in Austria.

- Poundland / Dealz, 60 net new stores (119 including Fultons), which represents an increase of 6.5% YoY (12.9% including Fultons). - 954 store renewals completed (827 PEPCO, 127 Poundland) upgrading stores to our latest layout and environment, driving LFL sales growth and positive customer perception.

Trading Context & Performance

The fourth quarter saw a return to all stores trading, reflecting a further easing of disruption seen in the third quarter as a consequence of the Covid pandemic.

Commenting on the results, Andy Bond, CEO Pepco Group, said:

“We delivered another strong trading performance and made good progress against our strategic plans during the year. Despite the operational challenges from Covid disruption, we continued to open new stores across all three of our brands, opening 141 in the final quarter. This brought the total to 483 net new stores for the year – a record number of annual openings – including the first PEPCO stores in Austria, Serbia and Spain. We are encouraged by the initial performance of the Western European PEPCO stores across Italy, Austria and Spain. We are also pleased by the results of our store renewal programme in driving our LFL performance and enhancing the customer experience.

“As consumer demand and business activity returned following Covid impacts, pressure on global supply chains has increased with reduced raw material availability leading to commodity inflation, further compounded by constrained container capacity which significantly increased shipping costs from the final quarter. Through a combination of actions taken in our operating model and our unique Far East direct sourcing operation, PGS, which has strong direct supplier and factory relationships, we have quickly taken operational action to mitigate these impacts.

“In order to further drive our significant growth plans and recognising the financial strength of the Group alongside the price sensitive nature of our core customer, we intend to invest into our price proposition to maintain our price advantage. We have developed clear plans to reduce our operating cost base through leveraging our increased scale and capability to maintain the continued delivery of our profit growth.

“While the backdrop against which we operate will remain challenging for some time, we remain confident in the significant growth opportunity we have, our plans to achieve them, and meeting future market expectations.”

Group Performance Overview

PEPCO'S LFL growth was +9.8% for the full year, including the impacts of Covid-related store closures. This is driven by the strength of proposition, including our store and proposition refit programmes and higher levels of customer demand. Poundland Group’s full year LFL of +3.1%, provides a clearer indication of the strengthened customer offer and, in particular, strong performances across recently extended categories in clothing and homewares and the introduction of a new frozen and chilled offer to 35 stores in the quarter (127 full year).

Alongside the renewal programme the proposition transformation continues driving multi-price participation to 36.2% of sales (LY 25.9%).

Recognising the significant future store capacity in all of the territories that it operates, PEPCO expanded its store portfolio in the full year by 364 stores (+17.3% YoY) which included its first stores in Austria, Serbia and Spain. In addition, PEPCO continued to upsize or relocate stores, numbering 60 in the full year and began the first steps in updating branding in stores to reflect the new design that will represent PEPCO in our next phase of growth. The store renewal programme continues in both PEPCO and Poundland updating nearly 1,000 stores in the year which will deliver sustainable LFL growth. Following sustained improving performances, we continued the roll-out of the Dealz format across Poland and Spain with 65 stores opened in the year and 14 in the quarter, with over 100 stores now trading in Poland.

To support our agenda for growth, we have made the decision to appoint Trevor Masters as Group Chief Operating Officer – which we announced on the 8th of October – an appointment we are confident will further accelerate our growth agenda and increase efficiency.

Cash and Net Debt

The Group continues to be strongly cash generative after capital expenditure1 of c.€190m. Closing cash of €513m (FY20: €400m) and net debt of €102m (FY20: €328m) (on an IFRS16 basis Net Debt was €1,200m (LY € 1,239m)) reflects continued underlying business growth and actions developed across 2020 and 2021 with key suppliers alongside significant stock efficiency programmes which reduce the required stock levels and enhance the Group’s working capital cycle.

Profit Range

Full year underlying EBITDA delivery is anticipated to be within a range of €640m to €655m at the upper end of analyst expectations and representing c.45% growth at the mid-point on the Covid impacted prior year.

Source : Pepco Group

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.