UK DIY News

Eurocell Posts Solid Financial Performance; Gains Market Share

- Solid financial performance and continuing to gain market share

Eurocell plc, the market leading, vertically integrated UK manufacturer and distributor of innovative window, door and roofline PVC products, today announces its results for the year ended 31 December 2022.

Financial headlines

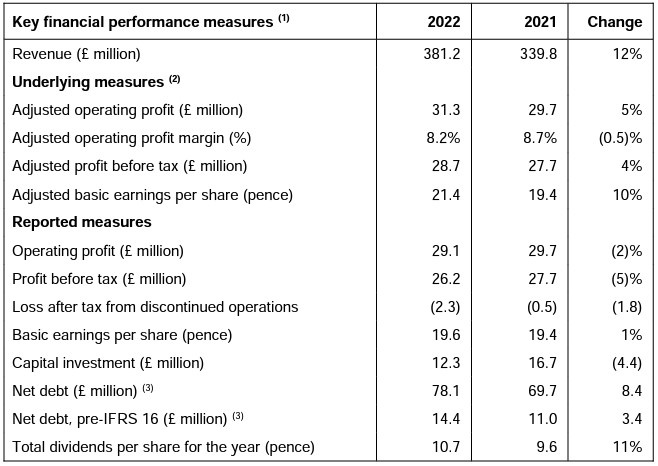

- Delivered a solid financial performance against an increasingly challenging backdrop and strong 2021 comparatives

- Continued successful deployment of commercial strategies, with sales up 12% vs 2021, including:

- Profiles up 15% and Building Plastics up 10%

- New build, large contract and RMI(4) project work robust throughout the year

- Slowdown in smaller discretionary RMI work experienced by trade fabricators and the branch network in H2

- Price was the significant driver of sales growth in 2022

- Selling price increases and surcharges recovering unprecedented input cost inflation

- H2 margins reflected lower volumes and not all cost inflation being fully recovered until early in 2023 - Cyber incident in July / August, resulted in temporary disruption and some financial impact

- Incident efficiently resolved, with the business remaining operational throughout

- Insurance claim partially resolved, with compensation income of £1.1 million recognised in 2022

- Steps taken to implement further resilience and security measures

- Adjusted operating profit from continuing operations up 5% vs 2021

- Adjusted operating profit margin of 8.2% (2021: 8.7%), reflecting the dilutive impact of inflation - Adjusted profit before tax from continuing operations up 4% vs 2021, reflecting lower sales volumes, cost control, operating efficiencies and recovery of significant input cost inflation

- Investment in business growth and resilience, with capex of £12.3 million, including substantial completion of operating capacity expansion and the start of a programme to improve IT infrastructure

- Strong balance sheet and liquidity, with pre-IFRS 16 net debt of £14.4 million (31 December 2021: £11.0 million)

- Average pre-IFRS 16 net debt of £17.0 million in 2022

- £75 million unsecured sustainable revolving credit facility refinanced in May 2022

- Proposed final dividend of 7.2 pence per share (2021: 6.4 pence per share), resulting in total dividends for the year of 10.7 pence per share up 11%, reflecting solid financial performance and a lower tax rate in 2022

Operational headlines

- Increased run rate on Profiles fabricator wins, with 29 new accounts in 2022 (2017-21: average 15 per annum)

- In Building Plastics, 2023 focus on optimising performance from existing branch estate

- New warehouse and expanded manufacturing capacity now delivering improved operating efficiencies

- Decisive action taken on costs to prepare the business for 2023

- Reduced operating costs by c.£5 million per annum from the beginning of 2023, with the related redundancy costs and asset impairment charges (together £2.2 million) included as a non-underlying item in the financial statements

- Following a review, streamlined the business via the disposal of Security Hardware in December, with loss on sale and trading loss (together £2.3 million) presented as a discontinued operation in the financial statements Sustainability headlines

- Strong on sustainability as the leading UK-based recycler of PVC windows:

- Further improvement in proportion of recycled material used to 29% (2021: 27%)

- 82% of waste recycled in 2022 (2021: 82%)

- c.£1.5 million investment in solar panels to be installed at our primary manufacturing facilities

Mark Kelly, Chief Executive of Eurocell plc said: “In 2022, the business responded well to major challenges to report solid financial results for the year, with progress in sales and adjusted profits against a very strong 2021. “Looking ahead, in preparation for tougher market conditions, we completed a restructuring programme in Q4 2022 to reduce operating costs, and in December, to further simplify the business, we sold the trade and assets of Security Hardware.

“We continue to take market share and have increased the run rate on new fabricator account acquisitions, with our pipeline of other potential new customers remaining healthy. Market share gains are further supported by the impact of maturing branches and a widening product range, all underpinned by very high product availability and increasingly efficient operations.

“For the current year, the latest construction industry forecasts(5) recognise the currently challenging market conditions and ongoing macroeconomic uncertainty. However, we have acted swiftly on cost to prepare the business for 2023 and we expect our strategy to enable us to optimise performance in our markets.

Source : Eurocell PLC

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.