UK DIY News

Eurocell Sales And Profits Down; Strategic Review Complete

- Profits in line with expectations; strong cash flow

Eurocell plc, the market leading, vertically integrated UK manufacturer, distributor and recycler of innovative window, door and roofline PVC products, today announces its preliminary results for the year ended 31 December 2023.

Summary

• Profits in line with expectations, despite further market deterioration in the second half

• Challenging backdrop, with weak RMI(1) market and particularly severe decline in new build housing

• Early and decisive action taken on cost in response to lower volumes and to position the business well for when markets recover

• Efficient inventory management driving strong cash flow performance, maintaining strong balance sheet and liquidity

• Review of strategy complete, with pathway to organic growth and improved margins identified

Financial headlines

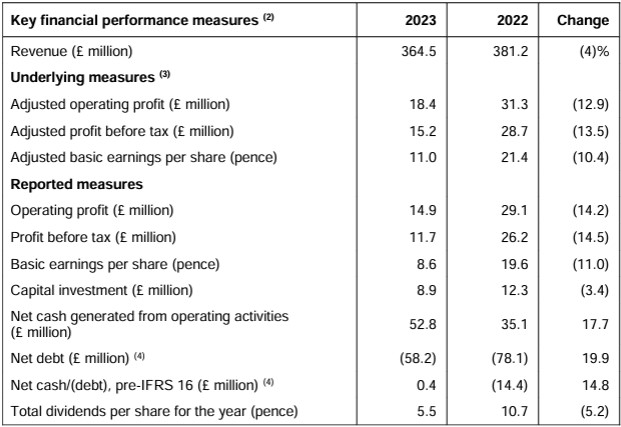

- Group sales down 4% on a strong 2022 comparative period, with volume 6% lower, including:

- Profiles down 4%: reduced RMI(1) and significantly weaker new build activity, partially offset by benefit of market share gains, with volumes 7% below 2022

- Building Plastics down 4%: RMI volumes in our branches 5% below 2022

- Increased competition for limited demand leading to pressure on margins in the branch network

- Continued input cost inflation, offset with selling price increases where possible:

- Particularly labour, recycling feedstock and electricity, where we operate a rolling 12-month forward hedging policy

- Some easing on input cost pricing through the second half of the year - Adjusted profit before tax from continuing operations down 47% vs 2022

- Lower sales volumes, input cost inflation and margin pressure in the branches, partially offset by selling price increases, operational improvements and cost reduction - Net cash generated from operating activities up 50% vs 2022

- Efficient stock management driving a net working capital inflow of £13.4 million (2022: net outflow £13.1 million) - Strong balance sheet and liquidity, with pre-IFRS 16 net cash of £0.4 million (31 December 2022: net debt of £14.4 million)

- Average pre-IFRS 16 net debt of £9.5 million in 2023 (2022: £17.3 million) - Proposed final dividend of 3.5 pence per share, resulting in total dividends for the year of 5.5 pence per share (2022: 10.7 pence per share)

- £5 million share buyback programme commenced in January 2024

- As of 15 March 2024, 2.0 million shares purchased under the programme at a cash cost of £2.5 million

Operational and sustainability headlines

- Early and decisive action taken on operating costs in response to lower volumes

- Q4 2022 restructuring reduced operating costs by £5 million per annum from the start of 2023

- Further headcount reduction in Q2 2023 to deliver savings of c.£2 million in the second half and c.£4 million per annum thereafter, with the related redundancy costs (£2.7 million) included as a non-underlying item

- Continuing programme of operational improvements

- Strong on sustainability as the leading UK-based recycler of PVC windows, with the proportion of recycled material used improving to 32% (2022: 29%) Review of strategy complete

- Pathway identified to building a £500 million revenue business generating a 10% operating margin within 5 years

Darren Waters, Chief Executive of Eurocell plc said: “The trends reported at our half year results in September continued for the remainder of 2023, with some further modest weakening in our key markets. Against this challenging backdrop, we are pleased to report profits for the year in line with expectations and strong cash flow generation.

“We took early and decisive action on costs in response to lower volumes and have continued to focus on efficient working capital management, driving a good cash flow performance. Whilst the near-term outlook for our markets remains challenging, these actions leave us well placed to benefit from a market recovery when it comes.

“Our review of strategy is now complete and I am very pleased with the outcome. Looking ahead, we have identified a clear pathway to building a £500m revenue business, generating a 10% operating margin over a five-year period, built around four pillars; Customer Growth, Business Effectiveness, People First and ESG Leadership. This is an ambitious vision, but when we aggregate the growth opportunities, and apply a degree of sensitivity, we believe it is an achievable target, with the potential to create significant shareholder value.”

Source : Eurocell plc

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.