UK DIY News

BRC Responds To Spring Budget

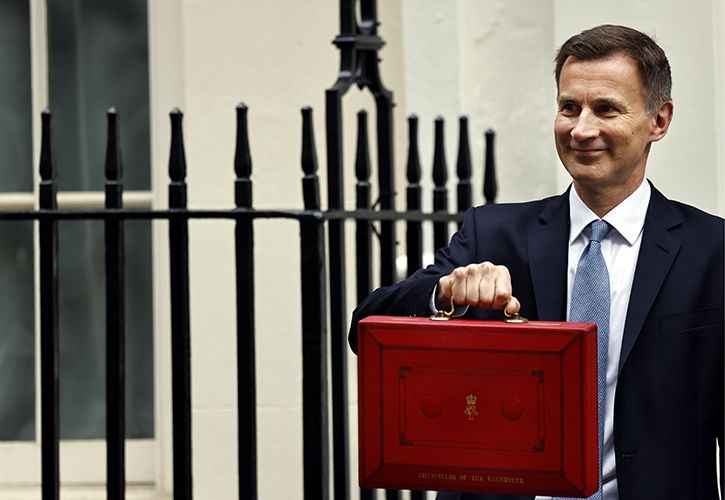

Responding to the Chancellor’s Spring Budget, Helen Dickinson, Chief Executive of the British Retail Consortium, said:

“When shops we love shut down, when jobs we need are absent, and when investment we benefit from is lost, it’s our lives and our communities which lose out. Retail employs three million people and invests over £17bn annually, yet the industry’s ambition to deliver a net zero, digitally transformed future with higher skilled, better paid jobs means its potential goes so much further. It seems the Chancellor does not share in our ambition, and today’s Budget will do nothing to deliver a better future for retailers and their customers.

“The cost of living crisis has taken a toll on businesses and households. Consumer confidence remains low and retail sales volumes in 2023 were the lowest in four years. Yet the Chancellor has done little to promote growth and investment, instead hindering it with the business rates rise in April. This has consequences for jobs and local communities everywhere – from the smallest villages to the biggest cities.

“The cut to national insurance might go some way to supporting households impacted by the high cost of living. However, unless Government addresses the government imposed cost increases, we may yet see the spectre of higher inflation return, limiting the benefits to households of lower national insurance.”

On Business Rates:

“Government inaction will now cost the retail industry £470m extra every year in business rates – money that could have been better spent improving our town and city centres, investing in lower prices, and maintaining jobs and commerce all over the UK. How can a whopping 6.7% tax rise in April be justified, when the Chancellor himself is saying inflation is forecast to be nearer 2%.

“This rise in rates does not exist in a vacuum – retailers are also contending with cost pressures throughout the supply chain, in the context of the largest increase to the National Living Wage on record.

“Government has had five years to fix the problems with business rates, as they promised in their election manifesto. Retailers pay over £7 billion a year in business rates – over 22% of the total raised by the tax. This is disproportionate, destructive, and any Government that is serious about growing the economy must address this as a matter of urgency.”

On VAT-Free Shopping:

“The UK remains the only European economy without a tax-free shopping scheme, meaning we are missing a golden opportunity to boost tourism and spending across the country. Independent research from CEBR shows that the UK economy is losing £11 billion a year because of the loss of tourism resulting from, what is effectively, a tourist tax. Tax-free shopping not only convinces tourists to buy more, but it also attracts shopping tourism, supporting businesses and jobs in the UK.”

On National Insurance, Alcohol Duty and Fuel Duty freezes:

“Many people are still feeling the impact of the high costs of living, and measures to cut national insurance, as well as alcohol and fuel duties, will go some way to helping support households during this challenging time. Putting more money into people’s pockets is the first step towards bolstering the UK’s weak consumer confidence and spending.

“However, increasing disposable income will only improve standards of living if inflation can be brought to heel. Retailers face billions in additional costs as a result of new government policies – including higher business rates, a deposit return scheme, and changes to waste electrical takeback, all of which will feed into customer prices. Government must consider the cumulative impact of introducing all these policies, and more, in such a short space of time, or else risk a second wave of inflation impacting households.”

On Crime:

“The Chancellor noted that burglaries and violent crime had halved. This simply doesn’t tally with the experience of thousands of those working in retail. The number of incidents of violence and abuse rose to 1,300 per day in 2022/23 from 870 the year before. No one should have to go to work fearing for their safety. The Protection of Workers Act in Scotland already provides additional protection to retail workers, so why should our hardworking colleagues south of the border be offered less protection? It is vital that government takes action – introducing a new standalone offence for assaulting or abusing a retail worker.

On the Apprenticeship Levy:

“Yet again a key opportunity has been missed to fix the broken Apprenticeship Levy. This inflexible, outdated system hinders retailers from effectively investing in their workforce. Its inflexibility has deprived tens of thousands of people across the country of potential apprenticeships and training opportunities and stands in the way of career progression for many people working in the industry. For many retailers, who are unable to draw effectively from the Levy funds they put in, the system is little more than a tax, adding the inflationary impacts of rising business rates, labour costs, and supply chain pressures.”

Source : BRC

Image : Sean Aidan Calderbank / shutterstock.com / 2275340641

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.