UK DIY News

Wickes: Record Sales And Further Market Share Gains

Wickes Group plc has published full-year results for the 52 week period to 31 December 2022, advising of record sales and further market share gains; well-placed to continue to outperform the market.

Financial Highlights

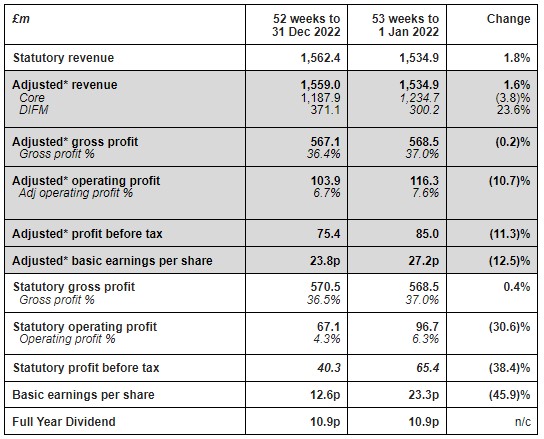

- Like for Like (‘LFL’)1 sales up 3.5% in FY2022, and 22.8% on a three-year basis

- Total year-on-year revenue growth of 1.8% to a record £1,562.4m

- Further market share gains in Core2, and a strong recovery in delivered DIFM sales

- Adjusted profit before tax £75.4m, in line with guidance, following a record £85.0m in 2021

- Statutory profit before tax of £40.3m after absorbing non-recurring costs of £35.1m

- Net cash position of £99.5m (2021 £123.4m), reflecting the impact of £24.4m IT separation costs

- IFRS 16 net debt of £591.8m (2021 £618.7m); leverage of 2.9x3

- Final dividend of 7.3p, giving a total of 10.9p for the full financial year in line with guidance

Strategic Highlights

- Digital TradePro membership growth rate accelerated to 18% with 112,000 new customers (2021: 81,000), taking the total to 746,000; TradePro sales in 2022 increased by 19%

- Successfully broadened our DIY customer appeal through the introduction of 30 minute click & collect, Klarna payment options, and the launch of the Wickes eBay store

- Further market share gains in Core, following a record year in 2021, with Core LFL down 2.0%; three-year LFL of 33.0%

- Strong recovery in DIFM delivered sales, up 26.1% LFL, as we worked successfully through the order book, which remains ahead of pre Covid levels

- Delivered over £20m of cost savings from productivity gains and efficiencies in 2022

- 12 refits completed in 2022; ROCE and sales uplifts remain strong and in line with expectations

- First new store opened in Q4 in Bolton, with a strong performance in its first Winter season

- Outlined Science-Based Targets for carbon emissions with approval received in December 2022, and launched our Sustainable Home Guide to help customers reduce energy bills and emissions

Capital Allocation Policy

- The Company is reviewing its capital allocation policy and will provide an update along with its Q2 trading update in July

Current Trading & Outlook

In the first 11 weeks of 2023 trading has been in line with our expectations. Core sales are moderately behind the same period last year, with Trade sales in growth and DIY continues to normalise. In DIFM, delivered sales are slightly ahead year on year due to the elevated order book; ordered sales are in line with the same period in 2022.

Whilst we are mindful of the macroeconomic backdrop, we remain confident in our ability to drive further market share gains given the strength of our proposition and improvements we have made to our offer. We have efficiency plans in place which will offset inflationary pressures in 2023, with the exception of energy costs which as previously indicated will be £10m higher than in 2022. We will issue our next trading update after Easter.

Click here to view the full results publication

David Wood, Chief Executive, commented:

"This was a period in which we achieved record sales and made further market share gains. While profit declined, the outcome is still significantly ahead of the pre-Covid period. Our performance was underpinned by our balanced business model, digital leadership and ability to offer the best value and service across Trade, DIFM and DIY. This has been achieved due to the expertise and dedication of our 8,100 colleagues, and I would like to thank each of them for their support over the last 12 months.

Like all businesses we remain watchful of the external consumer environment. However, we have the right strategy and a compelling offer for customers, and look to the future with confidence. We will continue to invest across our distinctive growth levers, and are well-placed to achieve further market share gains."

Click here to download the full results publication

Click here to download the results presentation

Source : Wickes PLC

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.