UK DIY News

Wickes Posts Group LFL Sales Decline

- Wickes Group plc – Trading Update for six months ending 29 June 2024

- Sales & volume growth in Retail; market remains challenging in Design & Installation

- Profit outlook for the year remains unchanged

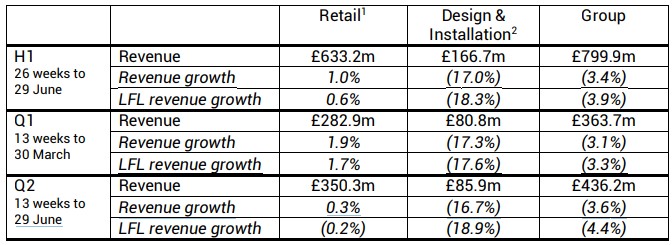

In the first half of 2024 Wickes has delivered continued sales and volume growth in Retail1 with LFL sales up 0.6%. Challenging market conditions have continued in Design & Installation2 where we saw LFL sales decline by 18.3%. Overall Group LFL sales decreased by 3.9% compared to the prior year.

Retail sales remain resilient and we have continued to increase market share to record levels, demonstrating the continued strength of Wickes’ great value and service-led proposition. Growth in the first half was driven by volume, with selling price deflation of around 3%. The phasing impact of the Easter peak trading period this year reduced Retail LFL sales in Q2 by 1.4%.

Within Retail, TradePro sales continue to perform strongly, up 14% in the half, reflecting a healthy pipeline of work for local trade professionals and continued sign-ups to the TradePro scheme. Active TradePro members have increased by 18% year-on-year to 541,000. DIY sales remain in moderate decline as customers continue to focus on smaller projects.

Design & Installation delivered sales3 in the half reflected the continued soft consumer appetite for larger ticket purchases and a strong comparative in H1 2023. Ordered sales4 in the first half have shown a single digit year-on-year decline. Our ongoing strategic focus on our lower-priced Wickes Lifestyle Kitchens5 continues to deliver good results, with sales up 18.8% year-on-year in H1.

The Solar Fast acquisition completed on 21 May and we have recently rolled out Solar Fast point-of-sale assets in 50 of our stores and launched the digital journey on the Wickes website. Our 51% stake will be fully consolidated from the date of completion and included in Design & Installation sales.

Reflecting our continued focus on tight cost management, our planned productivity initiatives include savings in distribution and the cost benefits from technology investments in customer service. In addition, recently implemented changes to our Design & Installation operation, to simplify and improve the customer experience, will result in further cost savings.

Investment in our strategic growth levers continues, with two new stores opened in the half, in Long Eaton and Durham. We have refitted three stores and continue to see return on invested capital of over 25% from our refit programme, which has now covered c.78% of the store estate.

The balance sheet remains strong with net cash at the half year of £151.5 million. Whilst the trading environment remains uncertain, given the resilient first half in Retail and our continued focus on costs, the overall outlook for adjusted profit before tax for 2024 remains unchanged.

We expect to report half year results in early September 2024.

David Wood, Chief Executive of Wickes, commented:

“Our excellent value and service-led offer gives DIYers and tradespeople reason to keep coming back to Wickes. Against a challenging trading backdrop, we have grown volume and taken further market share in Retail, with our TradePro scheme continuing to show strong momentum as local trade professionals turn to Wickes to save them time and

money. We’re seeing good demand for our lower-priced Wickes Lifestyle Kitchens, reflecting customers’ desire for quality and value. We continue to invest in our growth levers and are particularly excited about the recent acquisition of Solar Fast”.

1) Retail refers to the revenue stream formerly described as Core. Retail revenue relates to products sold directly to customers (both DIY and local trade), in stores or online.

2) Design & Installation refers to the revenue stream formerly described as DIFM or Do-it-for-me. Design & Installation revenue relates to projects such as kitchens and bathrooms, sold by our showroom Design Consultants. Revenue is recognised when delivery and installation (where applicable) is complete. Design & Installation includes Solar Fast.

3) Delivered sales refers to the revenue which is recognised when the Group has satisfied its performance obligation to the customer and the customer has obtained control of the goods or services being transferred.

4) Ordered sales refers to the value of orders at the point when the order has been agreed.

5) Sales of Wickes Lifestyle Kitchens which include a design element are classified as Design & Installation revenues, whereas Self Serve purchases of the Wickes Lifestyle Kitchen range are classified as Retail revenues.

Source : Wickes

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.