UK DIY News

Stelrad Posts Strong Interim Performance

Stelrad Group plc (“Stelrad” or “the Group” or “the Company”, LSE: SRAD), a leading specialist manufacturer and distributor of radiators in the UK, Europe and Turkey, today announces its unaudited interim results for the six months ended 30 June 2024.

Financial and operational highlights

Financial and operational highlights

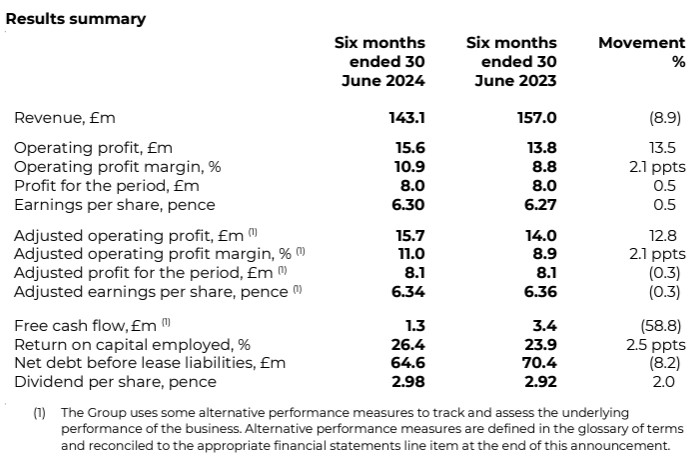

- Revenue was down 8.9%, as anticipated, to £143.1 million due to the continuation of a challenging macroeconomic environment.

o UK & Ireland: revenue was only down 1.5% supported by strong product mix despite reduced volume.

o Europe: revenue was down 12.6% primarily due to depressed levels of repair, maintenance and improvement (“RMI”) activity.

o Turkey & International: revenue was down 30.6%, to £7.2 million, due to low economic activity in Turkey. - Market share increased by 1.6% to 20.8%1.

- On Time In Full (OTIF) delivery of 98% in the UK & Ireland building trust in our supply chain to customers.

- 16% rise in contribution per radiator to over £20, driven by operational flexibility, new designs and cost management.

- Operating profit rose to £15.6 million, an increase of £1.8 million (13.5%), benefitting from ongoing operational discipline and margin management. Adjusted operating profit rose to £15.7 million with an adjusted operating profit margin of 11.0%, up from 8.9% in 2023.

- Positive free cash flow, despite seasonal high point and selective investments in working capital in advance of an expected market recovery.

- Return on capital employed increased by 2.5 ppts to 26.4% due to improved operating performance and lower Euro asset values.

- Leverage at 30 June 2024 was 1.49x (December 2023: 1.47x), based on net debt before lease liabilities.

- Interim dividend of 2.98p pence per share (2023 interim dividend: 2.92p), to be paid on 25 October 2024, an increase of 2%, reflecting the strength of the Group’s balance sheet and the Board’s confidence in the Group’s future growth prospects and increasing cash generation.

- Outlook for FY24 unchanged.

Commenting on the Group’s performance, Trevor Harvey, Chief Executive Officer, said: “Despite continued macroeconomic challenges across Stelrad’s geographies, the Group has delivered a strong performance in a volume environment that remains subdued, with inflation and high interest rates continuing to suppress both RMI and new build markets.

“Stelrad’s performance during the period, particularly in terms of market share growth and growth in contribution per radiator, combined with cost base reduction and ongoing margin optimisation actions, demonstrates the strength of our business model, and further underpins the Board’s confidence in the outlook for the full year.

“Stelrad remains well positioned for a sustained period of profitable growth as markets recover across our core geographies, with the Group well placed to benefit from strong underlying replacement demand across Europe and the long-term regulatory tailwinds for decarbonised, energy-efficient heating systems.”

Source : Stelrad plc

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.