UK DIY News

Sainsbury's Notes Sales Decline At Argos

- Next Level strategy delivering strong momentum; committed to continued outperformance

J Sainsbury plc has published preliminary results for the 52 weeks ended 1 March 2025.

Simon Roberts, Chief Executive of J Sainsbury plc, said: "We've transformed our business over the past four years. We have created a winning combination of value, quality and service that customers love, investing £1 billion in lowering our prices. More people are choosing Sainsbury's for their main grocery shop as a result, delivering our highest market share gains in more than a decade. We are committed, above all else, to sustaining the strong competitive position we have built - consistently giving customers the great value they have come to expect from Sainsbury's - and we expect to continue to outperform the market.

"Our customer offer is the strongest it has ever been. We've expanded Aldi Price Match to more products than ever before in addition to offers on more than 9,000 products with Nectar Prices. Customer satisfaction with product availability is at record levels and we're continuing to add more new, innovative products to our ranges. Nectar is taking our ability to create personalised value and loyalty to the next level and our long-term contracts with farmers and suppliers demonstrate our commitment to resilience and sustainability across the UK food system.

"Our belief in the strength of Sainsbury's offer has driven our decision to make our largest investment in expanding our store space in over a decade as we open supermarkets in key new locations and extend food space within many of our existing stores. It's also why we continue to invest in our colleagues, whose dedication will power our Next Level plan. Working together with our suppliers we will continue to deliver for our customers, our shareholders and the communities we serve."

Financial Highlights

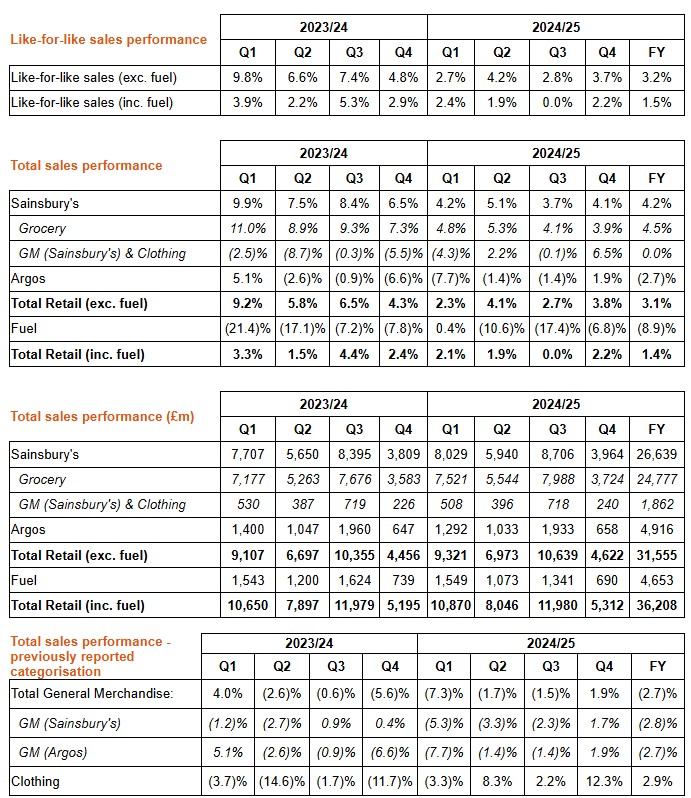

- Sainsbury's FY sales (excluding fuel) £26.6bn, up 4.2%, Argos FY sales £4.9bn, down (2.7)%, Fuel FY sales £4.7bn, down (8.9)%

- Strong year-end sales momentum, with growth in all our brands: Sainsbury's Q4 sales up 4.1% and Argos Q4 sales up 1.9%, reflecting continued improvement in online traffic trend

- Retail underlying operating profit £1,036m, up 7.2%, with double-digit growth at Sainsbury's partially offset by lower profits at Argos

- Statutory profit after tax £242m, up 77%. Non-underlying items of £(297)m on a post-tax basis predominantly relate to the restructuring of the Financial Services division and Retail restructuring costs

- Retail free cash flow of £531m, in line with guidance to deliver at least £500m

- £200m share buyback programme complete; full-year dividend of 13.6 pence, up 4% year-on-year

2025/26 Share Buyback and Special Dividend

Reflecting the strength of our balance sheet, we will buy back at least £200m of shares in 2025/26 and we expect to return bank disposal proceeds of £250m via special dividend in the second half of the year. The special dividend will be accompanied by a proposed share consolidation

Any distributable bank disposal proceeds in excess of £250m will be used to enhance the share buyback above a core £200m base

Financial Summary | 2024/25 | 2023/24 | YoY |

Business performance |

|

|

|

Retail sales (inc. VAT, excl. fuel) | £31,555m | £30,615m | 3.1% |

Retail underlying operating profit | £1,036m | £966m | 7.2% |

Total Financial Services underlying operating profit* | £30m | £29m | 3.4% |

Underlying profit before tax* | £761m | £701m | 8.6% |

Total underlying basic earnings per share* | 23.1p | 22.1p | 4.5% |

Proposed full-year dividend per share | 13.6p | 13.1p | 3.8% |

Net debt (inc. lease liabilities) | £(5,758)m | £(5,554)m | £(204)m |

Non-lease net debt | £(264)m | £(200)m | £(64)m |

Return on capital employed* | 9.0% | 8.3% | 70bps |

Statutory performance |

|

|

|

Group revenue (excl. VAT, inc. fuel) | £32,812m | £32,238m | 1.8% |

Profit after tax | £242m | £137m | 76.6% |

o/w Continuing operations | £420m | £308m | 36.4% |

o/w Discontinued operations | £(178)m | £(171)m | (4.1)% |

Total basic earnings per share* | 10.4p | 5.9p | 76.3% |

Net cash generated from operating activities (continuing) | £1,364m | £2,113m | £(749)m |

*On a total basis inclusive of discontinued operations

2025/26 Outlook

We have made four years of exceptional progress and investment, resetting our value proposition and strengthening the fundamentals of our business. This puts us in a strong competitive position and we are committed to sustaining this in the year ahead. We expect to continue to grow grocery volumes ahead of the market and we have started the year with good trading momentum across all our brands. We expect to deliver Retail underlying operating profit of around £1 billion and Retail free cash flow of more than £500 million

Profit delivery will be supported by continued growth in Nectar profit contribution and industry-leading cost saving delivery and will be weighted more towards the second half versus last year, reflecting the timing of benefits from space reallocation activity and new store openings

Building on strong foundations

The first year of our Next Level Sainsbury's strategy has built on the success of our Food First strategy, delivering further grocery market share gains1 and significant operating leverage. This reflects the investments we have made over the last four years to improve our grocery proposition. We have built resilience and sustainable competitive advantage through strengthening the fundamentals of the business across logistics, technology and the way we work with suppliers.

As a consequence, we are winning more big basket primary customers2, providing us with the confidence to accelerate our plans to bring more of the Sainsbury's food range to more customers. We have acquired 14 new supermarket sites in key target locations. Together with further new supermarket openings and expanding food space in our supermarkets through space reallocation, this provides a unique opportunity to drive further market share gains.

The strength of our balance sheet and cash generation are key strategic assets, allowing us to invest capital to remain competitive, drive growth and efficiency and build competitive advantage while also delivering strong returns to shareholders. During the year we invested £825 million of capital in the business and have returned more than £500 million of our £531 million Retail free cash flow to shareholders, completing our share buyback programme of £200 million and paying ordinary dividends of £308 million. The strength of our balance sheet was recognised by S&P and Moody's giving public investment grade ratings in January 2025 and we issued £550 million of unsecured fixed income bonds, our first unsecured bond issue in 21 years.

We have further sharpened our focus on our core grocery business over the last year, through the announcements of the sale of Sainsbury's Bank's core banking and ATM businesses and the sale of the Argos Financial Services cards portfolio.

As we announced in January, we have made changes within our Operating Board to recognise the different needs of the Sainsbury's and Argos businesses and have reorganised our store support centre teams to reflect the distinction between the two. Rhian Bartlett, Chief Commercial Officer for Sainsbury's, now leads our commercial proposition across grocery, Sainsbury's general merchandise and clothing. To ensure a clear focus on delivering our More Argos, more often plan, Graham Biggart has taken on the role of Managing Director for Argos. These changes are driving faster decision making and improved performance for both Sainsbury's and Argos.

Across the business, we are focused on delivering on the eight commitments that we made in February 2024:

- Food volume growth ahead of the market

- Deliver profit leverage from sales growth

- Customer satisfaction higher 26/27 vs 23/24

- £1bn of cost savings over three years to 26/27

- Colleague engagement higher 26/27 vs 23/24

- £1.6bn+ Retail free cash flow over three years to 26/27

- Deliver our Plan for Better commitments

- Higher return on capital employed

Our progress against these commitments will be driven by our four strategic outcomes: First choice for food, Loyalty everyone loves, More Argos, more often and Save and invest to win.

More Argos, more often

Following a slow start to the financial year and a significant reduction in online traffic, Argos sales were behind our expectations in the first half of the year, particularly in the first quarter and early weeks of the second quarter. Sales strengthened into the second half as we took action to improve online customer traffic and volume and we returned to sales growth in the fourth quarter. Profits declined year on year in both H1 and H2, with actions taken during the year improving the trend in the second half.

Within a general merchandise market that remains highly competitive, our focus is on increasing customers' consideration of Argos - encouraging them to shop with us more often and with bigger baskets. To this end, we are driving change in our digital and commercial proposition, and we have made some good progress strengthening the Argos offer. We have also continued to reduce the complexity of the Argos operating model whilst still providing market-leading convenience for customers.

Focused on extending range, increasing desirability and enhancing digital capabilities

- We have reset our approach to trading events to deliver more impactful and focused value activity. We ran five of our new Big Red events during the year, delivering strong improvements in customer satisfaction scores for promotions and value22 and driving an increase in awareness of the premium brands available at Argos

- We continue to strengthen our partnerships with key supply partners, growing our share at key launch moments of the must-have new products from global brands, particularly across Gaming and Toys. Our partnership with Lego has expanded over the course of the year and for the first time this Christmas we partnered to run gamified engagement activity online for the 12 days of Christmas, attracting over 100,000 new customers to Argos

- We have taken action to improve our own labels in addition to the work over recent years on Habitat. We will focus on five primary owned brands (Habitat, Chad Valley, Bush, Home and McGregor), versus 11 previously. This year will see the range relaunch of McGregor in Garden & DIY and Chad Valley in Toys

- Through our Supplier Direct Fulfilment (SDF) model we have introduced more than 4,000 new products this year across 150 categories. This is a 43 per cent increase year-on-year, with a total of 13,500 SDF products now available. In the year ahead we plan to go further to extend the breadth of our range, with plans to add an additional 10,000 SDF products in key categories such as Household Electronics, Furniture, Computing and Gifting

- Our digital capabilities have strengthened through the year, driving more traffic to our site as we deliver a seamless online experience for customers with greater personalisation and improved complementary product recommendations. As a result, more customers are shopping with us online and more customers are making a recommended "attachment" purchase in the same transaction, driving an increase in items per basket. We will also be modernising the credit offer available on our website and are working closely on a new Argos Pay proposition with NewDay, following its acquisition of the Argos Financial Services cards portfolio. This will launch in early 2026.

Source : J Sainsbury plc

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.