UK DIY News

Revenue Down, Market Share Gains At Topps Tiles

Topps Tiles Plc, the UK's leading tile specialist, announces its unaudited consolidated annual financial results for the 52 weeks ended 28 September 2024.

Strategic and Operational Highlights

- Continuing to take market share in a difficult trading environment

- Market c. 20% down on pre-Covid levels, Group revenue +14.9% vs 2019

- New strategic goal, ‘Mission 365’ launched, to grow Group sales to £365 million, with an adjusted PBT margin of 8-10%

- Strong initial progress made with five key growth areas over last six months

- Trade digital experience improved –trade website relaunched, simpler registration process and pricing visibility

- B2B growth - CTD brand and certain assets acquired, further strengthening the Group’s trade presence. Actively working with the CMA in respect of their review process

- Category expansion continuing at pace with trial and roll out of new hard surface coverings offer

- Pro Tiler, now fully owned, delivered excellent growth with revenue up over 30% and strong profit margins

- Tile Warehouse sales run-rate trebled year on year

- New distribution centre acquired to facilitate further growth of Pro Tiler Tools and the wider Group

Financial Highlights

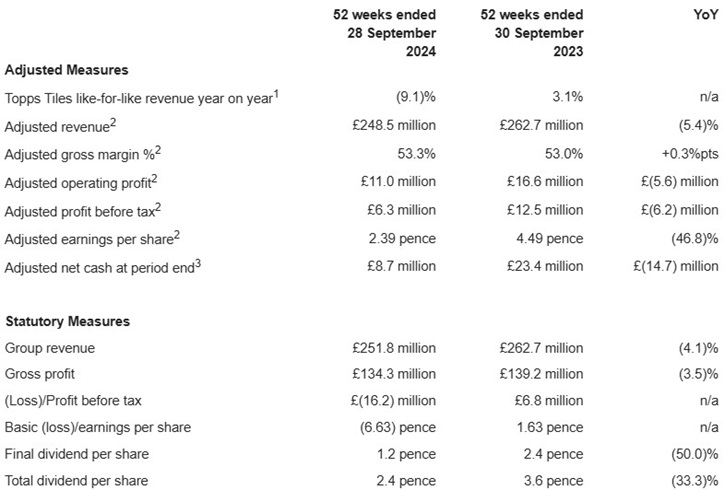

Financial Summary

- Adjusted revenue down 5.4% to £248.5 million

- Adjusted gross margin up 0.3%pts to 53.3%, driven by gains in Topps Tiles

- Adjusted operating costs down £1.1 million despite £4.9 million of inflationary costs

- Adjusted profit before tax down £6.2 million to £6.3 million due to operational gearing in the business

- Statutory loss before tax of £16.2 million as a result of £19.4 million non-cash impairment, primarily of right-of-use assets, and £3.1 million expense relating to purchase of remaining Pro Tiler shares

- Adjusted net cash outflow of £14.7 million, including outflows of £18.9 million relating to the acquisition of CTD Tiles and the remaining shares in Pro Tiler Limited, and a £6.4 million working capital benefit, driven by timing of year end

- Adjusted net cash of £8.7 million at year end, with £38.7 million cash headroom to banking facilities

- Full year dividend of 2.4 pence, at the top end of Group’s dividend policy and 1x covered by EPS, reflecting weaker trading in 2024 but also the Board’s confidence in the Group’s medium term prospects

Current Trading and Outlook

- Group sales in the first eight weeks returned to growth, up 1.2% year on year excluding CTD

- Topps Tiles like-for-like sales down 0.4% year on year in the eight-week period

- Macroeconomic indicators are mixed, with consumer confidence weak but some housing metrics trending upwards

- Additional cost headwinds from increases in National Living Wage and National Insurance contributions from April 25

- Significant self-help initiatives in play to deliver Mission 365

- Strategy, core strengths and robust balance sheet leave Group well placed to deliver significant medium term growth

Commenting on the results, Rob Parker, Chief Executive said:

“2024 has been a challenging year for RMI and especially bigger ticket spend. In the tile market, volumes remain well below pre-pandemic levels. Whilst Topps Group is not immune to these pressures, our growth strategy has served us well and we have continued to outperform the wider tile market.

The start of the new financial year has seen a return to modest sales growth for the Group, helped by weaker prior year comparatives and the continued strength of our trade offer. Whilst pleasing, the forward macro indicators for our market remain mixed, in particular weaker consumer confidence, and we need to see a sustained improvement in these metrics before we can be confident of a consumer recovery.

‘Mission 365’, which sets ambitious revenue and profit medium-term goals, has focused the business around key areas of growth and we have delivered good progress against these over the second half – notably our trade digital offer, our plans to significantly expand our addressable market into hard surface coverings, trade business to business opportunities with the acquisition of CTD Tiles and the strong growth in online pureplay. The robust strategic progress being made now to position the business for the future leaves us well-placed for a recovery in market volumes and underpins our confidence in the medium term outlook.”

1 Topps Tiles like-for-like revenue is defined as revenue from Topps Tiles stores that have been trading for more than 52 weeks and revenue transacted through Topps Tiles’ digital channels.

2 Adjusted revenue, gross margin %, operating profit, profit before tax and earnings per share exclude the impact of items which are either one-off in nature or fluctuate significantly from year to year. See the financial review section of this document for more details on each of these measures.

3 Adjusted net cash is defined as cash and cash equivalents, less bank loans, before unamortised issue costs as at the balance sheet date. It excludes lease liabilities arising from IFRS 16.

Source : Topps Tiles

Image : Topps Tiles Watford, Peter Fleming / iStockphoto.com / 1418450114

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.