UK DIY News

Pepco Group Reports Resilient Rebound In Q3 Trading

The fast-growing pan-European variety discount retailer, Pepco Group, owner of the PEPCO and Dealz brands in mainland Europe and Poundland in the UK, today reports a trading update for the third financial quarter ending 30th June 2021.

Key Performance Headlines

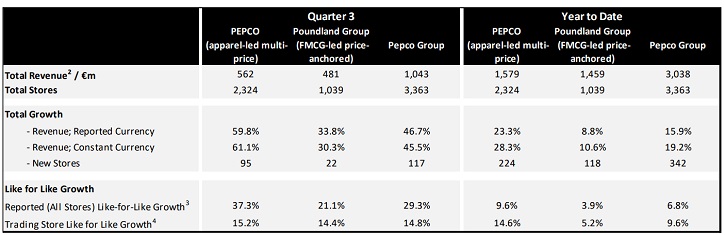

• Store expansion continues in line with guidance with 342 new stores opened in the year to date (“YTD”), being the 9-month period from October 2020.

- PEPCO: 224 new store openings in the YTD, which represents a 15.5% increase versus last year, including 18 in the newly-entered Western European markets of Italy and Spain.

- Poundland / Dealz, 118 new stores in the YTD, which represents an increase of 13.9% year-on-year.

• Resilient underlying constant currency like-for-like (“LFL”) sales growth in core segments:

- PEPCO: 37.3% LFL in Q3, 9.6% LFL in the YTD

- Poundland / Dealz: 21.1% LFL in Q3, 3.9% growth in the YTD

Trading Context & Performance

The third quarter represented the most significantly disrupted in the prior year, as a consequence of the Covid pandemic, with 6,895 (18.4%) total trading weeks lost in the comparative period versus 3,222 (7.5%) in the most recent reported quarter. The trading profile in the current year mirrored the easing of Covid-related closures such that by the final week of the quarter all stores were trading.

Commenting on the results, Andy Bond, CEO Pepco Group, said:

"We made good strategic progress in the third quater, with all three of our brands delivering a resilient trading performance as consumers continued to come back to PEPCO, Poundland and Dealz, following the gradual easing of Covid restrictions. We continued to invest in the future growth of our business opening 117 new stores in the three-month period and 342 in the year to date, as well as signing an agreement to take up to 29 stores in Austria. The Group also upgraded 260 PEPCO stores and, following the acquisition of Fultons Foods in autumn 2020, introduced a full chilled and frozen offer to 42 Poundland stores.

“Global supply chains continue to be impacted by both reduced raw material availability and input cost pressure compounded by constrained container capacity, which has the potential to introduce cost inflation starting during the autumn/winter 2021 season. However, our unique Far East direct sourcing operation, PGS, commands strong direct supplier and factory relationships. This allows us to continuously monitor and quickly take operational action to mitigate potential impacts, and we remain fully committed to being the lowest-price operator in all of our markets.

“While the consumer backdrop is likely to remain volatile and challenging for some time, we remain confident in the strength of our customer proposition and the long-term growth potential for our business.”

Revenue Performance

Group Overview

Customer restrictions were progressively eased over the reporting period, with the quarter beginning with 1,075 (33%) stores closed across 11 territories progressing to a full reopening by 27th June with associated consumer rebound. The comparative period of the prior year also represented the most severely impacted closure period with 6,895 (18.4%) total trading weeks lost in the prior year versus 3,222 (7.5%) in the currently reported quarter. The resulting LFL performance of 29.3% in the quarter (6.8% YTD) should be considered in this context, with trading store LFL (9.6% YTD) a more appropriate indicator of the underlying performance (14.8% in the quarter).

Strategic progress centred on increasing the size of the store portfolio while strengthening the customer proposition in all brands. PEPCO added 95 new stores in the third quarter with openings in all of its 14 current markets, including opening its first stores in Spain, its second Western European market. The programme to remodel existing stores continued with 8 stores either enlarged and / or relocated.

The roll-out of the Dealz format continued in Poland and Spain with 51 stores opened in the YTD and 24 in the quarter.

In this reporting period, 302 existing stores were refitted (627 YTD) through ongoing store conversion programmes in both PEPCO and Poundland. PEPCO conversions updated the store look and feel while rebalancing space to general merchandise ranges, particularly home décor. Poundland refits now total 171 stores across the entire estate, expanding the addressable market by introducing a new chilled and frozen proposition, enabled by the acquisition of Fultons Foods a market leading regional operator with 82 stores on acquisition.

PEPCO (Apparel-led multi-price)

Recognising the significant future store capacity in all of the territories that it operates, PEPCO expanded its store portfolio by 224 stores in the YTD which represented 15.5% year-on-year store growth. During the quarter 95 new stores were opened across all of its 14 existing territories including its first stores in Spain. In addition, PEPCO continued to upsize or relocate stores, numbering 39 in the YTD, and the business expectation remains to open 330 stores in the full financial year.

As a non-essential retailer, PEPCO has been most impacted by Covid-related closures from March 2020, with the third quarter of the prior year being the most impacted with almost 23% of trading weeks lost. Comparatively the closures in the early part of the third quarter in the current year were lower, with the progressive re-openings driving materially higher LFL given the low base the prior year.

On a LFL basis³, the PEPCO business reported 9.6% LFL growth YTD, broadly in line with both historical LFL performance and full-year guidance, giving further confidence in the underlying trajectory of the business.

Trading remains strong in the new Western Europe territories of Italy and Spain, with Spain ahead of our internal plan and Italy returning to levels of revenue achieved before the lockdown restrictions were introduced in December 2020.

Poundland Group (FMCG-led price-anchored)

As an essential retailer, Poundland has been able to trade throughout the Covid crisis, albeit experiencing significantly reduced footfall in periods of the most significant restrictions. Similar to PEPCO, the third quarter of the previous financial year was the most impacted with peak store closures of 142 stores in April 2020. The strong current year LFL performance of 21.1% should be considered in this context with the YTD trading store LFL of 5.2%, which is a clear indication of the strengthened customer offer.

Poundland’s revenue reflected strong performances across recently extended categories in clothing and homewares and the introduction of a new frozen and chilled offer to 42 stores in the quarter (91 YTD). The extension of product ranges to price points above and below the £1 anchor price point continued with multi-price participation across all FMCG and general merchandise categories leading to an increase of 23% of revenue (FY20: 16%). Alongside its trading activities the Poundland business also saw the launch of its newly formed charitable foundation, winning the Retail Systems’ Partnerships for Good Award 2021 for its tie-up with fintech company, Pennies, to drive donations.

The Dealz business continues to develop positively, having built the necessary confidence in both the customer proposition and the business model economics to accelerate the store roll-out programme. In the quarter, 24 Dealz stores were opened, increasing the portfolio by 53% versus the year-end position to 147. Our intention remains to open up to 70 new stores in the full financial year.

Cash and Net Debt

The Group continues to be strongly cash generative and maintained all of its targeted growth investments across the quarter. Closing cash of €448m (FY20: €461m) and net debt5 of €169m (FY20: €295m) reflects continued underlying business growth and actions developed during 2020 with key suppliers that enhance the Group’s working capital cycle. The year-on-year lower cash position is driven by excess cash utilised to pay down debt as part of the IPO driven refinancing in May 2021.

Source : Pepco Group

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.