UK DIY News

Pepco Group Achieves Record Underlying Group EBITDA

- Strong H1 profit growth with tangible strategic progress

Pepco Group, the fast-growing pan-European variety discount retailer, today reports interim results for the six month period ended 31 March 2024.

KEY HIGHLIGHTS

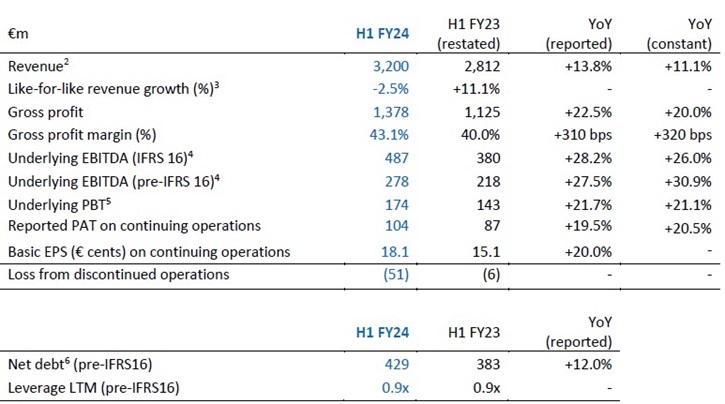

- Record H1 Group revenue of €3.2bn, up 13.8% year-on-year (“y-o-y”)

- Group gross margin up 310 basis points (“bps”) to 43.1%, driven by Pepco

- Record underlying Group EBITDA (IFRS16) of €487m up 28.2%, driven by Pepco EBITDA up 38.9%

- More measured store growth and disciplined capital investment

- Strong operating cash flow of €182m, an increase of €99m over the last year

- 289 net new stores opened in H1, of which 86 in Q2

- Group expects to deliver underlying full year FY24 EBITDA (IFRS 16) of around €900m (FY23: €753m)

FINANCIAL PERFORMANCE

Note: Austria is now classified as a discontinued operation following the Group’s exit of Pepco Austria. Therefore, all numbers above have been represented (including comparators) to exclude Austria.

- Group revenue of €3,200m, growing +13.8% y-o-y (+11.1% at constant currency)

- LFL revenue declined by 2.5% during H1 against a strong comparator (H1 FY23 LFL +11.1%)

o Pepco LFL -3.2%; Poundland LFL -0.7%; Dealz Poland -4.6% in H1

- Gross margin of 43.1% (H1 FY23: 40.0%), driven by strong recovery in Pepco (+480 bps y-o-y)

- Underlying EBITDA (IFRS16) of €487m up 28.2% y-o-y o Strong Pepco EBITDA growth of 38.9%; Poundland EBITDA down 6.5%; Dealz EBITDA up 100.0%

- Underlying PBT of €174m up 21.7% y-o-y

- Net debt at end of H1 FY24 was €429m (pre-IFRS16), representing 0.9x LTM EBITDA (pre-IFRS16) leverage 2

Commenting on the results, Andy Bond, Executive Chair of Pepco Group, said: “We are today reporting a solid Group performance for the first half, including record revenues and a significant uplift in gross margin, reflecting good progress against strategic priorities set out last autumn. The standout performer was Pepco’s Central and Eastern European business, the key engine driver for the Group. We have successfully rebuilt gross margin and store profitability in this region back towards pre-pandemic levels with further opportunities for improvement. This achievement underscores Pepco’s continuing and compelling customer offer across apparel and general merchandise at market-leading prices. Despite a positive FMCG contribution, Poundland’s performance was behind expectations due to challenges in implementing the significant range change to Pepco products, which we are addressing. Dealz Poland continued to make progress.

“Across the Group, we made significant strides in improving gross margin in H1, which increased by 310 basis points to 43.1%. This improvement was driven by enhanced product purchasing, as well as a more normalised environment for commodity prices, foreign exchange and freight cost versus the prior year, notwithstanding some impact from the situation in the Red Sea.

“We continued to expand our footprint across Europe, with 289 net new stores opening, primarily within our core high-growth CEE markets, focusing capital on openings that deliver the strongest returns. The robust performance delivered in the half reflects successful delivery against our strategy and a fantastic contribution from all colleagues across the Group, as we continue to build Europe’s leading variety discount retailer.

“Looking ahead, while consumer sentiment in some of our key markets remains challenging, we expect to deliver underlying EBITDA (IFRS16) for the full year in the region of €900 million, compared with €753 million in the previous year. We will also benefit from greater focus on disciplined capital investment, with an improvement in free cash flow generation expected in the full year. This financial strength positions us well to continue executing our growth strategy while maintaining a strong balance sheet.”

Source : Pepco Group

Image : Pepco / Morgengry Berlin

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.