Digital Retail News

Mobile POS Payment Market To Nearly Double By 2027

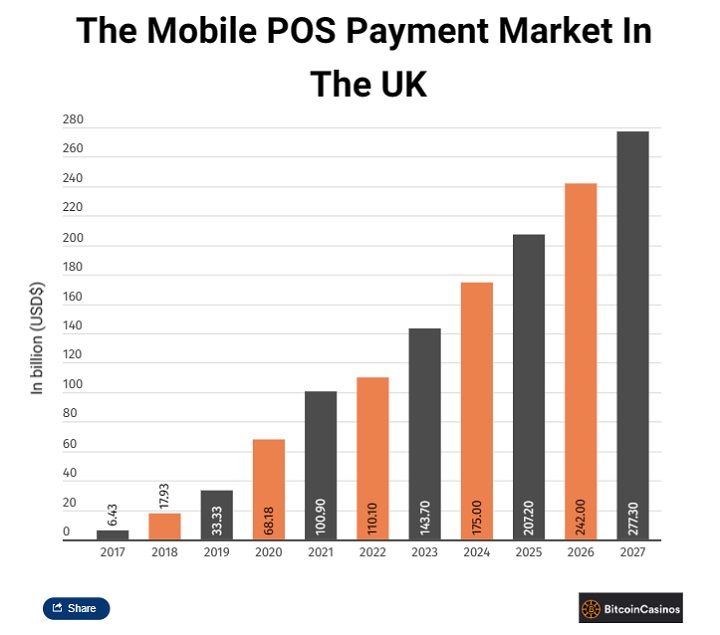

- Data forecasted by Statista & presented by BitcoinCasinos.com shows a 93% surge in the mobile POS payment market by 2027

Highlights from the data:

- Mobile POS payment market estimated to rise by 93% by 2027 in the UK

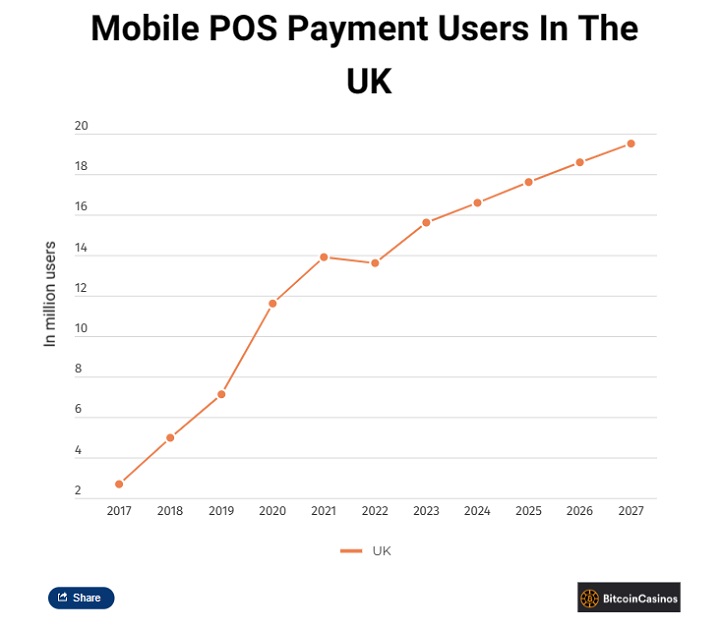

- 25% more people will use mobile POS payments by 2027

- Apple Pay leads brand shares with 40% stake

A mobile POS, or sometimes known as MPOS, is a point-of-sale system that uses a smartphone or tablet to act as a register and accept payments on the go.

These systems can accept frictionless payments such as contactless credit cards, digital wallets like Apple Pay, Google Play and Click to Play that use near field communication (NFC) technology.

They can also complete transactions with credit and debit cards with a magnetic stripe or EMV chip and QR codes.

The world is moving towards a cashless society and the transaction value of mobile POS payments is expected to increase further. Data sourced by Statista & presented by BitcoinCasinos.com found that POS payments have risen by 2,135% in the last six years (2017-2023).

Mobile POS Payment Market Estimated To Rise By 93% By 2027 In The UK

The mobile POS payment market is estimated to rise by 93% by 2027 in the United Kingdom.

The mobile POS payment market is estimated to rise by 93% by 2027 in the United Kingdom.

The data suggests that the market will surge in the coming years, sitting at $143.70 billion in 2023 and eventually rising to $277.30 billion in 2027.

25% More People Will Use Mobile POS Payments By 2027

25% more people are expected to use mobile POS payments by the year 2027 in the United Kingdom.

25% more people are expected to use mobile POS payments by the year 2027 in the United Kingdom.

In 2017, the number of users was just 2.7 million – which is a 478% increase to our present day in 2023 with over 15 and a half million users.

Apple Pay Leads Mobile POS Payment Brand Shares With 40% Dividend

Of all the key players in mobile payments, Apple Pay leads the way in payment brand shares with over 40%.

The latest available estimate on global Apple Pay users is that over 500 million people activated the service on their iPhones. Roughly one out of ten users are from the United States.

The service continues to gain popularity and attract more users every year with its convenience and execution.

Commentary

“The Mobile POS payment market has been experiencing significant growth in recent years.” says Nick Raffoul, Head of News at BitcoinCasinos. “One trend is the shift towards contactless payments, where customers can simply tap their mobile device or card to complete a transaction.

“This is due to the increasing demand for convenient and secure payment options, especially during the COVID-19 pandemic.

“Another trend is the integration of mobile POS systems with other business functions, such as inventory management and customer relationship management.

“Several factors are driving the growth of the mobile POS payment market.

“One key factor is the increasing penetration of smartphones and tablets, which are being used more frequently for both personal and business purposes.”

“Another factor is the growing adoption of cloud-based technology, which enables businesses to manage transactions and data more efficiently.

“Additionally, the rising popularity of e-commerce and online shopping is driving demand for mobile payment options.

“The Mobile POS market is expected to continue growing in the coming years.

“This growth is expected to be driven by factors such as increasing adoption of mobile payments, the rise of cloud-based solutions, and the growing demand for mobile POS systems among small and medium-sized businesses.”

Source : BitcoinCasinos

Image : PeopleImages / iStockphoto.com (1466394053)

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.