UK DIY News

LDC: Data Shows Independents More Resilient Than Chains

Research released today [4th November] by retail data consultancy the Local Data Company has revealed that the independent retail and leisure market was much more resilient than chains/multiples (brands with five or more stores) in H1 2020. The net change in the number of occupied units was less than a third (-1,833) of the figure for chains (-6,001).

64% of the retail and leisure market is comprised of independent businesses, therefore the scale of this variance is even greater in percentage terms with independent businesses declining by -0.54% compared to -2.77% for the chain units.

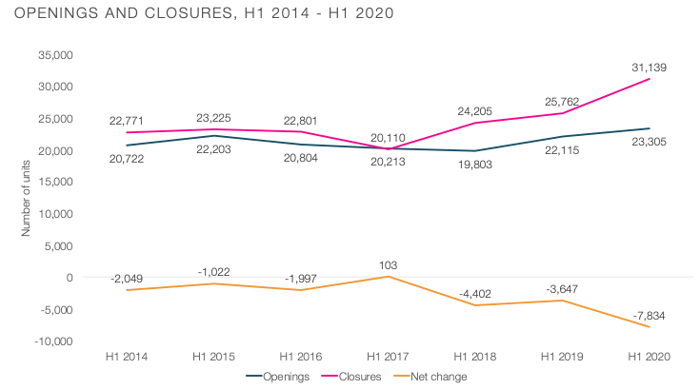

In total, the GB retail and leisure market declined by -7,834 units in the first half of the year, a 115% increase from the decline seen in H1 2019 (-3,647). Openings increased compared to H1 2019 at 23,305, up from 22,115. However, this was not enough to balance out the closures which increased by 5,377 compared to 2019 (31,139 closures). This equates to a 21% increase in the total number of closures as businesses struggled to survive in the face of the COVID-19 pandemic.

Figure 1: Openings, closures and net change in occupied stores for all GB retail and leisure units in H1 2020. (Source: Local Data Company)

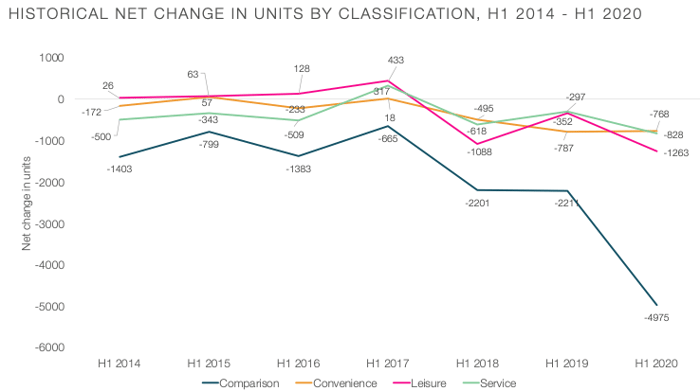

Comparison goods retail (selling physical goods such as fashion, footwear, books and homeware) accounted for 64% of all lost units in H1 2020 (net loss of -4,975 stores). This increased more than twofold from H1 2019 (net loss of -2,211 units). The loss in this type of retail store is the highest for any H1 period since 2014. This trend reflects the vast increase in online sales which had been rising steady since 2017 but jumped in April as a result of lockdown. Online sales were at 19.7% in August 2019 and peaked at 33.4% in May (Source: ONS).

The leisure and hospitality market declined by a net -1,263 units in H1 2020, up from -352 in H1 2019 - an increase of 259%. Challenges faced by the hospitality market have been well documented, with social distancing limiting customer numbers, enforced closures in Tier 3/lockdown areas, and the nationwide 10pm curfew creating additional challenges for these businesses.

Figure 2: Historical net change in units across GB by retail classification, H1 2014 – H1 2020. (Source: Local Data Company)

The only sector to see an improvement in net decline compared to the previous year was convenience (food retailers, off licences and convenience stores), with a net loss of -768 in H1 2020 compared to -787 in H1 2019. Grocery and convenience stores were classified as ‘essential’ during lockdown and therefore were able to remain trading. However, they faced their fair share of challenges, with stockpiling placing pressure on supply chains and an overwhelming surge in demand for delivery services.

COMMENTARY FROM LUCY STAINTON, HEAD OF RETAIL AND STRATEGIC PARTNERSHIPS AT THE LOCAL DATA COMPANY:

“The latest figures on the GB retail and leisure market tell the story of an immensely challenging few months for the retail and hospitality sector.. While the independent market has fared much better than chains, it is still in decline and combined, these two sectors total the biggest decline seen in a H1 period since our records began.

The independent market has fared better as these businesses have been able to be more agile, bringing in new product lines and offering food deliveries; have a smaller cost base to cover during periods of little or no trade and have been able to take advantage of government support schemes. However, as we continue through the year with various local lockdowns and restrictions, life will not get any easier for operators. These figures mark only the first phase in the impact of the pandemic on the retail economy this year with 20% of the market is still temporarily shut and with more months of difficult trading conditions ahead.

This being said, we still absolutely believe in the validity and relevance of physical retailing. Whilst there is no denying the impact of the pandemic on these sectors, this likely represents the inevitable structural change required albeit more painful as a result of the velocity and abruptness. With independents adapting well, new entrants still acquiring stores and sectors such as personal grooming continuing to thrive, there is no doubt we will eventually get to a more condensed though diverse and exciting retail and hospitality landscape as businesses and places acclimatise.”

Source : Local Data Company

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.