International DIY News

Kingfisher's 'Other International' Division Reports Growth

Kingfisher has published final results for the year ended 31st January 2022.

± Kingfisher’s subsidiary in Romania historically prepared its financial statements to 31 December. In the prior year (FY 21/22), Romania migrated to Kingfisher’s financial reporting calendar (year ended 31 January). Its sales and retail loss presented in FY 21/22 therefore included one additional month of results (January 2022) in order to facilitate the alignment to Kingfisher’s financial reporting calendar. Reported and constant currency variances for Romania’s total sales and retail loss are for February 2022 to January 2023 (compared against January 2021 to January 2022), whilst LFL and 3-year LFL sales growth compares equivalent periods in the current and prior years. ±± ‘Other’ consists of the consolidated results of Screwfix International, NeedHelp, and results from franchise agreements.

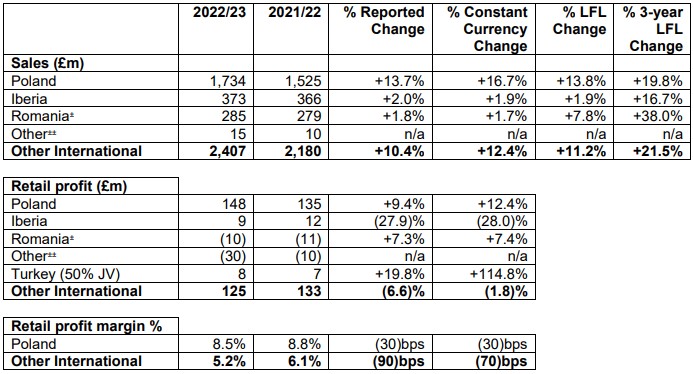

Other International total sales increased by 12.4% (LFL +11.2%) to £2,407m, with 3-year LFL sales up 21.5%, driven by growth in all key geographies. Retail profit decreased by 1.8% to £125m (FY 21/22: £133m; FY 19/20: £123m; at reported rates), largely due to an increase in losses incurred in ‘Other’ operations, driven by investment in Screwfix France, and a lower retail profit in Iberia. This was 29 substantially offset by higher retail profit in Poland. The retail profit margin % decreased by 70 basis points to 5.2% (FY 21/22: 6.1%; FY 19/20: 5.3%).

Poland total sales increased by 16.7% (LFL +13.8%) to £1,734m, against a prior year comparative impacted in Q1 by the COVID-related temporary closure of all Castorama stores (between 27 March and 3 May 2021). Notwithstanding this, Castorama continued to attract new customers and achieved strong market share gains in FY 22/23 by leveraging its leading market position and competitive pricing, supported by robust sales of DIY and DIFM/trade categories.

On a YoY basis, nearly all categories achieved double-digit LFL sales growth, with a standout performance in the kitchen category where its new OEB kitchen ranges delivered over 40% LFL sales growth. 3-year LFL sales for the year were up 19.8%. The business achieved good growth across all categories on a 3-year basis, in particular its building & joinery, outdoor, EPHC and kitchen categories. LFL sales of weather-related categories increased by 20% (increase of 34% on a 3-year LFL basis), while LFL sales of non-weather-related categories, including showroom, increased by 13% (increase of 18% on a 3-year LFL basis).

Castorama’s e-commerce sales increased by 2% YoY, with growth of +11% in H2. Castorama’s e-commerce sales were up 285% on a 3-year basis, with e-commerce sales penetration of 5% (FY 21/22: 5%; FY 19/20: 2%). Gross margin % decreased by 30 basis points, largely reflecting ‘normalised’ promotional activity versus the prior year. Retail profit increased by 12.4% to £148m (FY 21/22: £135m; FY 19/20: £151m; at reported rates) with growth in gross profit partially offset by an increase in operating costs. Operating costs increased by 16.8%, reflecting staff and operating cost inflation including higher energy costs, space growth and new store opening costs, and higher marketing costs. The increase in operating costs was partially offset by cost reductions achieved by our strategic cost reduction programme. Retail profit margin % decreased by 30 basis points to 8.5% (FY 21/22: 8.8%; FY 19/20: 10.4%). Space growth contributed c.3% to total sales. Castorama opened seven new stores in FY 22/23, including three big-boxes and four compact stores, bringing its total to 97 stores in Poland.

Iberia total sales increased by 1.9% (LFL +1.9%) to £373m, reflecting resilient sales against strong prior year comparatives. The business achieved good YoY growth in its EPHC, building & joinery and kitchen categories. 3-year LFL sales for the year were up 16.7%, with strong performances in building & joinery and outdoor, both up by c.30%. Retail profit decreased to £9m (FY 21/22: £12m; FY 19/20: £2m; at reported rates), reflecting a lower gross margin % and an increase in operating costs of 1.2%.

Romania total sales increased by 1.7% to £285m, despite the inclusion of one additional month of sales in the prior year comparative and the impact of COVID-related trading restrictions earlier in the year (lifted in March 2022). On an LFL basis sales growth was +7.8%, reflecting strong YoY performances in the outdoor, surfaces & décor and kitchen categories. 3-year LFL sales for the year were up 38.0%. Growth in gross profit was partially offset by an increase in operating costs of 7.1%, mainly driven by staff costs and operating cost inflation including higher energy costs. As a result, the business reduced its retail loss by 7.4% to £10m (FY 21/22: £11m reported retail loss; FY 19/20: £23m reported retail loss). On a comparable basis, excluding losses incurred in the month of January 2021, Romania’s retail loss increased by 6.8% YoY.

In Turkey, Kingfisher’s 50% joint venture, Koçtaş, continued to grow successfully against a challenging macroeconomic backdrop. The business contributed £8m of retail profit in the year (FY 21/22: £7m; FY 19/20 £9m; at reported rates). The business opened 129 mostly compact stores in their financial year to 31 December 2022, bringing its total store count to 355.

‘Other’ consists of the consolidated results of Screwfix International, NeedHelp, and franchise agreements. Due to these businesses being in their early investment phase, a combined retail loss of £30m (FY 21/22: £10m reported retail loss) was recorded, largely driven by Screwfix France as the business invested in the opening of its first distribution centre and stores. As noted in the UK & Ireland commentary above, Screwfix opened its first five stores in France following encouraging results as a pure-play only operator. During the year, we also opened two franchise stores under the B&Q banner in the Middle East. The stores and support office functions are fully operated and staffed by the Al-Futtaim Group.

Source : Kingfisher PLC

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.