UK DIY News

Kingfisher UK & Ireland: Screwfix Sees Robust Demand From Trade Customers

Kingfisher has published unaudited half year results for the six months ended 31 July 2024.

For International performance, click here

For Group performance, click here

UK & IRELAND

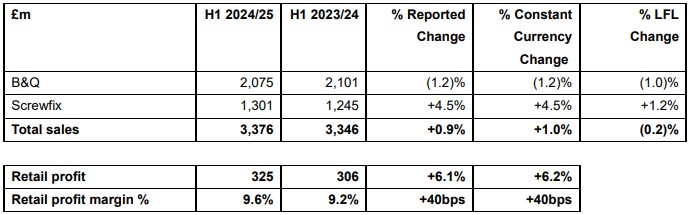

UK & Ireland sales increased by 1.0% (LFL -0.2%) to £3,376m, supported by strong e-commerce performance and our progress in addressing trade customer needs. Core categories (68% of sales) achieved positive LFL sales growth, up 1.4%, with resilient underlying volume trends driven by repairs, maintenance and existing home renovation activity. Sales of seasonal categories (slightly down YoY) were impacted by unfavourable weather patterns from April to June, before recovering in July. As expected, sales in 'big-ticket' categories (i.e., kitchen and bathroom & storage) remained weak. Overall, B&Q, TradePoint and Screwfix all grew faster than their respective markets in H1 (as measured by BRC, Barclays and GfK). Gross margin % increased by 50 basis points, reflecting effective management of product costs, retail prices and supplier negotiations, and a favourable sales mix within Screwfix.

Retail profit increased by 6.2% to £325m (H1 23/24: £306m, at reported rates), reflecting higher gross profit, partially offset by slightly higher operating costs* (up 1.0%, net of c.£25m of one-off business rates refunds at B&Q related to prior years). Excluding business rates refunds at B&Q, operating cost increases were driven by YoY increases in staff costs and higher costs associated with 54 net new store openings (YoY). Cost increases were partially offset by structural savings achieved by our cost reduction programme. Retail profit margin % increased by 40 basis points to 9.6% (H1 23/24: 9.2%).

B&Q total sales decreased by 1.2% (LFL -1.0%) to £2,075m, with positive LFL sales growth in core categories and resilient seasonal sales more than offset by weakness in 'big-ticket'. Underlying sales trends (i.e., excluding calendar and leap year impacts) in core and 'big-ticket' categories were consistent across Q1 and Q2, while sales of seasonal categories slowed (Q2 -2.4% vs Q1 +2.7%). Within our core and seasonal categories, we achieved positive LFL sales growth in building & joinery, tools & hardware, surfaces & décor and outdoor, partially offset by weather-related weakness in EPHC (electricals, plumbing, heating & cooling). B&Q's total e-commerce sales increased by 18.3% YoY, driven by the continued strong performance of B&Q's marketplace which reached an online sales penetration of 41% in Q2 (i.e., B&Q's marketplace gross sales* divided by B&Q's total ecommerce sales). B&Q's e-commerce sales penetration moved up to 14% (H1 23/24: 12%; H1 19/20: 5%). The business closed one big-box and one medium-box (small retail park) store in H1 following the expiry of their respective leases. As of 31 July, B&Q had a total of 309 stores in the UK & Ireland.

B&Q's trade-focused banner, TradePoint, delivered a strong performance driven by demand in the DIFM and trade customer segment. LFL sales for TradePoint were up 7.1%, with penetration of B&Q sales up by two percentage points to 22% (H1 23/24: 20%). This was supported by strong performances in its surfaces & décor and building & joinery categories. Sales of 'big-ticket' categories to trade customers were resilient, particularly in bathroom & storage, outperforming the rest of B&Q. TradePoint's loyalty programme continues to resonate with tradespeople, with new sign ups increasing by 22% YoY, and the business remains focused on strengthening relationships with its customers through further investment in dedicated sales partners, now present in 44 stores and driving a clear uplift in sales. TradePoint is present in 208 stores within the B&Q network (67% of stores).

Screwfix total sales increased by 4.5% (LFL +1.2%) to £1,301m, reflecting robust demand from trade customers. In particular, the business achieved good LFL sales growth in its tools & hardware, building & joinery and outdoor categories. In Q2, Screwfix delivered a resilient performance against tougher prior year comparatives (LFL +0.1% vs Q2 23/24 +5.6%), driven by positive LFL sales of core categories. Screwfix's e-commerce sales increased by 4.5% YoY, with e-commerce sales penetration of 59% (H1 23/24: 58%; H1 19/20: 32%). This was supported by several app-exclusive campaigns in the period, and the extension of its Screwfix Sprint proposition to an additional 100 stores (i.e., one-hour home delivery now available in over 430 stores, covering c.53% of UK postcodes). Overall, the business gained significant market share in H1.

Space growth and acquisitions contributed c.3% to total Screwfix sales. Screwfix opened 16 new stores - 15 in the UK (including two 'Screwfix City' ultra-compact format stores) and one in Ireland - bringing its total to 938 as of 31 July. The business continues to plan for up to 40 new stores in the UK & Ireland in FY 24/25, and remains on track to reach its medium-term goal of over 1,000 stores. Screwfix Spares continues to perform in line with expectations, and contributed c.1.0% to total Screwfix sales growth.

Further progressing its international expansion plans, Screwfix opened five stores in France in H1, with 25 stores in total as of 31 July.

Expansion Plans

B&Q

- We believe there are approximately 50 catchments or geographic 'white spaces' in the UK where B&Q is currently under-represented

- Following various tests and adaptations over the last three years, B&Q has now fully validated its retail park format. After being initially tested as a 'small retail park' compact store format, the validated format is between 2,000-4,000 sqm, enabling more area in store to be dedicated to inspiration (for example, for kitchen, bathroom & storage), garden centres and addressing the needs of trade customers. B&Q currently has 13 retail park stores, and plans to open one more in H2 and up to four further stores in FY 25/26

- We also currently have 11 'B&Q Local' stores in UK high streets, including our first 'B&Q Local' outside of London which opened in August. Work is being undertaken to optimise the format, including marketing support to drive customer awareness and adding additional services requested by customers such as 'big-ticket' project design via a remote access hub

TradePoint

- B&Q's trade-focused banner, TradePoint, has 208 trade counters (i.e., within 67% of B&Q's stores)

- In H1 the business updated 13 of its older trade counters by converting storage rooms to customer-accessible areas, allowing customers to see more products

- TradePoint continued to test solutions to increase TradePoint's penetration into smaller stores; for example by installing TradePoint signage at payment tills and creating smaller dedicated TradePoint areas with trade ranges.

Screwfix - UK & Ireland

- Opened 16 stores in H1, including 15 in the UK and one in the Republic of Ireland, further strengthening Screwfix's position as the UK's number one light trade retailer, and bringing the total number of stores in both countries to 938 as of 31 July

- On track to open 40 new stores in the UK & Ireland in FY 24/25, with a medium-term goal of over 1,000 stores

- This includes its ultra-compact format 'Screwfix City' stores, with nine such stores currently in operation. The business aims to open up to 100 of these formats over the next few years.

Source : Kingfisher plc

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.