International DIY News

Kingfisher France: LFL Sales Fall 1.2%

Kingfisher has published final results for the year ended 31st January 2022.

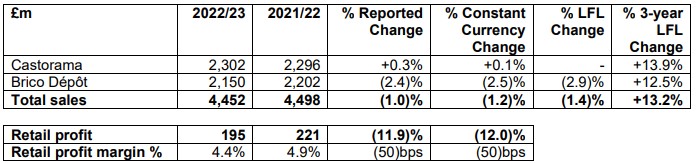

Kingfisher France sales decreased by 1.2% (LFL -1.4%) to £4,452m, against strong prior year comparatives in H1. In H2, total sales increased by 0.5% (LFL +0.5%). A resilient sales performance in DIY categories was outpaced by sales from DIFM/trade categories. 3-year LFL sales for the year were up 13.2%. The 3-year sales trend slowed to +10.9% in Q4 (versus +14.6% in Q3) due to a significantly stronger 3-year comparative in Q4 19/20 relative to the first nine months of FY 19/20. France LFL sales in Q4 19/20 were over eight percentage points higher than the first nine months of FY 19/20.

Castorama and Brico Dépôt continued to focus on strengthening their respective competitive positions in the market through improving their digital capabilities, product ranges and overall customer proposition, resulting in higher store and online NPS scores. Gross margin % decreased by 30 basis points, largely reflecting category mix impacts.

In H2, we completed our work to optimise distribution centre space in France, resulting in a cumulative reduction of c.27% in square metres versus two years ago. Retail profit decreased by 12.0% to £195m (FY 21/22: £221m; FY 19/20: £164m; at reported rates), with lower gross profit partially offset by lower operating costs. Operating costs decreased by 0.6% due to lower staff costs and cost reductions achieved by our strategic cost reduction programme, substantially offset by operating cost inflation including increases in pay rates and significantly higher energy costs. Retail profit margin % decreased by 50 basis points to 4.4% (FY 21/22: 4.9%; FY 19/20: 4.0%).

Castorama total sales increased by 0.1% (LFL flat) to £2,302m, reflecting resilient sales despite strong prior year comparatives in H1. Sales trends improved in H2 (LFL +0.7%) with positive LFL growth in the EPHC and building & joinery categories supported by energy efficiency and trade/renovation activity. 3- year LFL sales for the year were up 13.9%. The business achieved growth across all categories on a 3- year basis, with particularly strong performances in the outdoor and building & joinery categories, both up by c.30%. LFL sales of weather-related categories were broadly flat (increase of 24% on a 3-year LFL basis), while LFL sales of non-weather-related categories, including showroom, were also flat (increase of 11% on a 3-year LFL basis). Castorama’s e-commerce sales decreased by 19% YoY, largely reflecting strong online trading in the first half of the prior year. In H2, e-commerce sales increased by 27% YoY. Castorama’s e-commerce sales were up 240% on a 3-year basis, with e-commerce sales penetration of 5% (FY 21/22: 6%; FY 19/20: 2%). Castorama opened two new stores in FY 22/23; its first high street compact store tests in Paris. As of 31 January 2023, Castorama had a total of 95 stores in France.

Brico Dépôt total sales decreased by 2.5% (LFL -2.9%) to £2,150m, again reflecting resilient sales levels against strong prior year comparatives in H1. Sales trends improved in H2 (LFL +0.2%) with positive LFL growth in the EPHC, building & joinery and kitchen. 3-year LFL sales for the year were up 12.5%. The business achieved strong growth across its outdoor, building & joinery and EPHC categories on a 3-year basis. Brico Dépôt continues to strengthen its discounter credentials through further differentiating its ranges and maintaining a strong price index relative to its home improvement peers. Brico Dépôt’s ecommerce sales decreased by 20% YoY, again reflecting strong online trading in the prior year. In H2, ecommerce sales increased by 7% YoY. Brico Dépôt’s e-commerce sales were up 133% on a 3-year basis, with e-commerce sales penetration of 4% (FY 21/22: 5%; FY 19/20: 2%). In FY 23/24, Brico Dépôt France will test its first ever compact store – a 1,000 sqm format.

Source : Kingfisher PLC

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.