UK DIY News

John Lewis Partnership reveals unaudited results and cuts staff bonus

John Lewis has published unaudited results for the 52 weeks ended 28th January 2017.

Key points

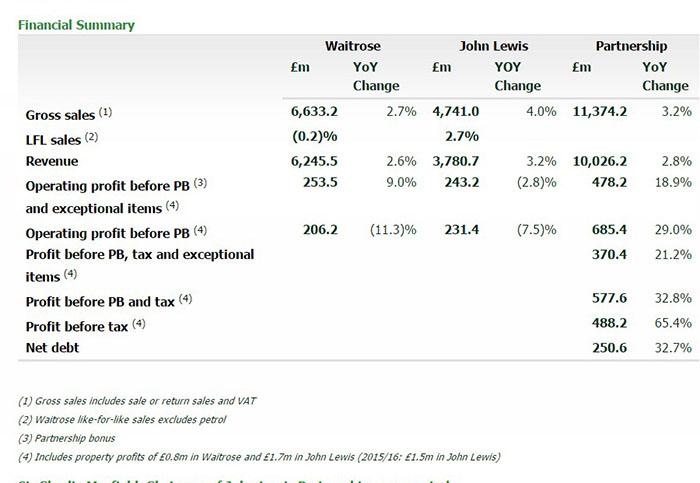

- Gross sales up 3.2% with increased market shares(5) for both brands and rising customer numbers

- Profit before Partnership Bonus, tax and exceptional items up 21.2% to £370.4m

- Exceptional income of £207.2m mainly includes £270.0m income for a reduction in pension liabilities, offset by a £42.9m charge for write down of property and other assets, and related costs, and £20.7m charge for restructuring and redundancy costs (2015/16: income of £129.3m following the sale of the Clearings building).

- Stronger balance sheet, with net debt 32.7% (£121.9m) lower than January 2016 at £250.6m

- Accounting pension deficit expected to be approximately £1bn at January 2017, higher than the £940m deficit at January 2016. However, we have made good progress and our actuarial pension deficit at 31 March 2016 was nearly half the deficit at the 31 March 2013 valuation

- Pension accounting charges decreased by £64.7m, mainly due to the impact in the year of changes to our pension scheme agreed in 2015, and lower accounting charges as a result of an improvement in the real discount rate used to determine the cost at the beginning of the year compared to the beginning of the previous year

- Partnership Bonus of £89.4m; 6% of salary (equivalent to more than 3 weeks’ pay for Partners with us for the whole year)

Sir Charlie Mayfield, Chairman of John Lewis Partnership, commented:

'Waitrose and John Lewis have achieved growth in sales and market share, and our profits before exceptionals are up 21.2%. A large part of this profit increase was due to lower pension accounting charges. After excluding these and our long leave accounting charges, our profits before exceptionals increased by 1.9% in spite of trading pressures and investment in pay.

There are also a number of exceptional items in our results this year, which reflect the steps we are taking to adapt the Partnership for the future. After including these exceptional items, the operating profit in both Waitrose and John Lewis was below last year.

In January, we said Partnership Bonus was likely to be significantly lower this year. The Board has awarded a Bonus of 6%, which is equivalent to more than 3 weeks’ pay. Bonus is lower because the Board has decided to retain more of our annual profits in order to strengthen our balance sheet. This allows us to maintain our level of investment in the face of what we expect to be an increasingly uncertain market this year, while absorbing the costs associated with adapting the Partnership for the future.

We have also continued to put more money into pay. During the year, the average pay rates for our non-management Partners rose 5.0%.

This reflects our determination to create better jobs for better performing Partners on better pay, which is one of three elements to our strategy. As a part of that we are changing the nature and shape of roles within the Partnership and we have made a number of announcements to that effect this year. We will also be accelerating investment in innovation for customers across Waitrose and John Lewis. For example, from May we will begin rolling out technology to ensure Partners have access to more information at their fingertips to enhance service delivery and, in Waitrose, 2017 will see a significant investment in existing shops.'

Source : John Lewis Partnership

www.johnlewispartnership.co.uk

Interested in advertising on Insight DIY? Learn more here.

Want more John Lewis Partnership news? Sign-up for our weekly newsletter here.

If your business is interested in pricing intelligence or you're currently trying to track retail prices manually, there really is a much easier way. Just contact us here.

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.