International DIY News

International Sales Decline At Kingfisher

Kingfisher plc has published unaudited half year results for the six months ended 31 July 2023.

For Group and UK & Ireland results, click here

FRANCE

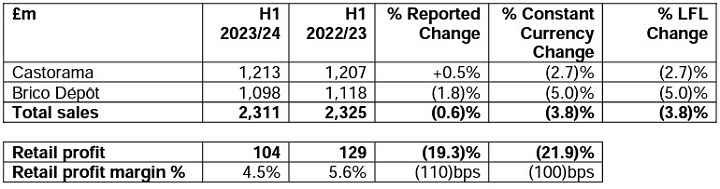

Kingfisher France sales decreased by 3.8% (LFL -3.8%) to £2,311m, with trading impacted by a challenging consumer environment and unseasonal weather conditions throughout the half. In Q1, national strike action caused lower direct footfall into several Brico Dépôt store locations, with the weather affecting the performance of seasonal categories. The LFL sales trend improved slightly in Q2 (LFL -3.5% vs Q1 -4.1%), with a small uplift in seasonal category sales. Encouragingly, core and ‘big-ticket’ category sales performed well throughout the half, particularly at Castorama. Gross margin % decreased by 30 basis points, largely reflecting the higher weighting of sales towards special promotions (‘arrivages’) at Brico Dépôt, and higher clearance costs.

Retail profit decreased by 21.9% to £104m (H1 22/23: £129m, at reported rates), with lower gross profit somewhat offset by lower operating costs. Operating costs decreased by 1.5% due to the flexing of variable costs, and reductions achieved by our strategic cost reduction programme. This was substantially offset by cost inflation, including YoY increases in pay rates and energy costs, together with higher technology spend. Retail profit margin % decreased by 100 basis points to 4.5% (H1 22/23: 5.6%, at reported rates).

Castorama total sales decreased by 2.7% (LFL -2.7%) to £1,213m, a resilient performance against a challenging consumer backdrop. Sales trends improved in Q2 (LFL -2.3% vs Q1 -3.1%), largely driven by improvements in core and ‘big-ticket’ category sales, with positive LFL growth in surfaces & décor, building & joinery and tools & hardware. Seasonal sales improved slightly in Q2 but continued to be impacted by the weather. In H1, Castorama improved its online customer journey and further extended its customer offer, leading to an improvement in both store and online NPS scores. Castorama’s ecommerce sales increased by 6.9% YoY, with e-commerce sales penetration of 6% (H1 22/23: 5%; H1 19/20: 2%). As of 31 July 2023, Castorama had a total of 95 stores in France.

Brico Dépôt total sales decreased by 5.0% (LFL -5.0%) to £1,098m, a weaker performance relative to Castorama. Overall sales trends in Q2 were similar to Q1 (LFL -4.8% vs Q1 -5.2%), with a small improvement in seasonal category sales due to the weather. In Q2, performance was impacted by a reallocation of a portion of its marketing budget to digital, which proved unsuccessful and has been corrected since mid-July. The business also saw lower cross-selling from its special promotions (or ‘arrivages’). In H1, Brico Dépôt launched trade proposition trials in 24 stores, including a 2% cashback offer for trade customers, and implemented changes to its website which enabled a 30% improvement in its speed and page-load times. Brico Dépôt’s e-commerce sales increased by 20.2% YoY, the fastest ecommerce sales growth rate of all banners in the Group. E-commerce penetration reached 5% (H1 22/23: 4%; H1 19/20: 2%). During the half, the business also opened its first ever compact store – an innovative 1,000 sqm format. As of 31 July 2023, Brico Dépôt had a total of 124 stores in France.

OTHER INTERNATIONAL

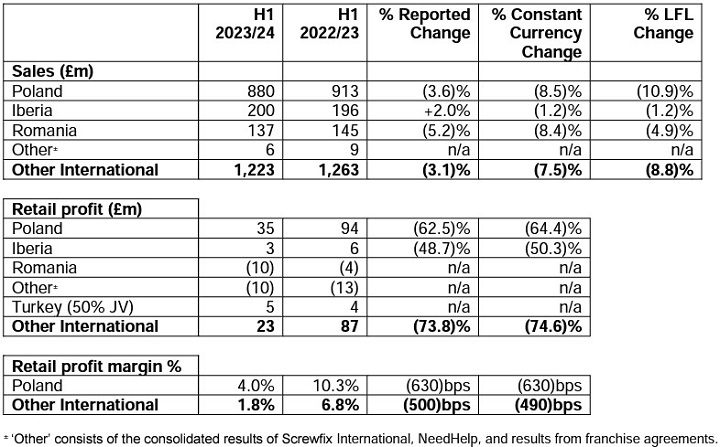

Other International total sales decreased by 7.5% (LFL -8.8%) to £1,223m, reflecting tough prior year comparatives across all geographies (H1 22/23 LFL +19.5%). Retail profit decreased by 74.6% to £23m (H1 22/23: £87m, at reported rates), largely reflecting the retail profit decline in Poland. Retail profit margin % decreased by 490 basis points to 1.8% (H1 22/23: 6.8%, at reported rates).

Poland total sales decreased by 8.5% (LFL -10.9%) to £880m, against strong prior year comparatives (H1 22/23 LFL +25.9%) and a challenging trading environment. Overall sales trends in Q2 were similar to Q1 (LFL -11.5% vs Q1 -10.3%), with ongoing macroeconomic challenges in the country leading to a deterioration in consumer sentiment and lower than expected market growth. On a two-year basis, Castorama’s sales grew faster than the market (as measured by GfK). Performance was weak across both core and ‘big-ticket’ and seasonal categories, with sales from the DIY customer segment outpacing DIFM and trade. Space growth contributed c.2% to total Poland sales. In H1, Castorama opened one medium-box store, bringing its total to 98 stores in Poland as of 31 July 2023.

In line with the business’ longer-term objectives, Castorama continued to develop its trade proposition, launching tests for ‘CastoPro’ zones in three of its stores, providing a dedicated space to bring together key trade ranges and serve trade customers. Castorama’s e-commerce sales decreased by 33.8% YoY, following some temporary disruption arising from the implementation of its new digital technology stack in Q2. E-commerce sales penetration was 4% (H1 22/23: 5%; H1 19/20: 2%).

Gross margin % decreased by 170 basis points, largely reflecting higher customer participation in promotional activity, higher clearance, and sales mix. Retail profit decreased by 64.4% to £35m (H1 22/23: £94m, at reported rates) due to a lower gross profit and an increase in operating costs. Operating costs increased by 9.3%, driven by cost inflation (including YoY increases in pay rates and energy costs), higher technology spend, higher costs associated with five new store openings (YoY), and charges related to ineffective foreign exchange hedges. Increases were partially offset through reductions achieved by our strategic cost reduction programme. Retail profit margin % decreased by 630 basis points to 4.0% (H1 22/23: 10.3%, at reported rates).

As a result of our performance in H1 and the trading environment in the country, we are proactively managing our operating costs. In H2, the business will strengthen actions around its cost base, including further flexing staffing levels, lowering discretionary spend, and rephasing certain investments including opening fewer stores than previously planned (now planning for a total of five new stores in FY 23/24, versus seven previously). The business continues to target up to 80 medium-box and compact store openings over the next five years.

Iberia total sales decreased by 1.2% (LFL -1.2%) to £200m, reflecting a resilient performance against good prior year comparatives (H1 22/23 LFL +2.3%) and the impact of unseasonal weather on seasonal category sales in Q2. Core and ‘big-ticket’ sales were +0.2% for the half. The business achieved good YoY growth in its building & joinery, EPHC and kitchen categories. Retail profit decreased to £3m (H1 22/23: £6m, at reported rates), reflecting lower sales and gross margin %, with slightly higher operating costs, up 1.7% YoY.

Romania total sales decreased by 8.4% to £137m (LFL -4.9%), reflecting strong prior year comparatives (H1 22/23 LFL +8.9%). Sales trends improved in Q2 (LFL -2.7% vs Q1 -7.8%), largely driven by an improvement in its core and ‘big-ticket’ category sales, with positive LFL growth in EPHC and tools & hardware. Romania’s retail loss increased to £10m (H1 22/23: £4m reported retail loss), primarily reflecting lower sales and gross margin %. Operating costs increased by 1.0%, with cost inflation largely offset by our strategic cost reduction initiatives including reduced energy usage in stores.

In Turkey, Kingfisher’s 50% joint venture, Koçtaş, contributed £5m of retail profit (H1 22/23: £4m, at reported rates). The business opened 42 mostly compact stores in their financial half-year to 30 June 2023, bringing its total store count to 397. ‘Other’ consists of the consolidated results of Screwfix International, NeedHelp, and franchise agreements. Due to these businesses being in their early investment phase, a combined retail loss of £10m (H1 22/23: £13m reported retail loss) was recorded, largely driven by Screwfix France as the business invested in the opening of new stores. As noted in the UK & Ireland commentary above, Screwfix has a total of nine stores in operation in France as of 31 July 2023, having opened four in H1. The business will also launch as a pure-play online retailer in several European countries, later in Q3. Following extensive testing and review, our two B&Q franchise stores in Saudi Arabia will close by early 2024, and we will re-focus efforts on wholesale and franchise agreements in other markets. We currently have two wholesale agreements in place with the Al-Futtaim Group in the Middle East, whereby certain OEB products are supplied to its retailers.

Source : Kingfisher plc

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.