UK DIY News

Homewares And Furniture Boost Q3 Sales At Dunelm

- Strong sales and gross margin; on track to deliver FY PBT in line with consensus

Dunelm Group plc (“Dunelm” or “the Group”), the UK’s leading homewares retailer, updates on trading for the 13-week period ended 29 March 2025.

| Q3 | Year-to-date | ||

| FY25 | YoY | FY25 | YoY |

Total sales | £462m | +6.3% | £1,356m | +3.7% |

Digital % total sales1 | 41% | +4ppts | 39% | +3ppts |

1 Digital includes home delivery, Click & Collect orders, and tablet-based sales in store

Highlights

- Strong sales growth of 6.3% to £462m with broad-based growth across our homewares and furniture categories

- Digital participation up 4ppts to 41%

- Gross margin up 30bps year-on-year, with full-year guidance unchanged at 51.5% – 52.0%

- Continued strategic progress including further product elevation and the opening of our 200th store

- PBT for FY25 expected to be in line with consensus2

2 Company compiled consensus average of analysts’ expectations for FY25 PBT is £208m, with a range of £204m to £214m

Strong sales growth across our categories

We are pleased to report strong sales growth of 6.3% to £462m in the third quarter. Our sales and volume growth was broad-based across our categories, and we saw a good start to our new Spring / Summer ranges, as well as a successful Winter Sale at the beginning of the period. Furniture categories again performed particularly well, as our extended ranges and bolder designs resonated with customers. Alongside this, we continued to grow our core textile-focussed categories, from pillows to rugs, reflecting the ongoing work we are doing to elevate our products, offering quality at all price points.

Digital participation was up 4ppts year-on-year to 41%, as we have continued to optimise the online customer experience, with AI-powered search and recommendations improving relevance and conversion. Performance was also driven by strong Click & Collect sales, which again grew significantly in the quarter, benefiting from extended ranges and further optimisation of our fulfilment channels, with smaller items of furniture now available.

Gross margin

Gross margin improved by 30bps year-on-year. We continue to exercise operational grip on input costs and with prices held broadly stable, customers continue to find great value in our ranges at all price / quality tiers. Our full-year gross margin guidance is unchanged, at between 51.5% and 52.0%.

Strategic and operational update

We have made further progress with our strategic priorities, which frame our approach to sustainable, long-term growth, and build on our unique and specialist proposition as the Home of Homes.

Our elevated product offering continues to inspire customers, with our new Sophie Robinson collaboration offering bolder, more colourful options giving customers new ideas on how to create a maximalist look across their home. Reflecting the relatively warm spring so far, the performance of our Summer Living ranges has been encouraging, as customers get their gardens ready for summer.

We are continuing to connect with more customers, increasingly using data and insight to drive decision-making across the business, from enhancing our digital customer experience to expanding our store portfolio. In the quarter, we opened two new stores: a larger superstore in Merthyr Tydfil and a smaller superstore in Bracknell, and we relocated our Peterborough superstore to an improved site after the period end. The total estate now comprises 200 stores, and whilst this is a notable milestone, we continue to seek out new opportunities to bring Dunelm to more customers. We are on track with our plans to open five new superstores in the full year (including one relocation).

We have also completed a freehold acquisition in Kingston upon Thames, a key target area of ‘white space’, which we expect to open as a Dunelm store in FY26. As guided at our interim results in February, as a result of this acquisition we now expect capex for the year to be between £60m and £70m.

Maintaining our focus on harnessing our operational capabilities, we have also started the rollout of self-service tills across the estate, including in all of our new superstores, and with plans to install in over 100 stores by the end of FY26.

Summary and outlook

We delivered a strong sales performance in the third quarter, in terms of both quantity and quality. At the same time, we have continued to offer outstanding value to our customers, increasing volumes and gross margin year-on-year, with growth across our categories. We expect to deliver PBT for FY25 in line with consensus3.

We are pleased that our own performance and that of the wider market has been stronger in Q3 than we saw in the first half, however it is too early to say whether or not we are seeing an improved trend. We are also mindful of increased levels of uncertainty and volatility in the current environment, and the known labour cost headwinds. We remain confident in our plans and the strategic progress we are making, and are on track to achieve our milestone of 10% market share in the medium term.

3 Company compiled consensus average of analysts’ expectations for FY25 PBT is £208m, with a range of £204m to £214m

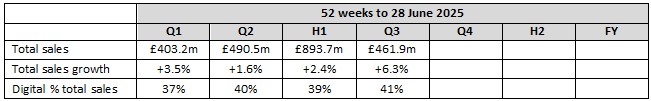

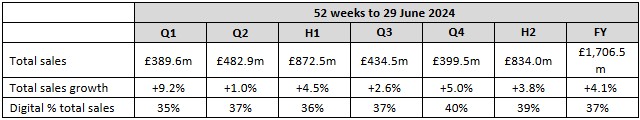

Quarterly analysis

Nick Wilkinson, Chief Executive Officer, commented:

“We’ve had a good third quarter, with strong growth and further strategic progress. The Dunelm brand continues to attract a broad range of customers, offering outstanding value and quality, and we’re really pleased with how our new ranges are being received.

“We remain committed to driving market share gains through growth across all our channels. March saw the opening of Dunelm’s 200th store in Merthyr Tydfil, an exciting milestone, and we continue to see new opportunities, filling ‘white space’ in our physical estate through a variety of store formats. At the same time, we’re improving customers’ digital experience, including through Click & Collect, which has continued to gain momentum.

“Our customers are now enjoying getting their homes and gardens ready for summer and we’re focused on being as relevant as possible for the warmer months ahead. We remain very mindful of the wider backdrop and the impact of increased uncertainty on consumer sentiment, but maintain our focus on strengthening Dunelm’s position as The Home of Homes.”

Source : Dunelm

Image : Imran Khan's Photography / shutterstock / 282750725

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.