UK DIY News

Headlam Notes Transformation Plan Progress As Sales Fall

- Significant progress on transformation plan; challenging market conditions impacted profitability in the short-term; strong balance sheet

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, today announces its full year results in respect of the year ended 31 December 2024 (the 'Period').

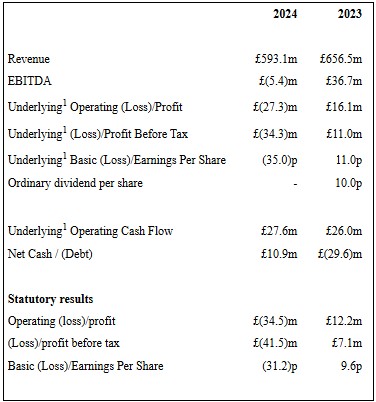

FINANCIAL HIGHLIGHTS

Financial results impacted by market conditions; market share held

- Group revenue declined 9.7% year-on-year in 2024; UK down 8.9%; Continental Europe down 14.9%

- Revenue growth in Trade Counters and Larger Customers, more than offset by decline in Regional Distribution

- Market share maintained2 in the year

- Underlying Loss Before Tax of £34.3m impacted by market decline and cost inflation, with a second consecutive year without price inflation in the core distribution market

Strong balance sheet; cash and working capital well-controlled

- Net Cash of £10.9 million at the end of the year

- Working capital well-controlled with stock levels reduced by £28.7m, driving good Underlying Operating Cash Flow of £27.6m

- £61.3 million of cash proceeds from property disposals, at an average 68% premium to book value

- Strong asset backing: the Group owns property valued3 at £93.9m as at December 2024

- Balance sheet further strengthened from pension buy-in transaction

STRATEGIC AND OPERATIONAL HIGHLIGHTS

Acceleration of strategy through transformation plan, with upgraded targets

- As announced in September 2024, an acceleration of existing strategy through a plan to transform the business by simplifying our customer offer, network and operations

- We have upgraded the targeted benefits: upon completion of the transformation plan we are targeting profit improvement of £25m (from an original £15m+) and a cumulative one-off cash inflow of at least £90m (previously £70m+) from property disposals and working capital optimisation, with one-off cash costs of £30m (previously £25m)

- The Group has made good progress to date, with £57m of cash benefit already achieved in H2 2024, and key transformation milestones achieved:

Simplify our customer offer

- Consolidated 32 trading businesses into one single, national business trading as Mercado, enabling customers to order from a broader, unified product list

- Implemented dedicated sales teams with specialist expertise for each of the residential and commercial sectors of the market

Simplify our network - Opened a new distribution centre in Rayleigh (Essex) and a new cross-dock facility in Ipswich; Enfield and Ipswich sites have been closed

- Consolidation of two distribution centres into one in Scotland

- Simplification has started to deliver working capital efficiency through higher stock turn

Simplify our operations - Centralisation of back-office processes and support functions now substantially complete

- Cost saving programme well-progressed; fuel costs locked in at lower rates

- We have implemented a comprehensive assessment programme to identify and capitalise on untapped opportunities for margin expansion and capital efficiency

Board changes

- As announced in February, following a six-year tenure with the Group, Keith Edelman, Non-Executive Chairman has stepped down from the Board and has been succeeded by Senior Independent Director, Stephen Bird

CURRENT TRADING AND OUTLOOK

- The Group's revenue for January and February 2025 declined 6% compared to the previous year

- The various external forecasts for flooring and related markets point to the flooring market returning to modest growth in 2025, albeit the timing and pace of recovery remains highly uncertain and could be influenced by macroeconomic and geopolitical developments

- In 2025 we will start to see the in-year contribution from the transformation plan

- The Board believes that the long-term outlook for Headlam remains positive, reflecting the combination of:

- Continued implementation of the existing strategy to broaden the base of the business

- The maturity of the Trade Counter business, recognising that the investment phase will be complete in mid 2025

- The benefits from the transformation plan, once fully implemented

- Market recovery, recognising that the market is now materially lower than in 2019 in volume terms

Commenting, Chris Payne, Chief Executive, said:

"In the face of ongoing market weakness, 2024 has seen Headlam accelerate a major strategic restructuring of the Group. At its heart, this transformation plan will simplify our customer offer, simplify our network and simplify our operations, positioning the Group to increase market share, structurally improve profitability and reduce the capital intensity of the business. We have made strong early progress on our plan and, today, upgrade the expected financial benefits from it.

Flooring is a discretionary 'big ticket' purchase and has been one of the weakest performing categories for consumer spending and the impact of the challenging trading conditions is evident in the Group's performance for 2024. Nevertheless the Board is encouraged by the significant amount of strategic progress that has already been driven against our plans and we remain focussed on delivering further momentum to ensure the business is positioned for market recovery and long-term success."

Source : Headlam plc

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.