UK DIY News

Headlam Group Notes Sales Decline In UK & Continental Europe

- Results in line with expectations; acceleration of strategy through a two-year transformation plan

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, today announces its results in respect of the first six months of the year to 30 June 2024 and launches the acceleration of its strategy through a transformation plan to simplify the business and enhance the customer offer, generating at least £15 million of annual profit improvement and £70 million of one-off cash benefits.

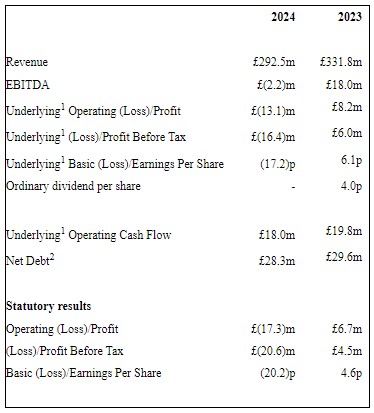

FINANCIAL HIGHLIGHTS

H1 results in line with expectations

- Revenue declined 11.8% year-on-year with UK down 11.3% and Continental Europe down 15.9%

- Revenue growth in Trade Counters and Larger Customers of 7% and 2% respectively

- Underlying Loss Before Tax of £16.4m impacted by market volume decline and a lack of price inflation in the market

- Strong cash generation with positive Underlying Operating Cash Flow of £18.0m

Strong balance sheet; cash and working capital well-controlled

- Working capital well-controlled with stock levels down £22.6m on a year ago

- Reduction in Net Debt to £28.3m with £72.2m of cash and undrawn facilities available at the end of the Period

- Strong asset backing: the Group owns property valued at £142.1m

- Further balance sheet strengthening provided by completion of pension buy-in

STRATEGIC HIGHLIGHTS

Acceleration of strategy through two-year transformation plan

- Acceleration of existing strategy through a two-year plan to transform the business. This plan will simplify our customer offer, network and operations; improving profitability, increasing market share and releasing capital from more efficient working capital management and the disposal of non-core property

- Each workstream is already underway, with the following key initiatives that will drive our operational and financial performance, creating long-term shareholder value:

Simplify our customer offer

- Consolidation of 32 trading businesses into one single, national business trading as Mercado, enabling customers to order from a broader, unified product list and to benefit from more time with our sales teams, who have smaller geographic territories

- Dedicated sales teams with specialist expertise for each of the residential and commercial sectors of the market

- Upgraded display stands and marketing support, helping our independent retailer customers to grow their businesses

Simplify our network

- Continued optimisation of our network, including opening a new distribution centre in Rayleigh (Essex) and a new cross-dock facility in Ipswich; resulting in the closure of our Ipswich distribution centre, which will be sold

- Consolidation of two distribution centres into one in Scotland, creating another surplus property to be sold

- Simplification will generate working capital efficiency through higher stock turn

Simplify our operations

- Centralisation of back-office processes and support functions

- Unlocking operational cost savings

The benefits of the two-year transformation plan are expected to be:

- Release of at least £70m cash from disposal of surplus property and optimisation of net working capital

- Ongoing profit improvements of at least £15m, with benefits starting to be realised during 2025 and fully achieved as a run-rate by the end of two years

- Increase in market share from investment in customer proposition

- Anticipated c.£25m of one-off cash costs to deliver the plan

- Full support from lending banks, having recently agreed a new covenant package through to the end of 2025

Current trading and outlook

- Group revenue for July and August declined 8.4% compared to 11.8% decline for the first six months, supported by four consecutive months of reduced revenue decline in Regional Distribution

- Limited indication of any market improvement yet

- Looking ahead, the lead indicators for the market are more positive, but the timing of market recovery remains uncertain and looks to be later than previously anticipated, with a return to growth now expected at some point during 2025

- The long-term outlook for Headlam remains positive, reflecting the combination of:

· Continued implementation of the existing strategy to broaden the base of the business

· The two-year transformation plan

· Market recovery, recognising that the market is now at least 25% lower than in 2019 in volume terms

· There is no change to the illustrative long-term revenue ambition for the Group that we set out in March 2024: a range of £900 million to £1 billion of revenue, driven by the combination of the above factors

Commenting, Chris Payne, Chief Executive, said:

"The challenges impacting the flooring market have been well documented and are fully reflected in Headlam's performance in H1 2024. Nevertheless, the Group has made good strategic progress and whilst these highlights are masked by external headwinds, it is particularly pleasing to see growth across the Group's Larger Customers and Trade Counters.

As the clear UK market leader, drawing on a heritage of over 30 years, a large and diverse customer base, and long-established supplier relationships, Headlam has a unique long-term opportunity. Whilst we cannot control the macro-economic environment, we can continue to adapt and evolve the business to take full benefit of the market recovery. I'm therefore pleased to announce today an acceleration of our strategy with a 2-year transformation plan to make Headlam a more effective organisation by simplifying our offer to customers and how we operate. As we unlock cash and costs from our business, we will further invest in the proposition across all our customer groups in order to grow market share and strengthen our position as the UK's leading floor coverings distributor.

Looking ahead, the lead indicators for consumer spending on home improvements are more positive, albeit the timing of recovery remains uncertain and is likely to be later than previously anticipated. However, with our new transformation plan underway, our teams are laser focussed on realising the benefits which will start to take effect in 2025, positioning the Group to emerge strongly when market conditions improve. We remain confident in the long-term outlook for the Group and look forward to announcing further progress against our plans in due course."

Source : Headlam Group plc

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.