UK DIY News

Growth At Pepco Group Despite 'Challenging' Conditions

Pepco Group, the fast-growing variety discount retailer which owns the Pepco and Dealz brands in Europe and Poundland in the UK, today reports a trading update for its third financial quarter of FY23 ending 30 June 2023.

SUMMARY

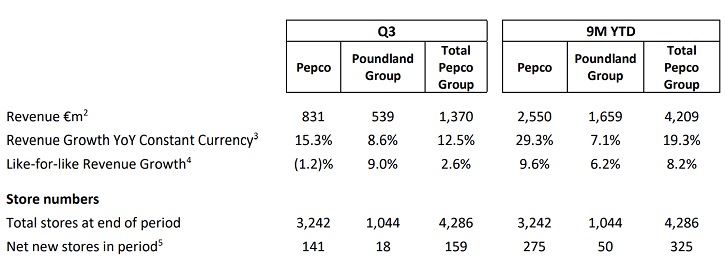

- Year to date 9-month Group revenue of €4,209m, up 19.3% on a constant currency basis, driven by Pepco growth of +29.3% and Poundland Group +7.1%

- Q3 Group revenue of €1,370m, up 12.5% year-on-year on a constant currency basis, with Pepco +15.3% and Poundland Group +8.6%

- Group like-for-like (LFL) revenues up 8.2% YTD and up 2.6% in latest quarter

o Pepco LFL revenue up 9.6% YTD, but down 1.2% in Q3 reflecting a challenging trading environment in April and May, particularly in Central Europe, and a stronger comparative period in the prior year. Trading has recovered in recent weeks with a positive LFL performance in June and the start to Q4

o Poundland Group LFL up 6.2% YTD, and up 9.0% in Q3 due to a strengthening FMCG performance

- Net new store openings of 325 in nine months to date (159 in Q3); the Group remains on track to open 550 net new stores in FY23

- Inaugural bond issue of €375m completed, with credit ratings achieved from Fitch, S&P and Moody’s

- The Group maintains its previous guidance on the full year EBITDA outlook.

Commenting on the results, Trevor Masters, CEO of Pepco Group, said:

“The past quarter saw the Group make further strategic progress, with 159 net new stores launched as we continued to execute on our profitable store opening programme. We remain confident of meeting our target of opening at least 550 new stores this financial year, with openings weighted towards the fourth quarter.

“As we highlighted at our interim results in June, the macro-economic climate continues to be challenging, particularly in Central Europe, due to elevated levels of inflation. In addition, Pepco’s Q3 growth reflected a period where the business benefited from trading upside in the prior year driven by the influx of people from the Ukraine war into its core markets. Poundland Group delivered a strong trading performance in Q3, driven by consumers prioritising spend on FMCG items. Both Pepco and Poundland Group are in positive LFL growth at the start of Q4.

“We remain committed to supporting our customers in this challenging environment by maintaining our market-leading pricing. We continue to seek improvements in the cost of doing business and leveraging our in-house direct sourcing arm, PGS, which is a key competitive advantage for the Group. Our focus remains on building a bigger, better, cheaper and simpler business and we are well positioned to deliver future success as inflationary pressures ease.”

Source : Pepco Group

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.