UK DIY News

Grafton Group Sees Strong Revenue Growth In 2022

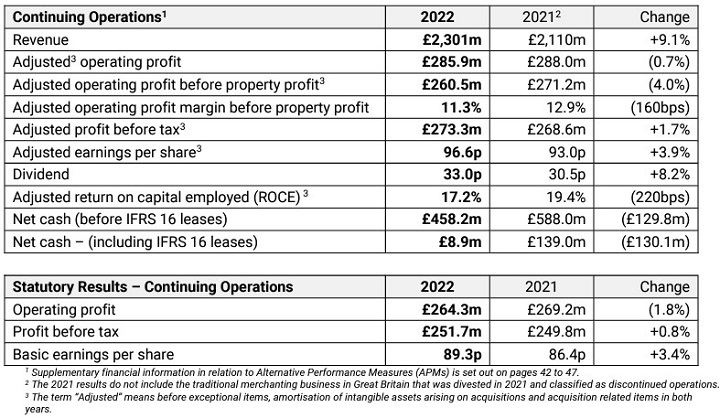

Grafton Group plc, the international building materials distributor and DIY retailer, has published final results for the year ended 31st December 2022, advising of a strong trading performance from a diversified earnings base.

Operational Highlights

- Excellent performance in distribution businesses in Ireland and the Netherlands

- Volumes and profitability lower in Selco against a strong comparative period and softer backdrop

- Good profit contribution from IKH in Finland

- Revenue and profitability normalised in Woodie’s DIY, Home and Garden retail business

- UK Manufacturing businesses performed well

- Further progress made against sustainability targets

- Diversified revenue base with over half generated in Ireland, the Netherlands and Finland

Financial Highlights

- 11.3% operating profit margin before property profit

- Adjusted return on capital employed of 17.2%

- Slight decline in adjusted operating profit (before property profit) to £260.5 million as expected

- Double digit/high single digit operating profit margin in all businesses (before property profit)

- High cash conversion with cashflow of £278.8 million from operations

- £208.9 million returned to shareholders during year through share buybacks and dividends

- Net cash at 31 December 2022 of £458.2 million (before IFRS 16 lease liabilities)

- Annual dividend per share growth of 8.2%

Eric Born, Chief Executive Officer Commented:

“In my first set of results as Chief Executive, I am pleased to report a strong performance by the Group which is ahead of market expectations. This is a great achievement by my new colleagues across the business and is testament to their dedication and professionalism. It has also confirmed the qualities of the business which attracted me to join Grafton.

“We still face many of the external challenges that we faced in 2022, but I am encouraged by the quality of the Group’s portfolio of higher margin businesses that are sensibly positioned with both market leading brands and geographic diversity. We now have more than half of our revenues coming from outside the UK in Ireland, Finland and the Netherlands.

“Importantly, with a very strong balance sheet, Grafton is well positioned to invest in future growth opportunities and we look forward with confidence.”

Divisions:

Distribution:

Ireland

Chadwicks, the market leader in the distribution of building materials in Ireland and the Group’s most profitable business, delivered a very strong performance. Revenue growth reflects both building materials price inflation and the impact of acquisitions. Operating profit grew strongly supported by an operating profit margin of 11.4 per cent.

Demand was underpinned by residential RMI spending, the construction of scheme and one-off houses and non-residential construction projects.

The specialist Sitetech business acquired in February 2022, a leader in the adjacent construction accessories new build market, made an excellent contribution to profit.

UK

Volumes in the UK RMI market were down compared to the prior year when there was a record level of spending on the home during the pandemic and lower spending in other areas of the economy. During 2022 households under pressure from increased energy and food prices quickly reduced discretionary spending on smaller value home improvements as the economy weakened and consumer sentiment declined. Revenue in the like-for-like business ended the year only marginally lower as a decline in volumes was largely offset by double digit materials price inflation.

Operating profit was down when benchmarked against a strong prior year result and the operating margin of 9.8 per cent reflected gross margin pressure in a competitive market and the operational gearing impact of lower volumes. Selco, which accounted for almost three quarters of UK distribution revenue, continued to invest in its business and branch network increasing it to 74.

The Netherlands

Isero, the market leading specialist ironmongery, tools and fixings business, achieved excellent results for the year, in broadly favourable markets. A strong underlying performance was complemented by a good contribution from acquisitions and benefits realised from implementing performance improvement measures. The operating profit margin increased by 70 basis points to 11.2 per cent. Market coverage expanded into the Northeast of the Netherlands with the acquisition in January of the five branch Regts business in Friesland which made a very good contribution to profit and increased the overall branch network to 123.

Finland

IKH, the workwear, personal protective equipment, tools and spare parts wholesaler acquired in July 2021, had a good first full year under Grafton ownership delivering an operating profit contribution that was in line with pre-acquisition expectations despite more challenging market conditions. Revenue in the early months of the year was down, on the pre-acquisition comparative period, due to lower demand for a number of weather sensitive product categories and weaker consumer sentiment following the invasion of Ukraine but recovered in the second half and ended the year strongly. The operating profit margin for the year was 14.2 per cent.

Retailing:

Woodie’s, the market leading DIY, Home and Garden business in Ireland successfully navigated a unique set of trading conditions in 2022 as exceptional pandemic related spending in the prior year unwound and there was also pressure on volumes from the decline in real disposable incomes and a sharp drop in consumer confidence. Operating profit normalised to a level that was 43.9 per cent higher than the pre-pandemic result for 2019. The operating profit margin for 2022 was 13.3 per cent.

Manufacturing:

CPI EuroMix, the market leader in the manufacture of mortar in Great Britain, reported growth in revenue and a good increase in operating profit. Volumes were softer in the final months of the year as activity in the new housing market moderated and were marginally down for the year.

StairBox, the market leading manufacturer of bespoke staircases primarily for the secondary housing market, experienced record demand from trade customers across Great Britain and increased revenue and profitability.

The operating profit margin in the manufacturing segment was 22.7 per cent.

Source : Grafton Group

Source : Grafton Group PLC

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.