UK DIY News

BMBI: November Builders Merchant Sales Slide

The latest Builders Merchant Building Index (BMBI) report shows builders’ merchants’ value sales were down -4.0% in October 2023 compared to the same month in 2022, with volume sales dropping -11.5% and prices rising +8.4%. With one more trading day in October 2023, like-for-like sales were -8.4% lower.

Eight of the twelve categories sold more in October 2023 compared to the previous year, with Miscellaneous (+16.5%) topping the list. Decorating (+10.8%), Workwear & Safetywear (+10.4%), Ironmongery (+7.0%) and Kitchens & Bathrooms (+4.7%) also did better than the merchants overall. Landscaping (-6.4%) and Timber & Joinery Products (-9.7%) were the weakest categories.

Month-on-month, total merchant sales were up +2.2% in October compared to September 2023. Volume sales were flat, and prices registered a moderate increase (+2.3%). With one additional trading day in October, like-for-like sales were -2.4% lower. Ten of the twelve categories sold more with Workwear & Safetywear (+19.3%) considerably ahead of the rest. Plumbing, Heating & Electrical (+11.6%) also performed well month-on-month. Landscaping (-6.5%) was weakest.

Total merchant sales in the year to date were -4.8% down on the same period (January to October) the year before. Volume sales were -13.9% lower, and prices rose +10.6%. With two more trading days this period, like-for-like sales were -5.7% lower. Nine of the twelve categories sold more with Renewables & Water Saving (+35.5%) growing the most, followed by Decorating (+9.7%), Workwear & Safetywear and Plumbing, Heating & Electrical (+6.0%). The three largest categories - Heavy Building Materials (-2.4%), Landscaping (-12.5%) and Timber & Joinery Products (-15.0%) – all sold less.

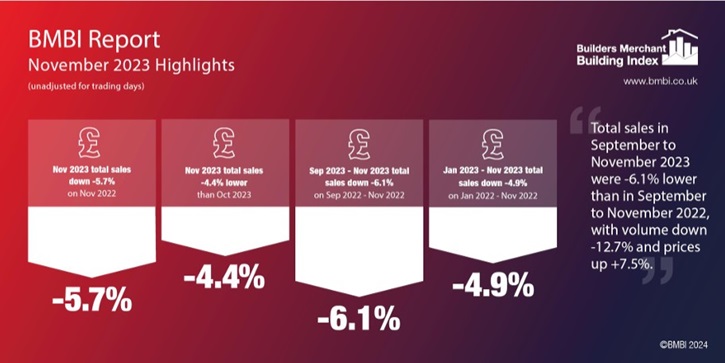

Mike Rigby, Managing Director of MRA Research which produces the BMBI report says: “November was another difficult month for the UK’s builders’ merchants. Following major storms in September and October, November delivered yet more wet and windy weather and widespread flooding which delayed planned construction work. The housing market is still in the doldrums with high mortgage rates, sizeable deposits and affordability affecting new house sales and the new build market. Rising rentals are also putting the squeeze on future house buyers. Housing RMI, however, has been more resilient. While November building activity was hampered by the weather, repair and maintenance work increased by +3.8% in the three months to November (source ONS).

“According to the long-standing GFK Consumer Confidence Survey published on December 15th, consumer confidence is rising (up +2 points to -22, a 20-point recovery from the battering it took under Liz Truss’ short-lived Government. In fact, it’s rising on all five of GFK’s metrics, but on the three that matter most to building, Personal Finance situation over the last 12 months was up two points to -14, 14 points higher than December 2022; and Personal Finance situation for the next 12 months was up one point to -2; 27 points better than December 2022.”

Joe Staton, Client Strategy Director GfK, says: ‘Despite the severe cost-of-living crisis still impacting most households, this slow but persistent movement towards positive territory for the personal finance measure looking ahead is an encouraging sign for the year to come.’ “The Major Purchase Index was also up one point to -23, 11 points higher than December 2022, which is particularly encouraging for home improvements in 2024,” Mike Rigby suggests.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 92% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

Source : BMBI

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.