UK DIY News

Average Household Expected To spend £40 More This Christmas Than Last

- Average household expected to spend £40 more this Christmas, but real expenditure is still falling short of pre-pandemic levels

The final months of the year, often referred to as the Golden Quarter, mark a critical period for retailers. November and December traditionally bring a surge in holiday shopping, major sales events, and festive campaigns, driving significant spikes in consumer spending. Nevertheless, while tills ring and wish lists grow, sales during this period have struggled to match pre-pandemic levels in recent years.

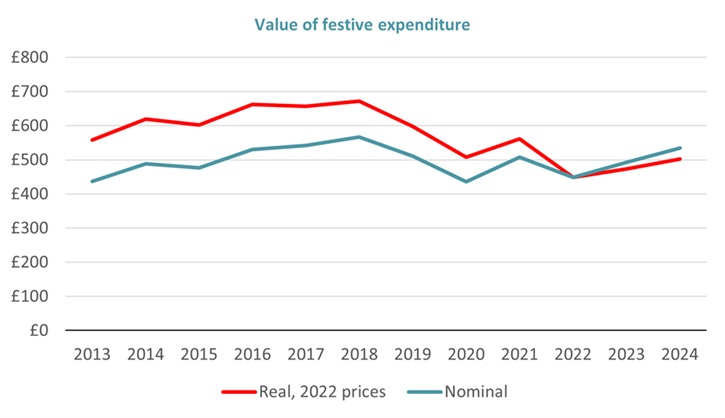

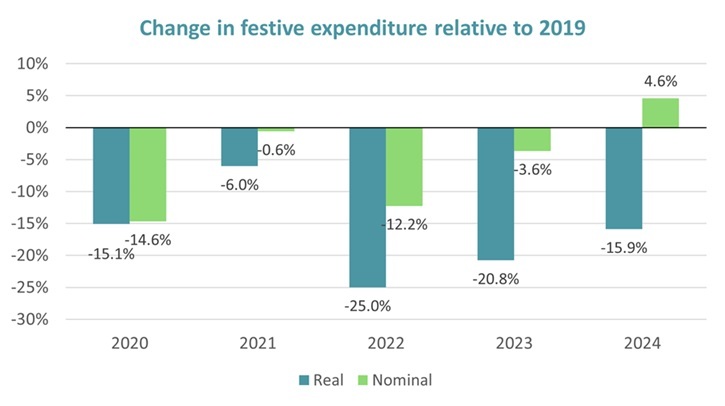

The cost-of-living crisis and the lingering effects of the pandemic have reshaped the financial landscape for UK households. This has been particularly noticeable during the festive season, with households cutting back on more discretionary aspects of spending. For instance, Cebr estimates that the typical household spent just £450 and £490 during the 2022 and 2023 Christmas seasons, respectively. These values were firmly down on pre-pandemic levels in both nominal and real terms.

As 2024 unfolds, there are encouraging signs of an improved consumer landscape. Slowing inflation and continually above average earnings growth have eased financial pressures, leaving households in a slightly better position. This is evidenced by our Income Tracker workstream with Asda, showing that the average household’s discretionary income is now around 11% higher than this time a year ago. Meanwhile, the improved financial landscape has also fuelled cautious optimism, reflected in the YouGov/Cebr Consumer Confidence Index, which has recorded positive values for 16 consecutive months.

Better consumer health is the main driver behind our expectation of a stronger Christmas this year. Cebr projects that the average household will spend £530 this festive season, representing a nominal increase of 8.6% compared to last year, equivalent to a real terms boost of 6.2%. This would be enough for Christmas spending to surpass 2019 levels in nominal terms. The outlook for a stronger Christmas is supported by recent survey data. For instance, PwC indicates that the easing of financial pressures has bolstered confidence and is expected to drive higher spending on gifts and celebrations in 2024 compared to the previous year. [1]

Chart source: ONS, Cebr analysis

Nonetheless, it should be noted that this expected spending value would still fall far short of pre-pandemic levels in real terms, being down by 15.9%. This continued shortfall suggests that many households remain cautious, with their behaviour still being shaped by the effects of the cost-of-living crisis. These changed consumer behaviours are also highlighted by other studies. According to Mintel, value for money remains a priority for consumers this year, with some cutting back on certain purchases or reducing consumption entirely.[2]

In terms of the breakdown of festive expenditure, the average household is expected to spend £110 in food stores this Christmas, up by 22.5% relative to last. This is the fastest expected growth rate across all store types, with the equivalent value for non-food stores standing at just 6.0%. The anticipated growth in food store spending is supported by a much lower rate of food price inflation this year, which has recently dipped below the 2.0% target, easing price pressures on households.

Despite the faster expected growth for food stores, the bulk of festive spending is still accounted for by non-food stores, encompassing popular Christmas gift items such as clothing and footwear, toys and games, and technology. The average household is expected to spend around £310 across these outlets this Christmas. A final ‘other’ category, predominantly covering online sales, accounts for a minority of spending, with the average household expected to spend around £110 this year. Despite the advancement in e-commerce brought about by the pandemic, this suggests that the high street is still the preferred means for consumers to engage in festive spending.

While the anticipated uptick in festive spending will be welcomed, bringing some relief to retailers and their cash flows, it is unlikely to alleviate broader economic challenges. Consumers continue to navigate the lingering effects of the cost-of-living crisis and ongoing economic weakness, while the risk of a technical recession this winter is increasingly a concern.

The divergence between nominal and real terms spending should also be highlighted. The fact that the former is now exceeding pre-pandemic levels in nominal terms, but the latter is falling short, suggests that consumers are now paying more to receive less. Indeed, for households to have the same Christmas as they did in 2019, they would have to spend an additional £100 above the expected value this year. Overall, with the percentage shortfall between current and pre-pandemic spending continuing to stand in double digits, it may be some time before high streets experience the same level of Christmas cheer as previously.

Chart source: ONS, Cebr analysis

[1] PwC – Festive Predictions Survey

[2] Mintel – Consumer Spending Outlook This Holiday Season

Source : Cebr

Image : Smileus / iStock / 624124526

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.